- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has remained flat over the last week but is up 23% over the past year, with earnings expected to grow by 15% annually in the coming years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability, aligning with anticipated market growth trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Bitdeer Technologies Group | 51.49% | 122.94% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.52% | 55.88% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc. is a digital asset technology company operating in the United States with a market capitalization of $1.92 billion.

Operations: TeraWulf Inc. generates revenue primarily through digital currency mining, with this segment contributing $128.35 million.

TeraWulf, navigating the volatile tech landscape, demonstrates a robust commitment to growth with a projected annual revenue increase of 30.1%. This figure notably surpasses the U.S. market average of 8.8%, positioning it well within the high-growth tech sector. Recent strategic moves include a significant partnership with Core42 for AI/HPC co-location services, indicating an expansion into AI-driven computing alongside its existing Bitcoin mining operations. This diversification is supported by recent filings for shelf registrations totaling $46.83 million, aimed at bolstering its financial structure and supporting expansive projects set for rollout in phases throughout 2025 at their Lake Mariner facility.

ADMA Biologics (NasdaqGM:ADMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ADMA Biologics, Inc. is a biopharmaceutical company focused on developing, manufacturing, and marketing specialty plasma-derived biologics for treating immune deficiencies and infectious diseases, with a market cap of approximately $3.89 billion.

Operations: The company generates revenue primarily through its ADMA Biomanufacturing segment, which contributes $373.22 million, supplemented by its Plasma Collection Centers with $9.45 million.

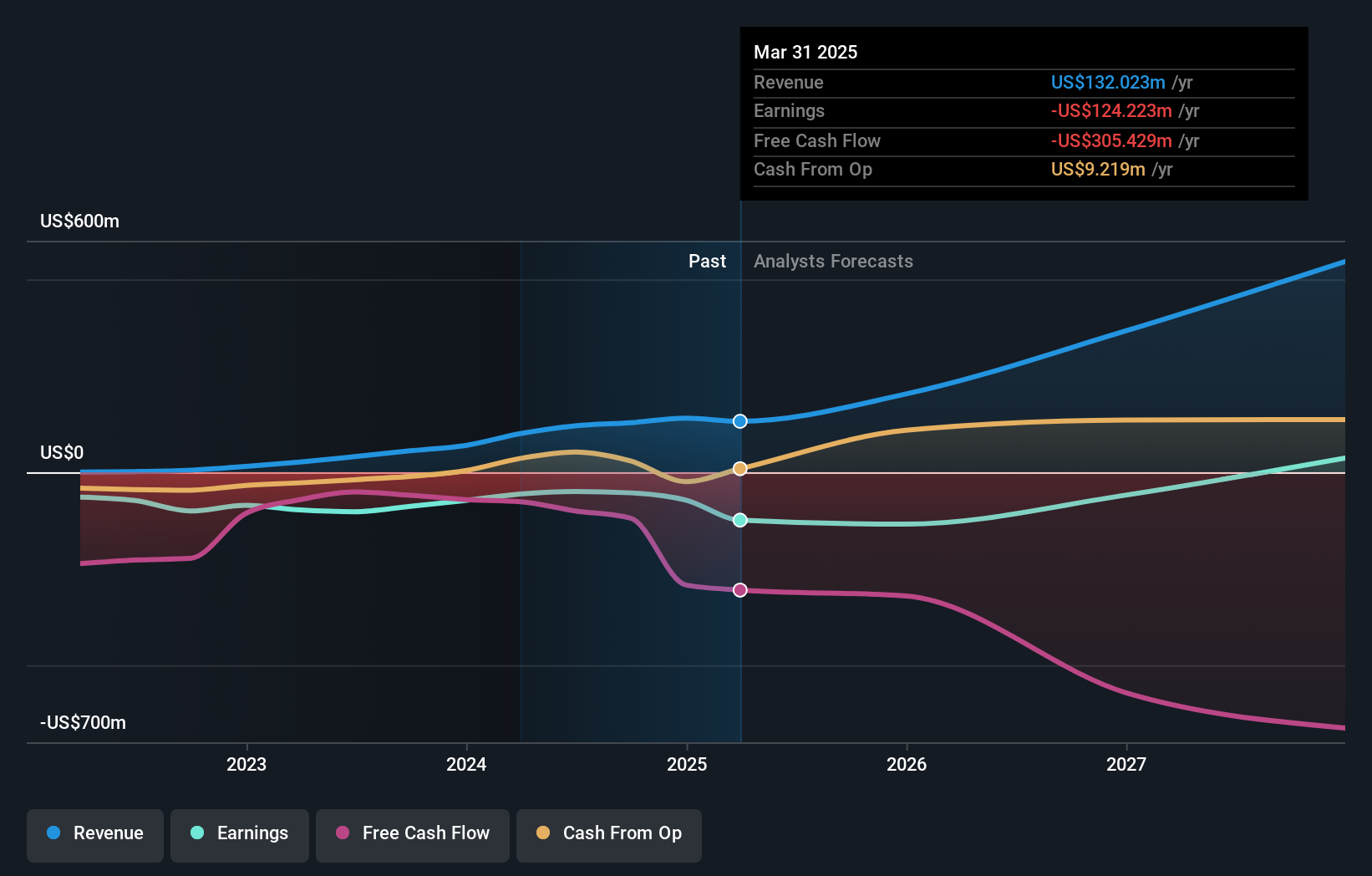

ADMA Biologics, showcasing resilience and growth within the biotech sector, has recently revised its earnings guidance upwards, reflecting robust financial health and market confidence. With a forecasted annual revenue growth of 18.5%—nearly double the U.S. market average of 8.8%—and an anticipated earnings increase of 26.7%, ADMA is positioning itself as a strong contender in high-growth biotechnologies. The company's strategic focus on expanding its product offerings is further evidenced by significant R&D investments, aligning with industry trends towards innovative healthcare solutions. Recent corporate moves include appointing seasoned executives to strengthen governance and repaying $30 million in debt to improve financial leverage, indicating prudent management and operational efficiency.

- Click to explore a detailed breakdown of our findings in ADMA Biologics' health report.

Understand ADMA Biologics' track record by examining our Past report.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market capitalization of $22.36 billion.

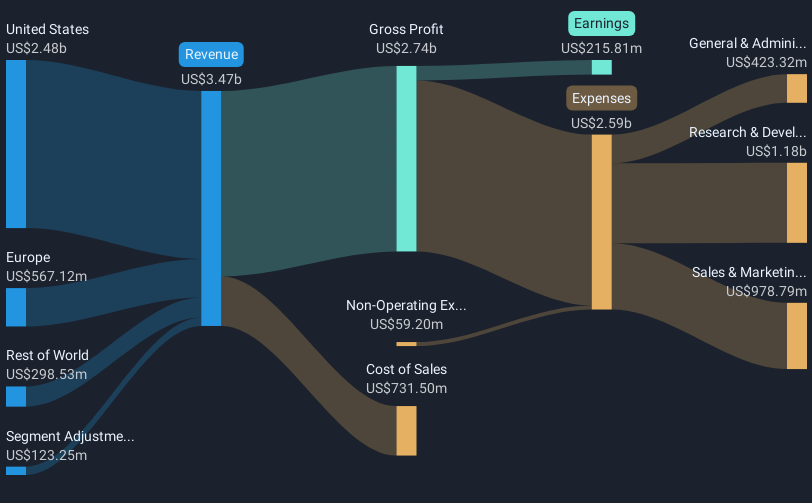

Operations: Pinterest generates revenue primarily from its Internet Information Providers segment, amounting to $3.47 billion.

Pinterest has demonstrated a robust financial trajectory, with its earnings expected to surge by 30.2% annually, outpacing the U.S. market's average of 14.8%. This growth is underpinned by a significant increase in revenue, projected at 12.2% yearly, which also exceeds the broader market's growth rate of 8.7%. The company's commitment to innovation is evident from its recent conference presentations and substantial R&D investments, positioning it well within the competitive tech landscape. Additionally, Pinterest has actively returned value to shareholders through an aggressive share repurchase program totaling $500 million last year, underscoring its strong financial management and optimistic future outlook.

- Dive into the specifics of Pinterest here with our thorough health report.

Explore historical data to track Pinterest's performance over time in our Past section.

Where To Now?

- Dive into all 233 of the US High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives