- United States

- /

- Media

- /

- NYSE:NYT

New York Times (NYT) Valuation: Exploring Upside Potential as Investors Warm to Media Sector

Reviewed by Kshitija Bhandaru

See our latest analysis for New York Times.

New York Times has seen its share price tick higher so far this year, suggesting that investors are warming up to the company’s steady revenue and profit growth even as headlines around media shakeups swirl. With a 1-year total shareholder return of nearly 3% and substantial gains over the past three years, momentum appears to be gradually building, setting an optimistic tone for those watching its valuation as industry trends shift.

If you’re weighing your next move in the shifting media landscape, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares still trading below analyst price targets, along with solid annual growth in revenue and net income, is New York Times undervalued at current levels? Or are markets already looking ahead and pricing in future gains?

Most Popular Narrative: 10.7% Undervalued

With the narrative fair value set at $62.25 and New York Times stock closing at $55.60, analysts see further upside. However, the gap has started to narrow as market optimism catches up to the fundamentals.

"Robust growth in digital subscriptions driven by an expanding portfolio of bundled offerings (news, Cooking, Games, The Athletic) and a focus on direct consumer relationships positions the company to capture more recurring revenue, strengthen ARPU, and reduce churn. This directly supports long-term revenue and margin expansion. Rising global demand for trusted, high-quality journalism amid increasing misinformation is enabling NYT to increase its international reach and subscription base, paving the way for sustained top-line growth and a larger addressable market."

Curious how this valuation stands out? One aggressive set of analyst projections puts future profit margins, growth, and global reach in the spotlight. Want to discover what surprising assumptions and bold estimates support the price target? Peek behind the curtain before making your next move.

Result: Fair Value of $62.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts in AI-driven news aggregation and potential subscriber churn could challenge the New York Times’s growth trajectory and put pressure on future margins.

Find out about the key risks to this New York Times narrative.

Another View: What Do Earnings Multiples Say?

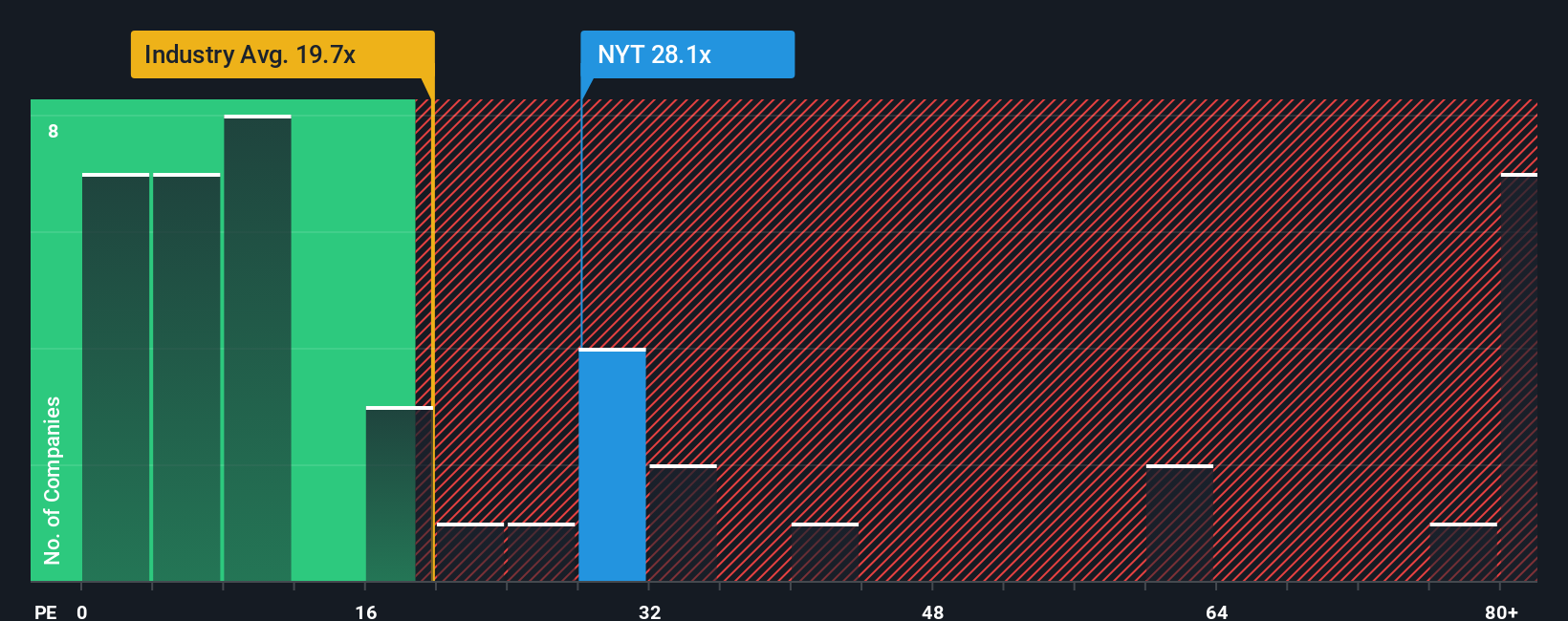

While analysts estimate New York Times is undervalued based on its earnings growth, using the market’s earnings ratio paints a different picture. The stock trades at 28.3 times earnings, much higher than both the industry average of 20.2 and its closest peers at 17.2, as well as the fair ratio of 21.8. This premium suggests investors may be pricing in high future growth. The question remains whether that optimism is justified or if it could leave little margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New York Times Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a custom narrative in just minutes. Do it your way

A great starting point for your New York Times research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize this opportunity to broaden your investment horizons. The Simply Wall Street Screener highlights smart picks that go beyond the obvious, saving you hours of research and helping you get ahead of the curve.

- Uncover rapid growth opportunities by checking out these 24 AI penny stocks which are transforming industries with artificial intelligence breakthroughs and next-generation automation.

- Capitalize on reliable yields as you review these 19 dividend stocks with yields > 3% featuring companies with robust dividends and a proven track record of rewarding shareholders.

- Stay ahead of the market by hunting for value among these 903 undervalued stocks based on cash flows profit-generating businesses trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New York Times might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NYT

New York Times

The New York Times Company, together with its subsidiaries, creates, collects, and distributes news and information worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives