- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

3 US Stocks That May Be Trading Below Estimated Value In December 2024

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights with the S&P 500 and Nasdaq hitting record levels, investors are keenly observing opportunities that may still be trading below their intrinsic value amidst this post-election rally. In such a vibrant market environment, identifying stocks that appear undervalued can offer potential avenues for growth, especially when these companies show strong fundamentals or have been overlooked by the broader market sentiment.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $126.05 | $242.81 | 48.1% |

| First Solar (NasdaqGS:FSLR) | $207.51 | $406.03 | 48.9% |

| West Bancorporation (NasdaqGS:WTBA) | $23.33 | $46.41 | 49.7% |

| Business First Bancshares (NasdaqGS:BFST) | $28.05 | $54.94 | 48.9% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.82 | $63.31 | 48.2% |

| Privia Health Group (NasdaqGS:PRVA) | $21.66 | $43.17 | 49.8% |

| First Advantage (NasdaqGS:FA) | $19.89 | $38.88 | 48.8% |

| Vasta Platform (NasdaqGS:VSTA) | $2.28 | $4.43 | 48.5% |

| Marcus & Millichap (NYSE:MMI) | $41.33 | $81.27 | 49.1% |

| Hesai Group (NasdaqGS:HSAI) | $8.00 | $15.68 | 49% |

Let's dive into some prime choices out of the screener.

First Solar (NasdaqGS:FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic solar energy solutions across the United States, France, Japan, Chile, and other international markets with a market cap of $22.26 billion.

Operations: The company's revenue primarily comes from its Modules segment, which generated $3.85 billion.

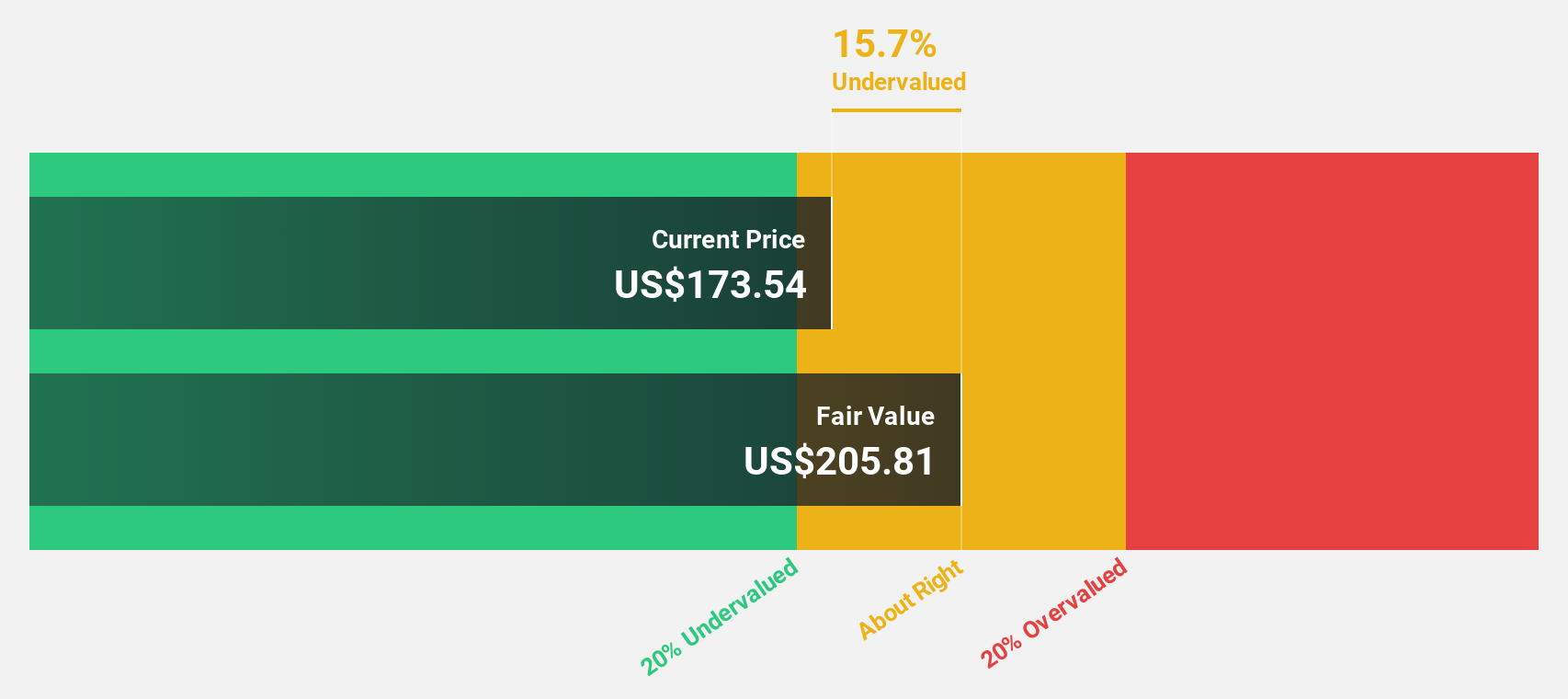

Estimated Discount To Fair Value: 48.9%

First Solar is trading significantly below its estimated fair value, with a current price of US$207.51 compared to a fair value estimate of US$406.03, suggesting potential undervaluation based on cash flows. Recent earnings reports reveal strong performance, with Q3 sales at US$887.67 million and net income at US$312.96 million, reflecting robust growth over the previous year. Analysts forecast high earnings growth exceeding market averages, supported by high-quality non-cash earnings.

- The analysis detailed in our First Solar growth report hints at robust future financial performance.

- Click here to discover the nuances of First Solar with our detailed financial health report.

Flutter Entertainment (NYSE:FLUT)

Overview: Flutter Entertainment plc is a sports betting and gaming company with operations in the United Kingdom, Ireland, Australia, the United States, Italy, and internationally, with a market cap of approximately $49.49 billion.

Operations: The company's revenue segments are comprised of $5.68 billion from the US, $3.44 billion from the UK and Ireland, $1.42 billion from Australia, and $3.03 billion internationally.

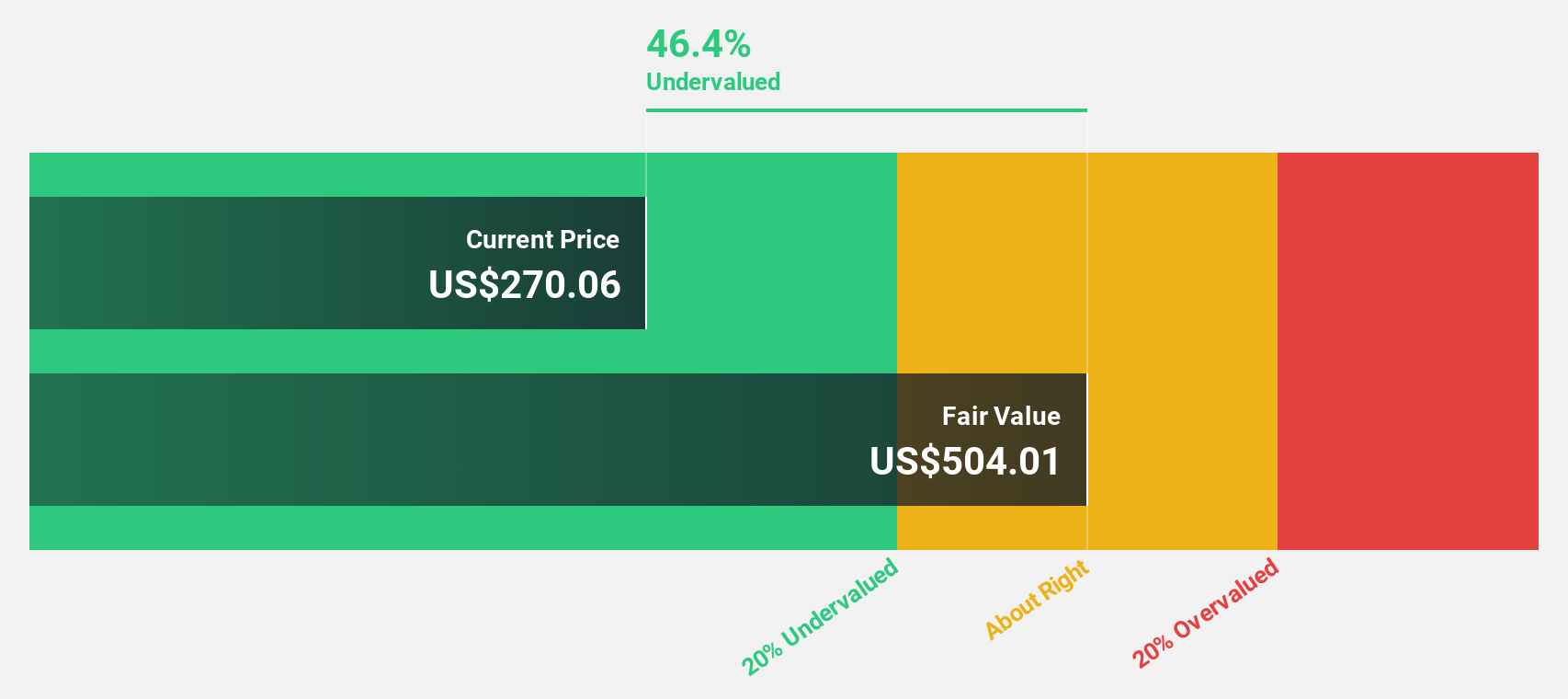

Estimated Discount To Fair Value: 31.7%

Flutter Entertainment's current price of US$282.64 is notably below its fair value estimate of US$413.83, indicating potential undervaluation based on cash flows. Recent earnings show improved performance, with Q3 sales rising to US$3.25 billion from US$2.56 billion a year ago and net loss narrowing significantly. Revenue is projected to grow at 12% annually, outpacing the broader U.S. market growth rate of 8.9%, suggesting strong future prospects despite recent losses.

- Upon reviewing our latest growth report, Flutter Entertainment's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Flutter Entertainment.

Reddit (NYSE:RDDT)

Overview: Reddit, Inc. operates a website that organizes digital communities and has a market cap of $24.87 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $1.12 billion.

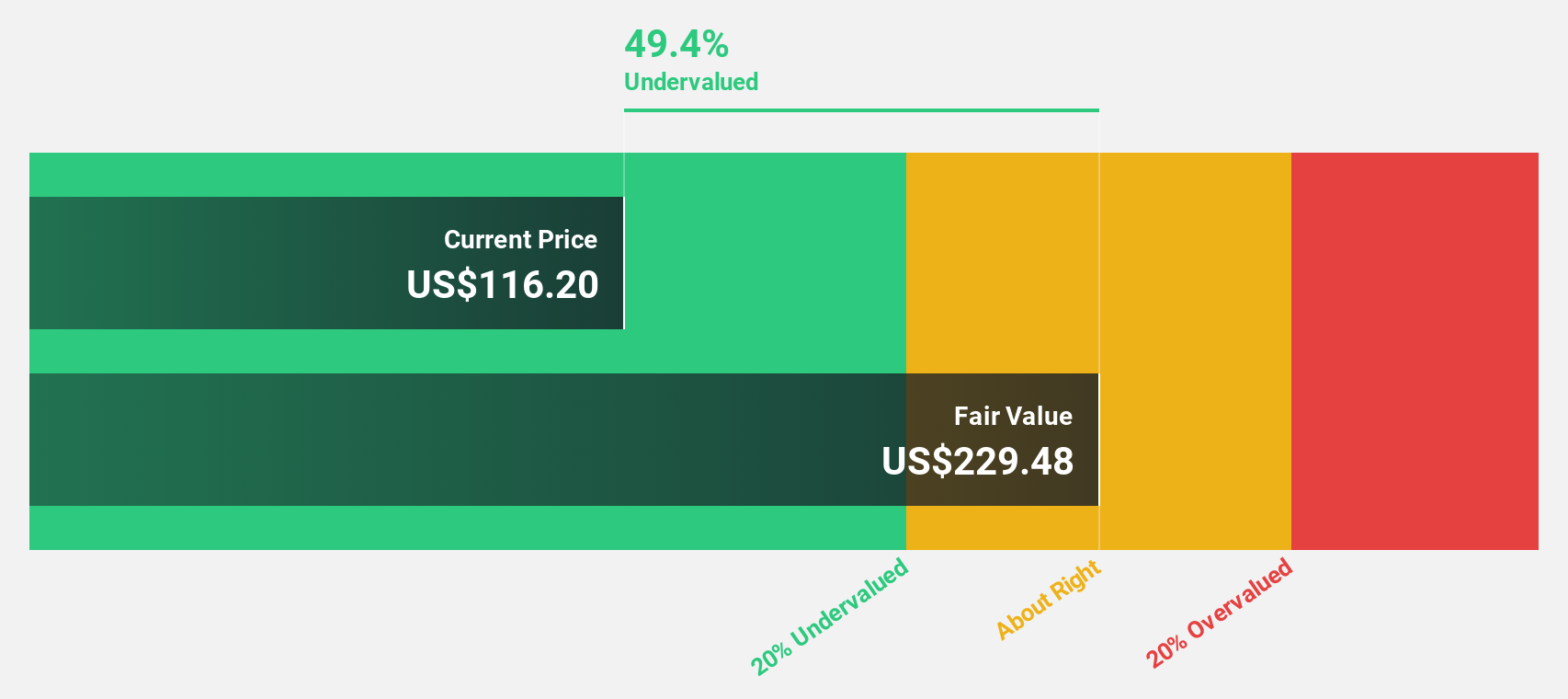

Estimated Discount To Fair Value: 28.1%

Reddit, Inc.'s stock price of US$149.83 is significantly below its fair value estimate of US$208.25, highlighting potential undervaluation based on cash flows. Q3 results show a strong turnaround with sales at US$348.35 million and net income reaching US$29.85 million from a prior loss, despite insider selling and volatility concerns. Revenue growth is forecasted at 23% annually, surpassing market averages and supporting future profitability within three years amidst low expected return on equity.

- Our growth report here indicates Reddit may be poised for an improving outlook.

- Take a closer look at Reddit's balance sheet health here in our report.

Summing It All Up

- Click through to start exploring the rest of the 180 Undervalued US Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, Japan, Chile, and internationally.

Very undervalued with flawless balance sheet.