- United States

- /

- Communications

- /

- NYSE:CALX

US High Growth Tech Stocks To Watch November 2025

Reviewed by Simply Wall St

In a volatile November 2025, the U.S. stock market has experienced significant fluctuations, with major indices like the Nasdaq and S&P 500 witnessing sharp declines following an initial Nvidia-led rally. Amidst these shifts, investors are closely monitoring high-growth tech stocks as they navigate mixed economic signals such as robust job growth juxtaposed with rising unemployment rates and fluctuating interest rates. In this environment, a good stock is often characterized by its ability to maintain resilience through strong earnings momentum and innovative capabilities that align with current technological trends and consumer demands.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 26.95% | 29.36% | ★★★★★★ |

| Workday | 11.18% | 32.10% | ★★★★★☆ |

| Circle Internet Group | 26.05% | 83.98% | ★★★★★☆ |

| Pelthos Therapeutics | 47.44% | 126.65% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.61% | ★★★★★☆ |

| Gorilla Technology Group | 32.60% | 199.39% | ★★★★★☆ |

| Procore Technologies | 11.61% | 114.49% | ★★★★★☆ |

| Zscaler | 15.80% | 40.68% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Calix (CALX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Calix, Inc. offers cloud and software platforms, systems, and services across various regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of approximately $3.64 billion.

Operations: The company generates revenue primarily from developing, marketing, and selling communications access systems and software, totaling approximately $933.68 million.

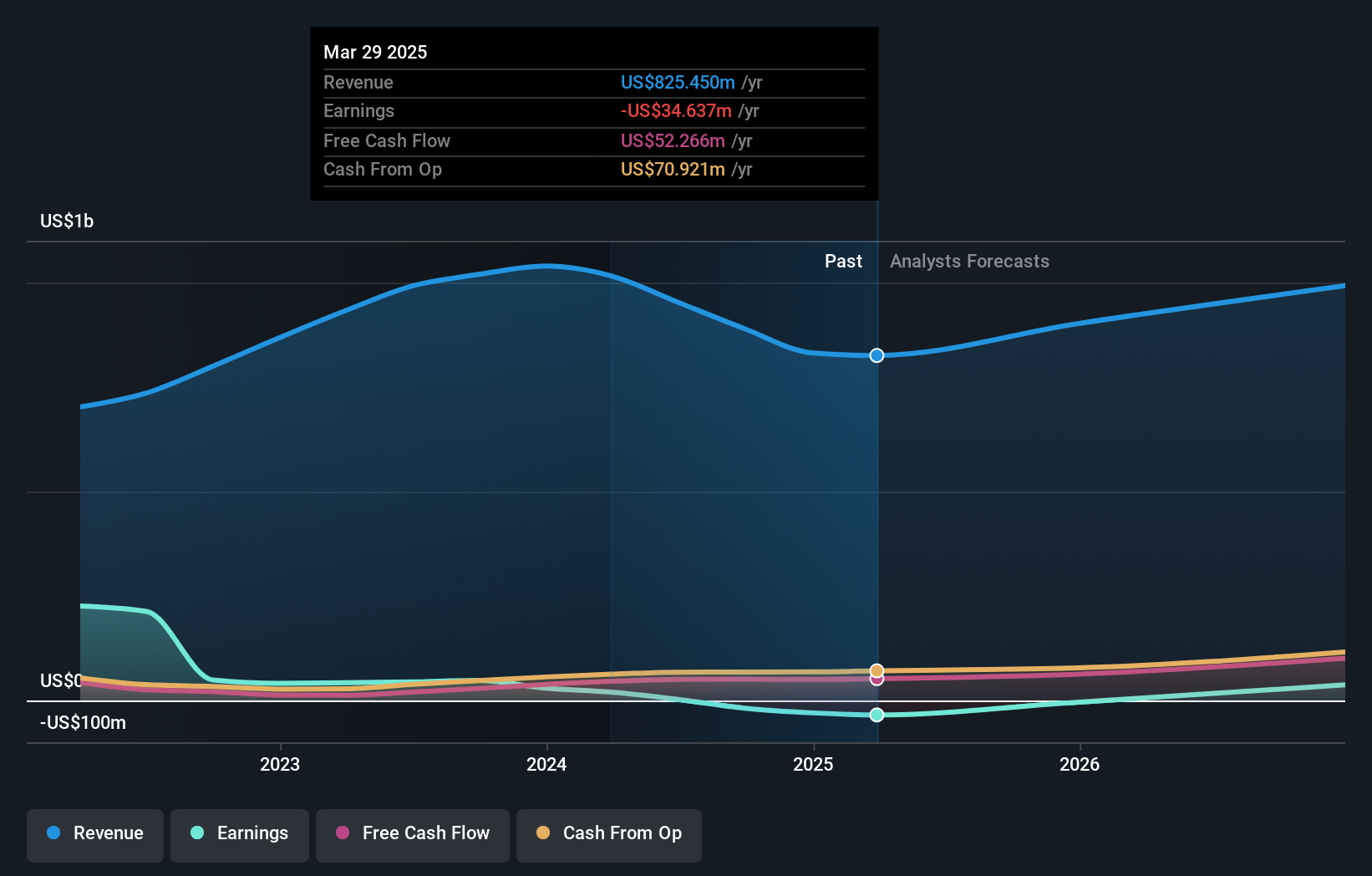

Calix's strategic emphasis on AI-driven broadband solutions is reshaping the industry landscape, as evidenced by its recent collaboration with CoastConnect. This partnership underscores a significant shift towards AI-enabled operations that streamline service delivery and enhance customer experiences. With an impressive annual revenue growth of 13.3% and a surge in earnings by 91.9%, Calix is leveraging its R&D investments, which have notably increased to over $100 million since November 2023, focusing on agentic AI capabilities within its Broadband Platform. These innovations are not only optimizing operational efficiencies but also positioning Calix at the forefront of broadband technology, promising robust future prospects in an increasingly digital and connected world.

- Delve into the full analysis health report here for a deeper understanding of Calix.

Gain insights into Calix's past trends and performance with our Past report.

Phreesia (PHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Phreesia, Inc. offers an integrated SaaS-based software and payment platform tailored for the healthcare industry across the United States and Canada, with a market cap of approximately $1.15 billion.

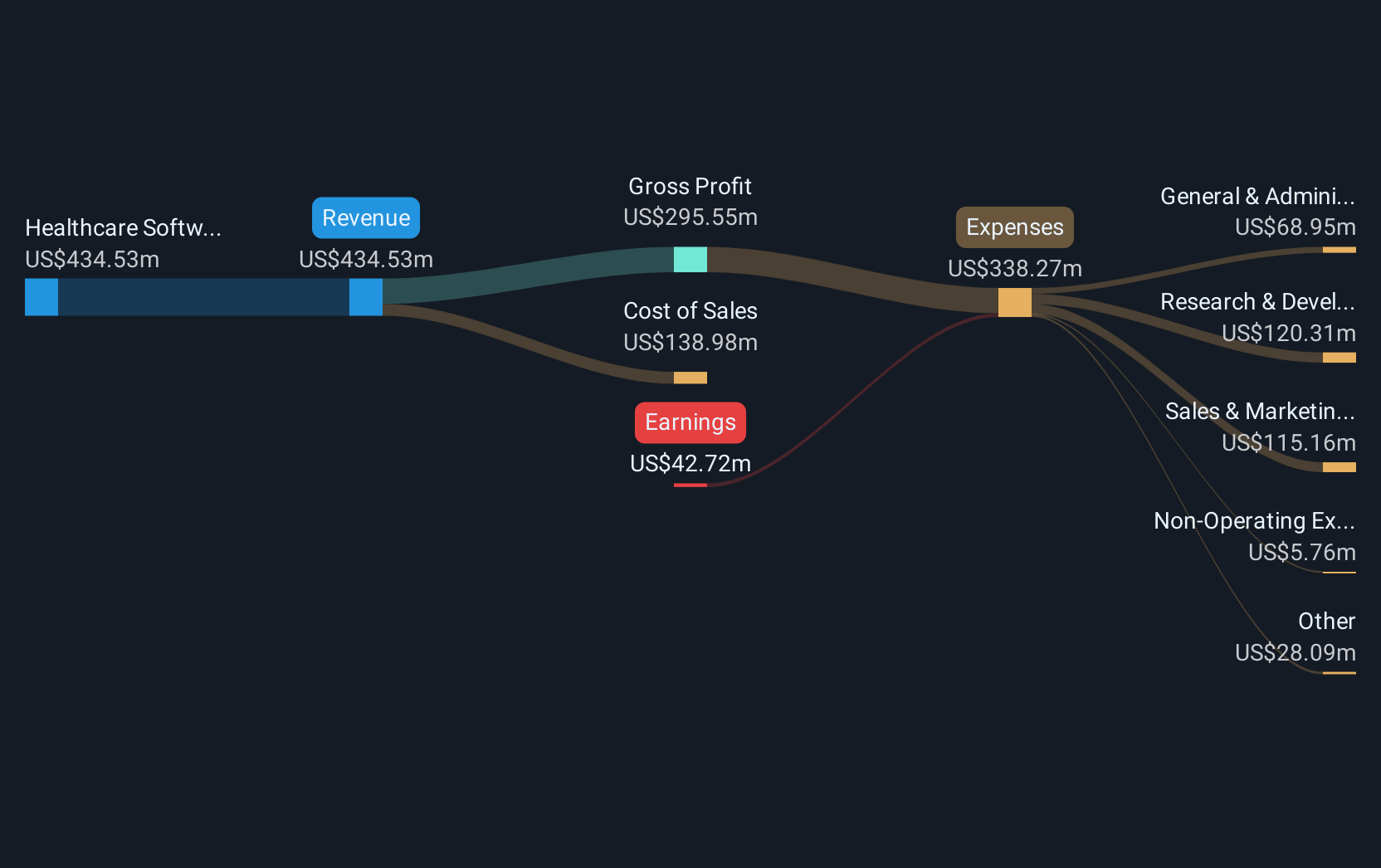

Operations: The company generates revenue primarily through its Technology Solutions segment, which accounts for $449.67 million.

Phreesia's recent pivot towards integrating advanced AI solutions, such as the newly launched Phreesia VoiceAI, underscores its commitment to enhancing healthcare efficiency through technology. This innovation is designed to manage high call volumes effectively, using natural language processing to improve patient interactions without additional staff burden. Financially, Phreesia has shown resilience with a significant turnaround in net income from a loss of $18.01 million to a profit of $0.654 million in Q2 2025 and maintained its revenue forecast for FY 2026 between $472 million and $482 million. Additionally, the collaboration with Sesame Workshop leverages beloved characters to educate young patients at points of care, potentially increasing user engagement and satisfaction—a strategic move that could enhance long-term customer loyalty and brand strength within the healthcare sector.

- Unlock comprehensive insights into our analysis of Phreesia stock in this health report.

Evaluate Phreesia's historical performance by accessing our past performance report.

Reddit (RDDT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Reddit, Inc. operates a digital community both in the United States and internationally with a market capitalization of approximately $35.58 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to approximately $1.90 billion. This digital platform leverages advertising and premium membership services as key revenue streams.

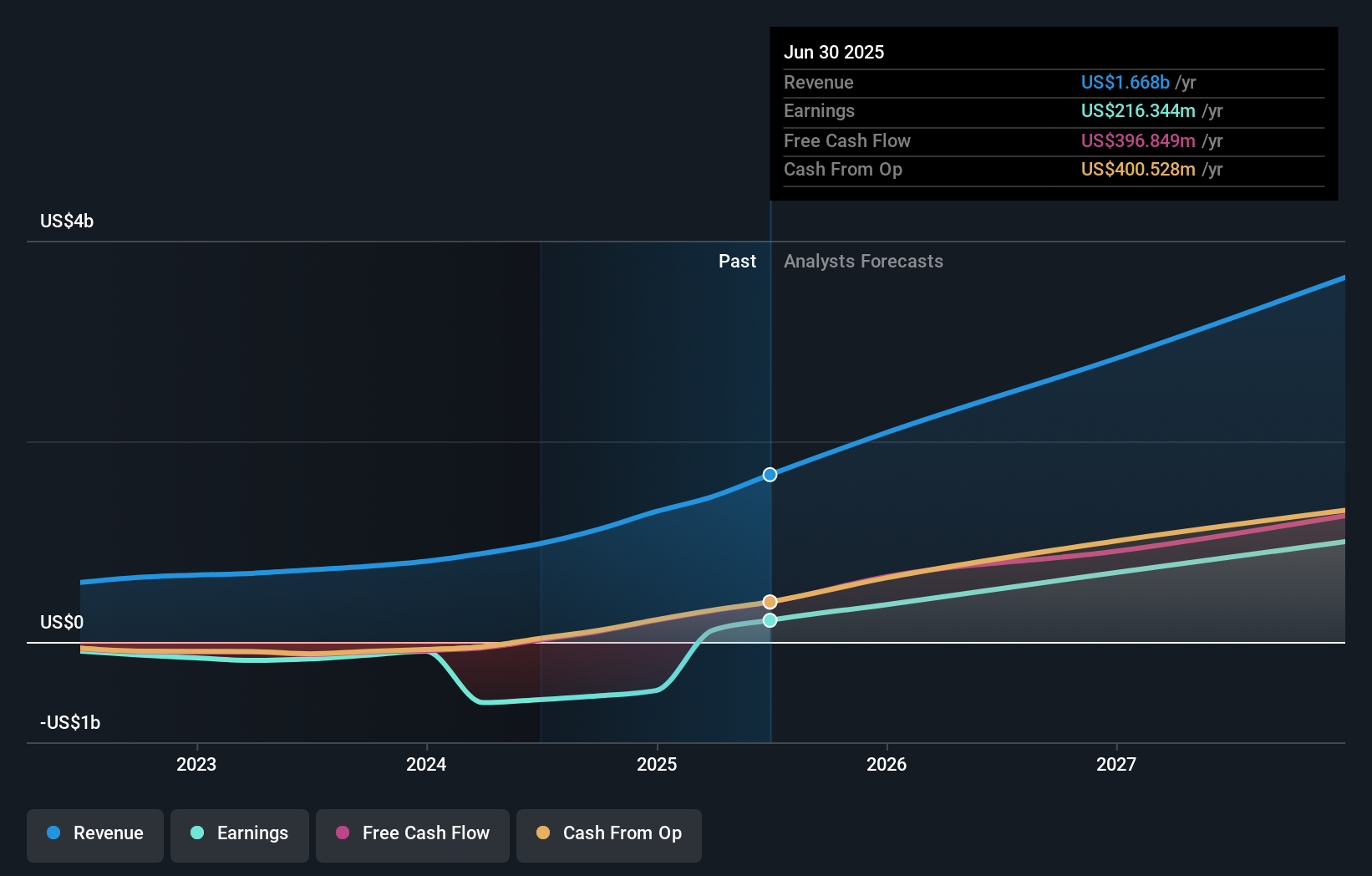

Reddit's transformation is marked by a robust surge in financial metrics and strategic positioning within the tech industry. In Q3 2025, sales soared to $584.9 million from $348.35 million the previous year, while net income escalated impressively to $162.66 million from $29.85 million, reflecting an annualized revenue growth of 24.8% and earnings growth of 36.2%. This performance underscores Reddit's adaptability and burgeoning role in interactive media services, outpacing both the US market growth rate of 10.5% and industry standards. Looking ahead, the company forecasts Q4 revenues between $655 million to $665 million, signaling sustained upward trajectory amidst competitive digital landscapes.

- Get an in-depth perspective on Reddit's performance by reading our health report here.

Gain insights into Reddit's historical performance by reviewing our past performance report.

Summing It All Up

- Click here to access our complete index of 72 US High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CALX

Calix

Provides cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives