- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Is Pinterest Stock a Bargain After Recent Slide Despite Strong Cash Flow Outlook?

Reviewed by Bailey Pemberton

- Wondering whether Pinterest at around $27 a share is a bargain or a value trap? You are not alone. This breakdown is designed to help you decide with confidence.

- Over the last week the stock is up about 6.5%, but that bounce comes after a rough patch with the price down 17.3% over 30 days and still negative at -11.0% year to date and -13.8% over the last year, even though it is up 20.4% over three years and still 62.0% below where it was five years ago.

- Recently, investors have been reacting to a mix of platform updates, new ad tools and partnerships that aim to make Pinterest more shoppable and more attractive to advertisers. In addition, commentary around user engagement trends and management’s product roadmap has shaped expectations about whether the business can convert its unique niche into sustained growth.

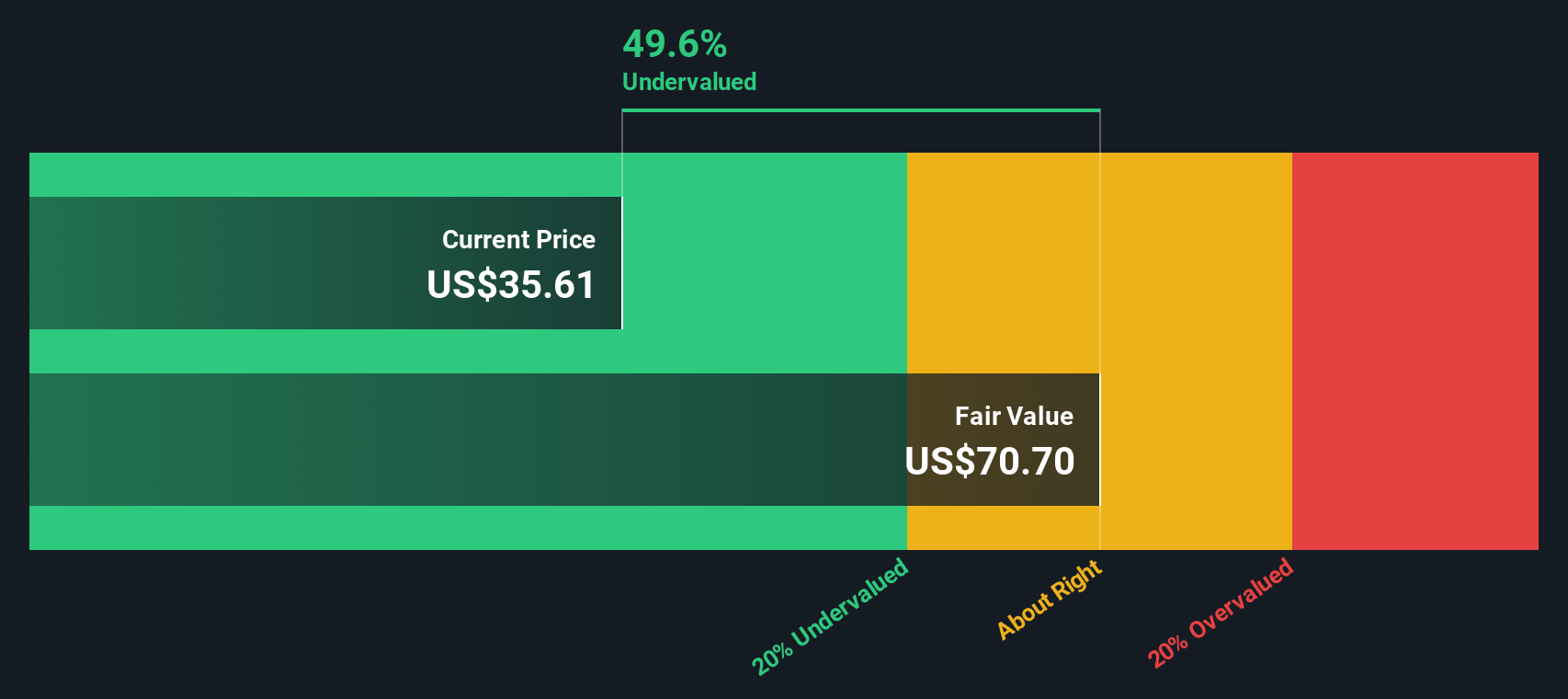

- Despite all that noise, Simply Wall St’s valuation checks give Pinterest a score of 6/6, meaning it screens as undervalued on every one of our six metrics. In the rest of this article we will walk through those valuation methods while also pointing to an even better way to make sense of what the numbers really imply for long term investors.

Find out why Pinterest's -13.8% return over the last year is lagging behind its peers.

Approach 1: Pinterest Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present. For Pinterest, Simply Wall St uses a 2 Stage Free Cash Flow to Equity model built on cash flow projections.

Pinterest currently generates about $1.13 billion in free cash flow, and analyst forecasts plus in house estimates see this rising to roughly $1.98 billion by 2030 and $2.34 billion by 2035. Analysts directly provide only the early years of this path, while later years are extrapolated based on growth assumptions. All figures are in $ and represent the cash that could ultimately accrue to shareholders.

When these projected cash flows are discounted back, the model arrives at an intrinsic value of about $51.12 per share. Compared with the recent share price near $27, the DCF implies the stock is roughly 46.7% undervalued, indicating a wide margin between today’s price and long term cash flow value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pinterest is undervalued by 46.7%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Pinterest Price vs Earnings

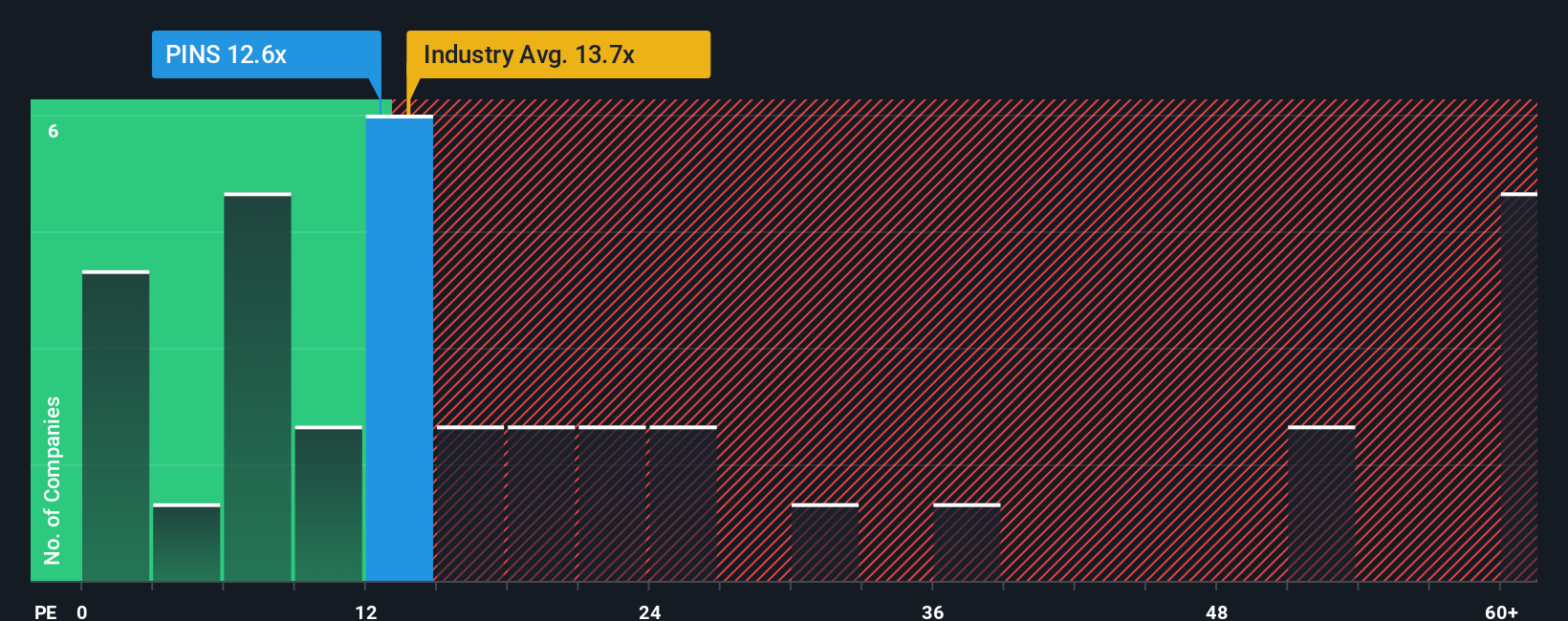

For a profitable, growing business like Pinterest, the price to earnings ratio is a useful yardstick because it relates what investors are paying directly to the profits the company is already generating. In general, faster growth and lower risk justify a higher PE, while slower growth or higher uncertainty usually warrant a lower, more conservative multiple.

At around 9.26x earnings, Pinterest trades well below the Interactive Media and Services industry average of about 17.19x and far under the broader peer group average near 66.76x. On the surface, that big gap suggests the market is either underestimating Pinterest’s earnings power or baking in meaningful execution risk.

Simply Wall St’s Fair Ratio, at roughly 14.59x, goes a step further by estimating the multiple Pinterest deserves based on its own earnings growth outlook, profit margins, risk profile, industry positioning and market cap. This makes it more insightful than a simple comparison against peers or the industry, which can be skewed by outliers or different business models. Since the Fair Ratio is materially higher than Pinterest’s current 9.26x, the multiple based view points to the shares trading below this indicated level.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

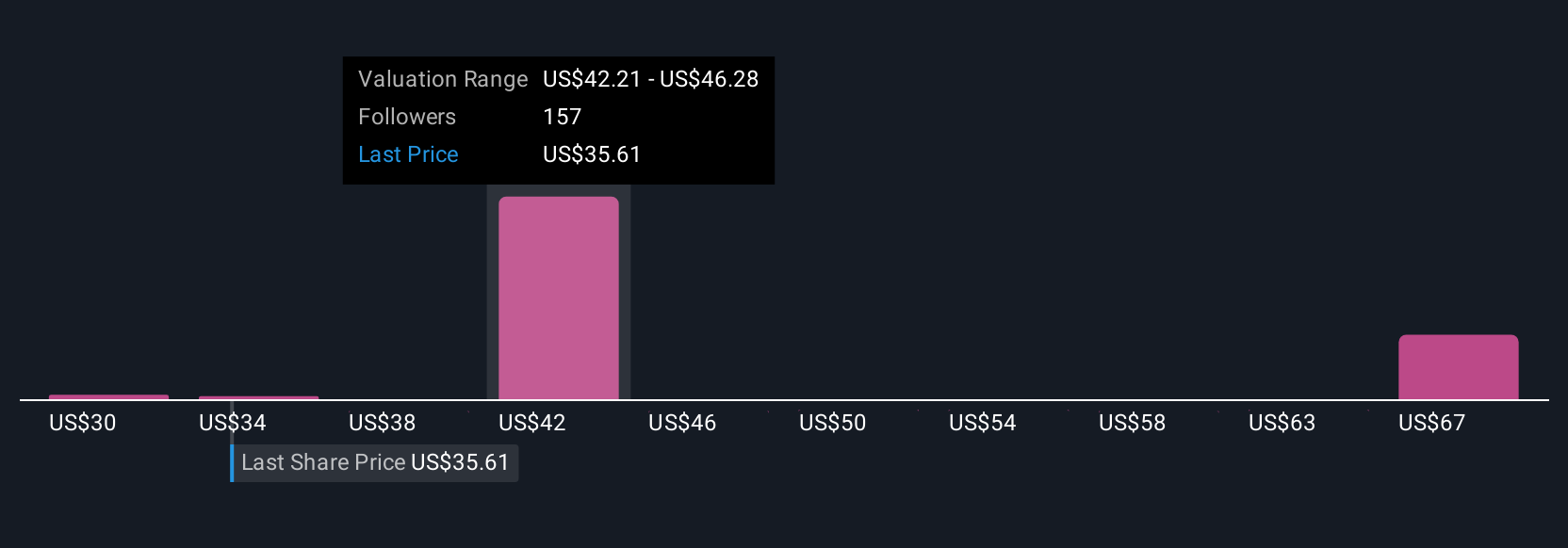

Upgrade Your Decision Making: Choose your Pinterest Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect your view of Pinterest’s story to a concrete forecast for its future revenue, earnings and margins. This then links to a Fair Value that you can directly compare with today’s share price to inform whether to buy, hold or sell. The numbers and Fair Value update dynamically as new news or earnings arrive. For example, one Pinterest Narrative might assume strong product execution and high profitability to reach a Fair Value near $43 per share. Another more cautious Narrative, focused on tougher competition and thinner margins, might land closer to $38. This shows in a clear, visual way how different but reasonable perspectives on the same business can lead to different, but still data driven, estimates of what the stock is actually worth.

Do you think there's more to the story for Pinterest? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026