- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Has Reddit’s AI Expansion Sparked a 43.6% Rally or Is Hype Driving the Stock in 2025?

Reviewed by Bailey Pemberton

- Wondering if Reddit stock is truly a bargain or just getting swept up in the buzz? You are not alone, as plenty of investors are debating its real value right now.

- In the past year, Reddit shares have jumped 43.6%. Even in the last week alone, the stock moved up 3.1%, hinting at lots of shifting sentiment and growth potential.

- News of Reddit expanding partnerships with AI companies and rolling out new ad formats has fueled the stock’s momentum. Investors hope these moves will unlock more value. This business evolution has added energy to recent price swings and is drawing fresh attention from the market.

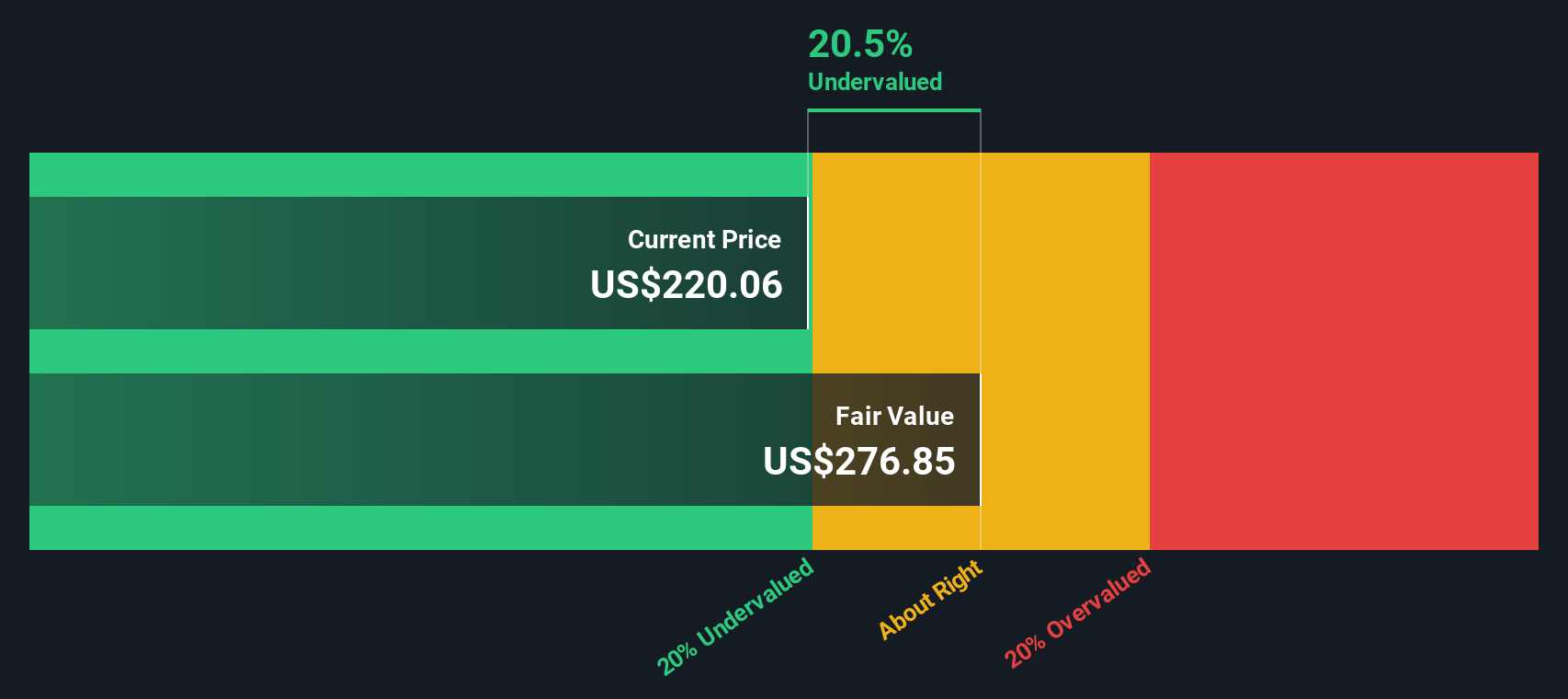

- Reddit earns a valuation score of 2 out of 6, suggesting it may only be undervalued in a couple of key areas according to traditional metrics. Up ahead, we will break down what those numbers truly mean, and share why there might be a smarter way to look at value than the usual approaches.

Reddit scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Reddit Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method offers a fundamental view of a business's worth, focusing on how much cash Reddit is expected to generate over time.

Reddit’s current free cash flow stands at $503.6 Million. Analyst forecasts suggest steady growth in Reddit’s cash flow, with projections rising to $2.45 Billion by the end of 2029. The estimates show increasing annual free cash flows in the coming years, typically based on available analyst coverage for the first five years, then extending into projections from Simply Wall St's methodology for up to a decade.

When all these projected future cash flows are discounted back to their present value, the estimated intrinsic value for Reddit lands at $307.18 per share. This represents a 38.3% discount compared to the current price and suggests that, according to the DCF approach, Reddit stock is significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Reddit is undervalued by 38.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Reddit Price vs Earnings

For profitable companies like Reddit, the Price-to-Earnings (PE) ratio serves as a widely recognized and meaningful valuation tool. The PE ratio helps investors gauge how much the market is willing to pay for each dollar of a company’s earnings, making it a direct way to judge perceived value and earnings power.

What qualifies as a “normal” or fair PE ratio isn’t one-size-fits-all. Rapidly growing companies or those seen as less risky often justify a higher PE, while slower growers or riskier businesses tend to trade at lower multiples. Growth prospects, stability, profit margins, and the industry outlook all feed into what counts as a reasonable ratio.

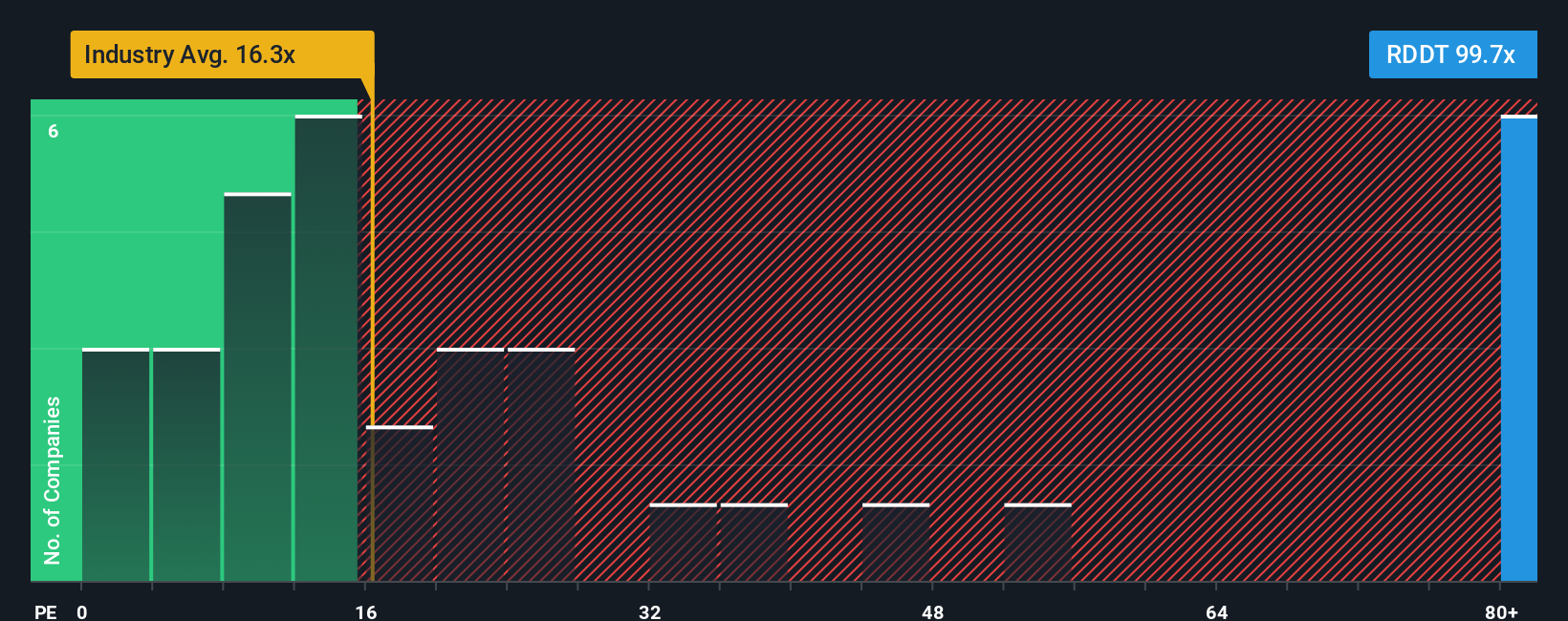

Currently, Reddit trades at a lofty 102.80x PE, well above the Interactive Media and Services industry average of 16.84x and a peer average of 18.14x. At first glance, this might suggest Reddit is pricey compared to its sector. However, looking deeper is essential.

The proprietary “Fair Ratio” from Simply Wall St delivers a smarter benchmark, weighing not just Reddit’s sector but also its earnings growth, profit quality, size, and unique risks. For Reddit, the Fair Ratio stands at 40.12x, a number reflecting these company-specific dynamics. This approach gives a more nuanced picture than a straight peer or industry comparison.

Given Reddit’s actual PE of 102.80x sits well above its 40.12x fair value, the numbers point to Reddit being overvalued on this metric. This suggests investors may be paying a premium for expected future growth or the platform’s unique position.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Reddit Narrative

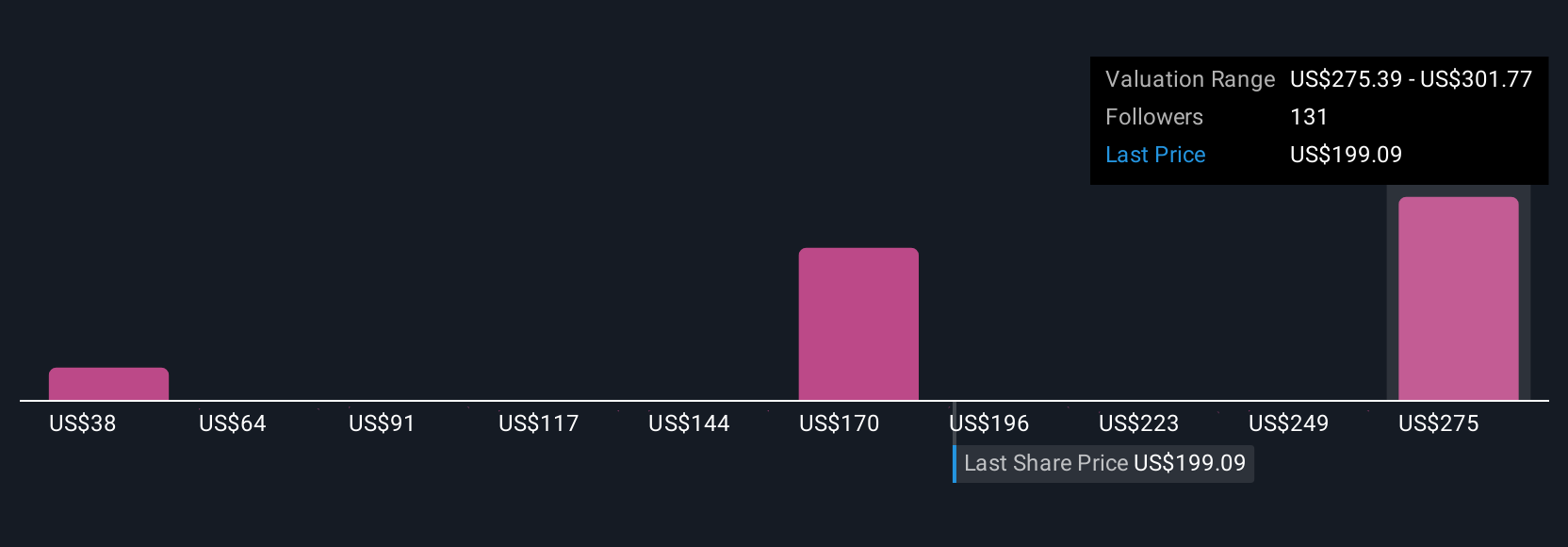

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story or perspective about a company, connecting what you believe about Reddit's future growth, risks, and profitability to a set of financial forecasts and a fair value estimate. Instead of focusing only on market multiples, Narratives help you express and test what you actually think will happen, putting your reasoning right next to the numbers.

On Simply Wall St’s platform, Narratives are accessible and easy to use on the Community page, empowering millions of investors to document their assumptions, forecast key trends, and instantly see how those translate into a fair value estimate for any stock. Narratives are dynamically updated when new news, earnings reports, or major developments occur, so your view can stay as fresh as the market itself.

By comparing each Narrative’s Fair Value to Reddit's current share price, investors can confidently decide if they think it’s time to buy or sell, backed by their own assumptions rather than market hype. For example, one Narrative for Reddit might expect robust user growth and set a fair value at $300, while another, more cautious viewpoint sees risk in digital ads and lands at $75, showing how every investor’s story can lead to a different conclusion.

Do you think there's more to the story for Reddit? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives