- United States

- /

- Entertainment

- /

- NYSE:RBLX

Can the Roblox Rally Continue After Its 209% Surge Into 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Roblox lately, you are definitely not alone. With its stock price closing at $131.72 and racking up an impressive gain of 123.9% in 2024 so far, Roblox has turned many heads on Wall Street. Over the past year, the surge is even more staggering: a whopping 209.1% rise. The past week and month have seen minor dips of -1.1% and -2.5%, respectively. These moves are catching the attention of investors who wonder if Roblox’s meteoric rise can continue or if things are about to cool off.

Much of this long-term momentum traces to renewed optimism about the platform economy, positive sentiment from analysts who see strong engagement trends, and a handful of high-profile content partnerships that continue to build Roblox’s appeal with new audiences. While this context adds needed color to recent chart movements, there is another question at the heart of any smart investment decision: how much is Roblox truly worth today?

When we break it down with traditional valuation methods, Roblox does not get any hidden “undervalued” score. Its valuation score stands at 0 out of 6 on our classic checks. In other words, using our usual yardsticks, there is no evidence that Roblox is hiding untapped value at current levels.

But valuation is rarely as simple as one number or one method. Next, let’s dig into the most common ways to judge what a company is really worth. Later, we will explore an even better approach that more and more investors are adopting.

Roblox scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Roblox Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting them back to present value. This approach aims to determine the true value of a business based on what it is expected to generate in real cash, not on accounting profits or market trends.

Roblox’s most recently reported Free Cash Flow (FCF) stands at $720.6 million. Analysts provide estimates for annual FCF growth over the next five years, projecting steady increases. By 2029, Simply Wall St calculations forecast Roblox’s annual FCF reaching roughly $3.8 billion, which is over five times its current level. Projections for the following five years, while less certain, show continued momentum and growth, with FCF still on an upward track.

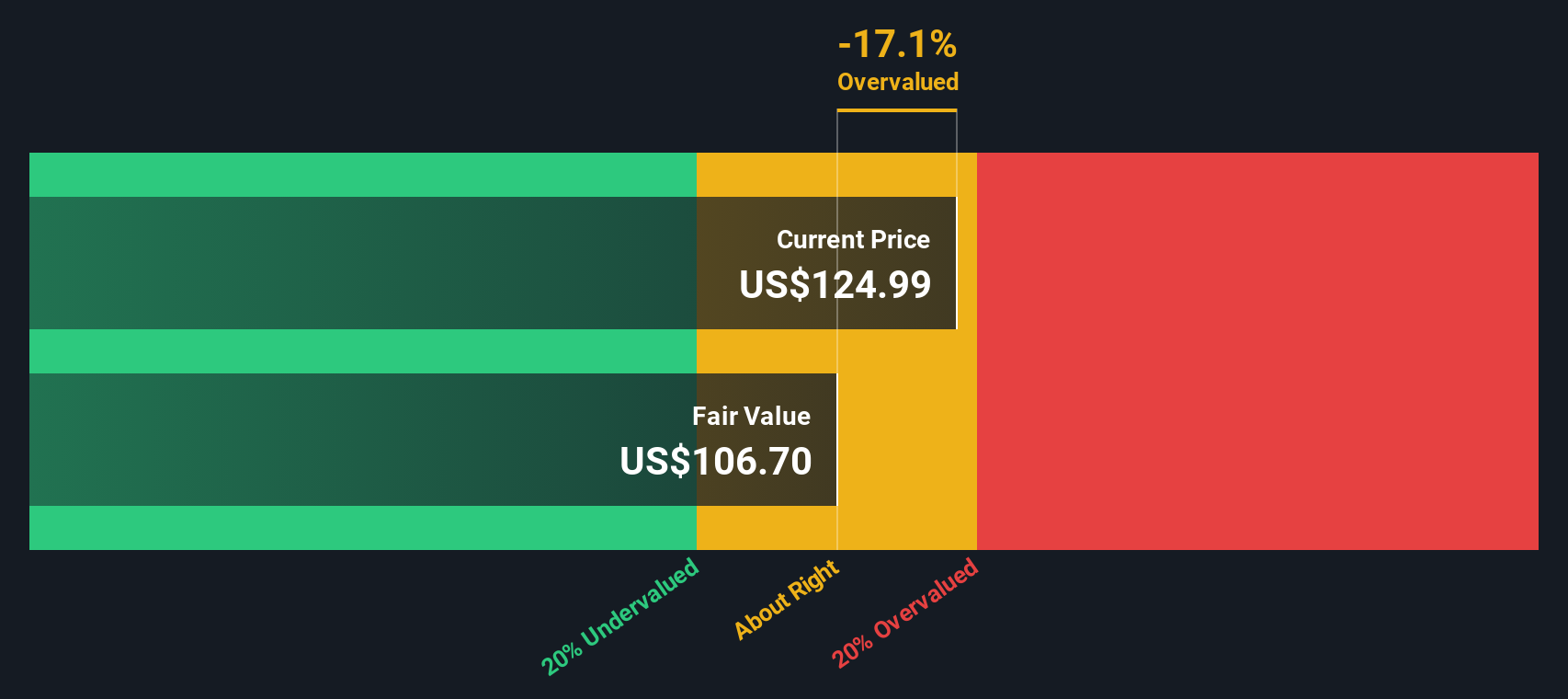

According to these discounted cash flow projections, the estimated intrinsic value per Roblox share is $107.05. With Roblox currently priced at $131.72, this analysis implies the stock is actually 23.0% overvalued compared to its calculated fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roblox may be overvalued by 23.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Roblox Price vs Sales (P/S) Multiple

The Price-to-Sales (P/S) multiple is a useful way to assess the value of companies like Roblox, especially when profitability remains inconsistent. This metric shows how much investors are willing to pay for every dollar of revenue and is most informative for high-growth tech platforms where free cash flow or net earnings are volatile due to ongoing reinvestment.

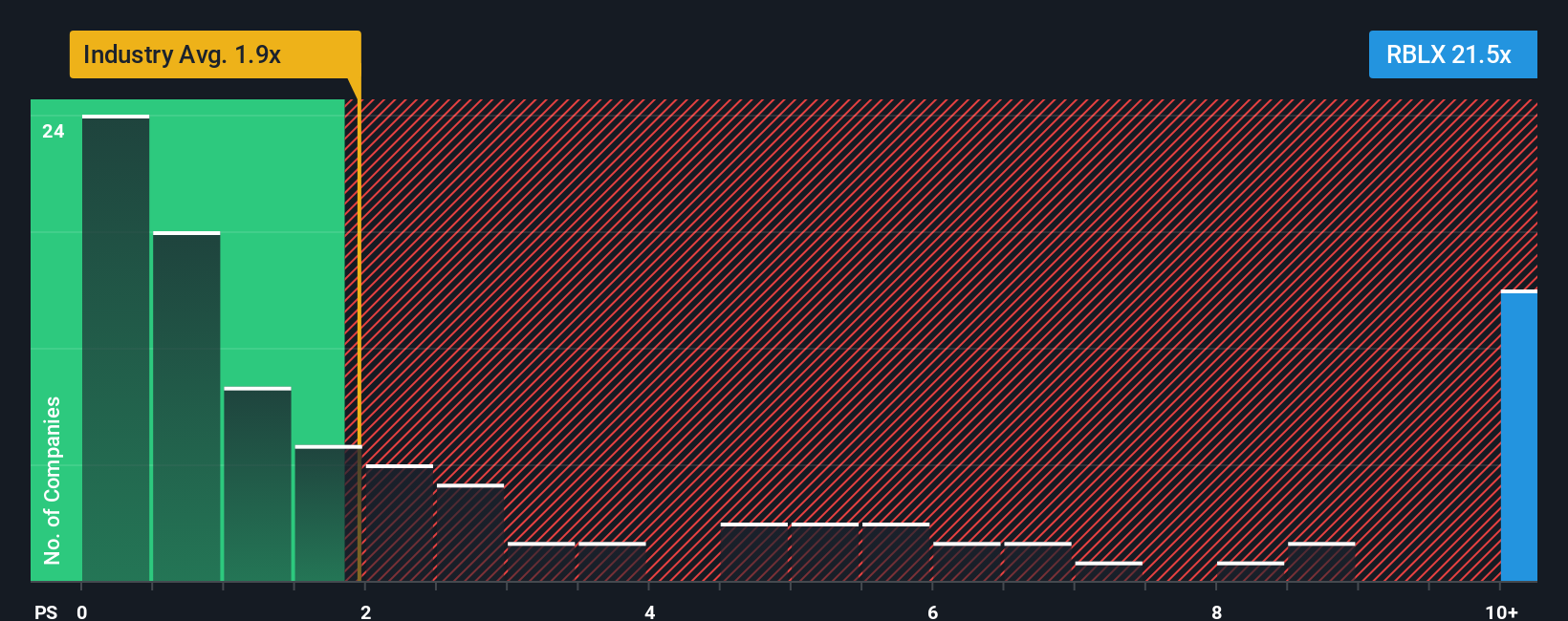

Typically, companies with higher expectations for growth or unique competitive advantages can justify higher P/S ratios. Those facing greater risks or slower growth trends should trade closer to the industry average. As of today, Roblox holds a P/S multiple of 22.7x, which stands out significantly against the Entertainment industry average of 2.03x and even its peer group average of 5.75x.

Simply Wall St’s proprietary “Fair Ratio” metric goes a step further than just comparing Roblox to sector medians or similar companies. This fair value multiple, currently set at 6.19x for Roblox, factors in the company’s specific revenue growth trajectory, margins, market size, and unique risk profile to arrive at what would be considered a ‘normal’ valuation for its circumstances.

At 22.7x, Roblox’s P/S multiple is well above this calculated Fair Ratio. This indicates it is priced for extremely bullish expectations that surpass industry, peer, and even growth-adjusted benchmarks.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roblox Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story and reasoning behind how you view a company’s future, connecting your perspective on Roblox’s business (such as global expansion, monetized content, and user growth) with financial forecasts and a fair value you believe is reasonable.

Unlike rigid models, Narratives let you combine your insights and assumptions, estimate key numbers like future revenue and margins, and see instantly how they translate into a fair value for the business. This approach shifts the question from “What’s the right price?” to “What story do I believe about Roblox’s future, and is the market pricing it in?”

Narratives are accessible and dynamic tools available on Simply Wall St’s Community page, where millions of investors share and update their views as news breaks or earnings are released. By comparing your Narrative’s fair value with the current price, you can make smarter buy or sell decisions based on your convictions instead of just headlines.

For example, one user’s Narrative might see Roblox’s global reach and expanding content as justifying a bullish fair value near $175 per share, while another highlights ongoing risks and sets a more cautious estimate at just $62. Both positions can be tracked and debated as new information is revealed.

Do you think there's more to the story for Roblox? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives