- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (NYSE:RDDT) Posts US$26 Million Net Income in Strong Q1 Earnings

Reviewed by Simply Wall St

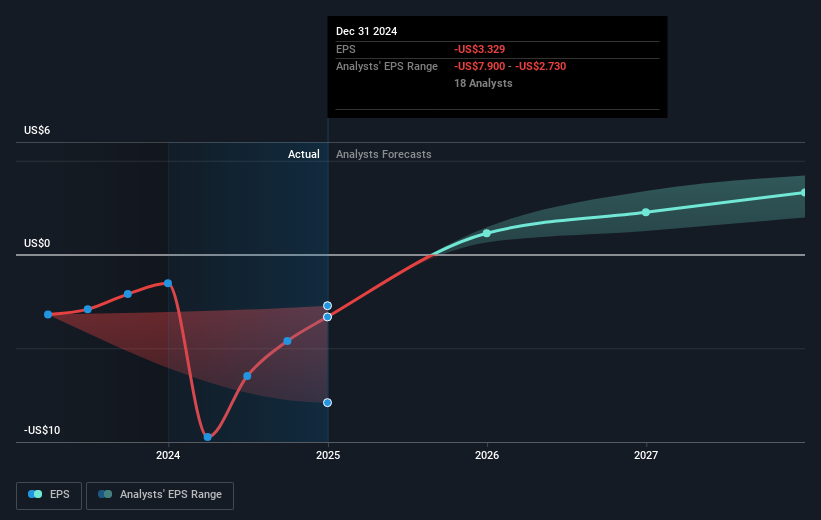

Reddit (NYSE:RDDT) recently appointed Adam Collins as its first Chief Communications Officer, marking a significant step in enhancing its communication strategies. This executive change, alongside the integration of Reddit into Smartly’s platform, enhances Reddit's service offerings for advertisers. Coupled with strong Q1 earnings increasing net income to $26 million and improved sales forecasts, these factors align with Reddit's 22% stock price rise in the last quarter. Meanwhile, the broader market faced volatility due to geopolitical tensions and awaited interest rate decisions, though it remained mostly flat. Reddit's advancements and financial performance provided a counterbalance to such market uncertainties.

We've identified 1 weakness for Reddit that you should be aware of.

The recent appointment of Adam Collins as Chief Communications Officer at Reddit and the integration into Smartly’s platform are strategic moves that could reinforce the company's narrative of international growth and product enhancement. These developments align with efforts to improve user engagement and advertiser expansion, which are crucial as Reddit focuses on non-U.S. markets. This could lead to potential increases in revenue and earnings forecasts, which are currently estimated to grow significantly in the coming years. The alignment with innovative communication strategies may also help in mitigating risks associated with overreliance on search-driven growth and scaling challenges.

Over the last year, Reddit's shares have seen an impressive total return of 122.29%. This figure stands in contrast to the broader U.S. market, which returned 9.8% over the same period. Comparatively, Reddit has outperformed the US Interactive Media and Services industry, which had a 13.8% return, reflecting its robust stock performance relative to its peers. This strong one-year performance positions Reddit favorably, highlighting investor confidence amidst market volatility.

With a current share price of US$117.09, Reddit's recent upward movement brings it closer to the analyst consensus price target of US$147.35. This target is 20.5% higher, suggesting room for growth should Reddit continue to execute its strategic initiatives successfully. However, potential risks related to regulatory challenges and competition remain considerations for future trajectories. The advancements in Reddit's offerings are expected to support ongoing revenue, earnings expansion, and potentially justify the premium valuation relative to industry averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion