- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (RBLX) Introduces AI Sentinel To Enhance Safety Across Digital Platforms

Reviewed by Simply Wall St

Roblox (RBLX)'s 80% surge over the last quarter reflects the company's strategic initiatives and market trends. The launch of Roblox Sentinel, an AI-driven safety tool, underscores its commitment to user safety, potentially influencing investor sentiment. Alongside this, the company's Q2 earnings report, despite widened losses, showed significant revenue growth, aligning with broader positive market movements. The introduction of a new Licensing Manager could also enhance revenue streams. While the broader market saw substantial gains with indexes reaching new highs, Roblox's steps toward innovation and community protection may have further supported its stock momentum.

Roblox's recent initiatives, including the launch of the AI-driven safety tool Roblox Sentinel, could significantly enhance user engagement and strengthen investor confidence. This aligns with the company's strategic focus on safety and innovation, possibly accelerating revenue growth. Over the past year, Roblox shares have delivered a very large total shareholder return of 248.75%, reflecting positive market sentiment despite ongoing challenges in achieving profitability. When compared to the broader US market, which returned 19.9% over the same period, Roblox's performance highlights strong investor interest and growth potential.

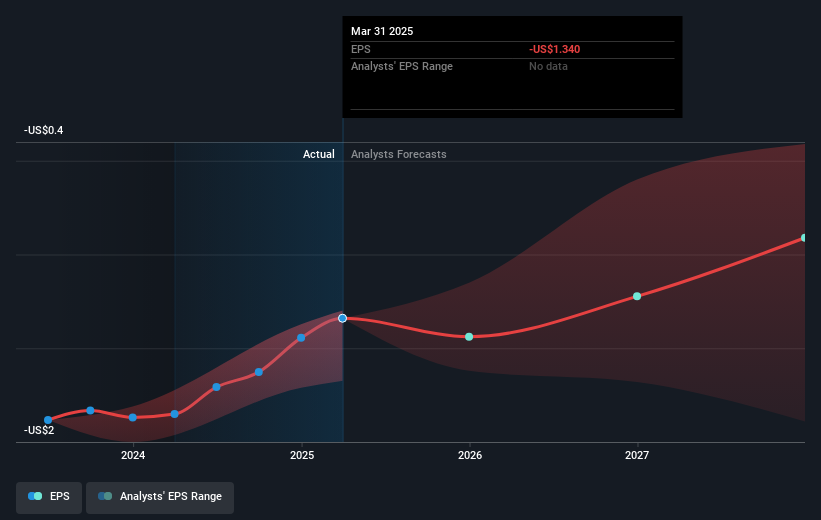

With a current share price of US$129.63, Roblox trades near its consensus analyst price target of US$140.48, suggesting moderate growth expectations. Despite concerns regarding its ability to achieve near-term profitability, the company's AI initiatives and market expansions into regions like India and Japan could positively impact revenue and earnings forecasts. Analysts expect revenue to grow annually by 20.9% over the coming years, positioning Roblox for potential market share gains. As the company's price-to-sales ratio remains elevated compared to industry standards, investors should carefully consider these growth trajectories in conjunction with market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives