- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Will Pinterest's (PINS) AI Content Controls Reshape Its Competitive Edge in the Social Media Landscape?

Reviewed by Sasha Jovanovic

- In recent days, Pinterest introduced new features allowing users to reduce or adjust the visibility of generative AI images in their feeds across multiple categories, following user concerns over a sharp increase in AI-generated content.

- This move highlights Pinterest’s recognition of user preferences and the ongoing industry debate about balancing AI-driven innovation with authentic, human-made content.

- Next, we’ll explore how placing control over AI content directly in users’ hands may influence Pinterest’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Pinterest Investment Narrative Recap

To be a Pinterest shareholder, you need to believe in its ability to drive higher user engagement and ad revenue through innovation in visual discovery and personalized content, all while navigating competitive and monetization challenges across markets. The new controls for AI-generated images are unlikely to materially impact the main catalyst, ongoing AI-driven personalization, or the biggest risk, which is growing ad competition and international ARPU lag. Instead, this update signals steady refinement of the user experience in support of Pinterest’s long-term growth drivers.

Among recent announcements, Pinterest’s expanded partnership with Instacart stands out as highly relevant. This move grows commerce features and deepens integration of shoppable ads, supporting key catalysts like higher conversion rates and incremental revenue streams, even as the company works to differentiate itself and protect its unique brand identity in a crowded market.

But in contrast, persistent concerns over competition from bigger platforms with stronger AI capabilities is something investors should watch for, as...

Read the full narrative on Pinterest (it's free!)

Pinterest's outlook anticipates $5.9 billion in revenue and $1.0 billion in earnings by 2028. This scenario assumes a 14.6% annual revenue growth rate but a decrease in earnings of $0.9 billion from current earnings of $1.9 billion.

Uncover how Pinterest's forecasts yield a $43.58 fair value, a 35% upside to its current price.

Exploring Other Perspectives

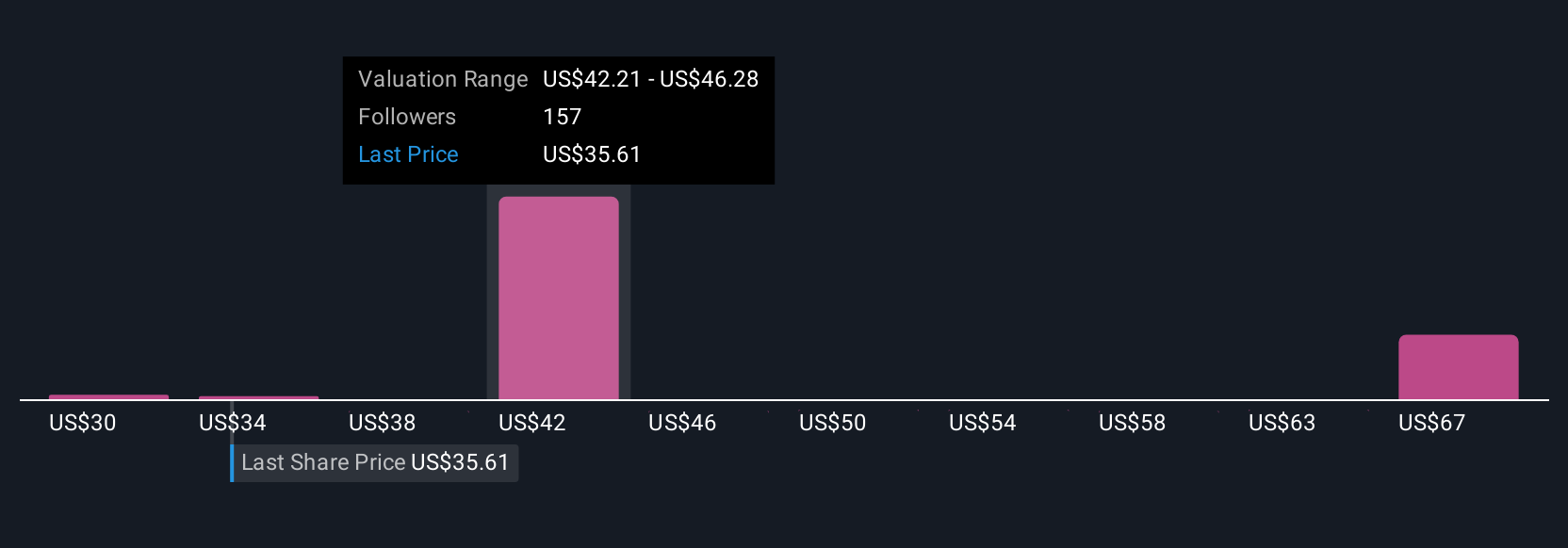

Sixteen member estimates from the Simply Wall St Community put Pinterest’s fair value between US$31.95 and US$57.75 per share. These differing opinions reflect how the risk of intensifying competition from larger digital ad platforms could have wide-ranging effects on future performance and are a reminder to review several viewpoints before investing.

Explore 16 other fair value estimates on Pinterest - why the stock might be worth as much as 78% more than the current price!

Build Your Own Pinterest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pinterest research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pinterest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pinterest's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives