- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Smartly Integrates Reddit (NYSE:RDDT) For Enhanced Advertising Campaign Automation

Reviewed by Simply Wall St

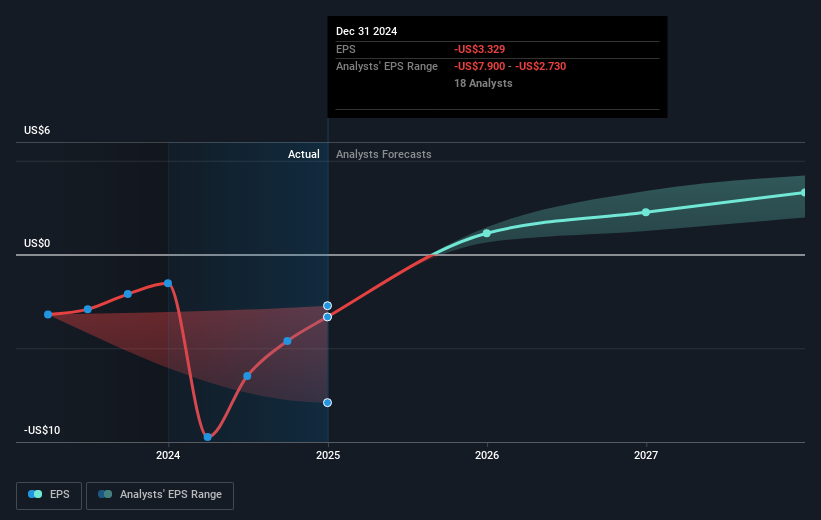

Despite Reddit (NYSE:RDDT) demonstrating a solid financial recovery with significant revenue and profit growth in Q1 2025 and its integration into Smartly enhancing advertising operations, its share price fell 3% over the past month. This decline aligns with broader market trends, as major indices like the Nasdaq dropped around 1% amid renewed global trade tensions instigated by President Trump's tariff threats. While Reddit's business developments offer potential for long-term growth, the market's overall bearish sentiment, influenced by tech sector volatility and wider economic uncertainties, likely exerted downward pressure on its share price.

Every company has risks, and we've spotted 1 weakness for Reddit you should know about.

Over the past year, Reddit's shares delivered a total return of 81.54%. This remarkable performance for the period highlights the company's rapid recovery and growth, particularly when compared to the US Interactive Media and Services industry, which returned 10.8% during the same timeframe. Moreover, Reddit also outperformed the broader US market, which saw a return of 10.5% over the past year. This strong performance underscores investors' positive sentiment towards Reddit's growth initiatives, strategic partnerships, and recent profitable turnaround.

The integration with Smartly and recent partnerships could potentially bolster Reddit's revenue and earnings forecasts. The enhancement of advertising capabilities and data collaborations suggests that Reddit is well-positioned to capitalize on increased advertiser engagement and more efficient campaign management. However, despite these positive developments, Reddit's current share price remains 47.18% below the consensus analyst price target of US$150.25. This indicates a potential undervaluation, reflecting market concerns amid broader economic uncertainties and tech sector volatility. Investors may find this differential significant as it highlights potential upside, should Reddit continue its trajectory of growth and profitability enhancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion