- United States

- /

- Media

- /

- NYSE:NMAX

What Recent Price Swings Mean for Newsmax Stock in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Newsmax stock? You’re not alone; this is the question on the minds of many investors right now. Newsmax has been in the spotlight due to some sharp price swings, and whether you’re already holding shares or considering jumping in, it’s important to look past the headlines and dig into what’s really happening with this stock.

In the past month, Newsmax shares have dropped 13.7%, adding to a tough year-to-date slide of 86.7%. Over the last week, things have been surprisingly stable, with just a small dip of 0.4%. These moves come at a time when the market seems to be reassessing risk across the media landscape, with sentiment shifting thanks to market-wide developments and evolving investor appetite. While the latest news hasn’t triggered any huge rallies or new risks for Newsmax, the general uncertainty in the sector does appear to be weighing on the stock’s performance.

When it comes to value, Newsmax’s current score is 1 out of 6 for being undervalued, meaning most valuation checks don’t point to a major bargain right now. But that’s just part of the picture. Let’s take a closer look at how the usual valuation methods stack up, and why there could be a smarter way to figure out whether Newsmax truly deserves your attention.

Newsmax scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Newsmax Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method looks beyond short-term price swings and aims to reveal what Newsmax might really be worth based on its long-term ability to generate cash.

For Newsmax, the latest reported Free Cash Flow (FCF) is -$82.3 Million, highlighting recent challenges. According to analyst forecasts, this is expected to turn positive over time, with FCF projected at $21.5 Million by 2027. Extending beyond the first five years, further projections, which are extrapolated rather than directly estimated by analysts, suggest FCF could reach $94.7 Million by 2035.

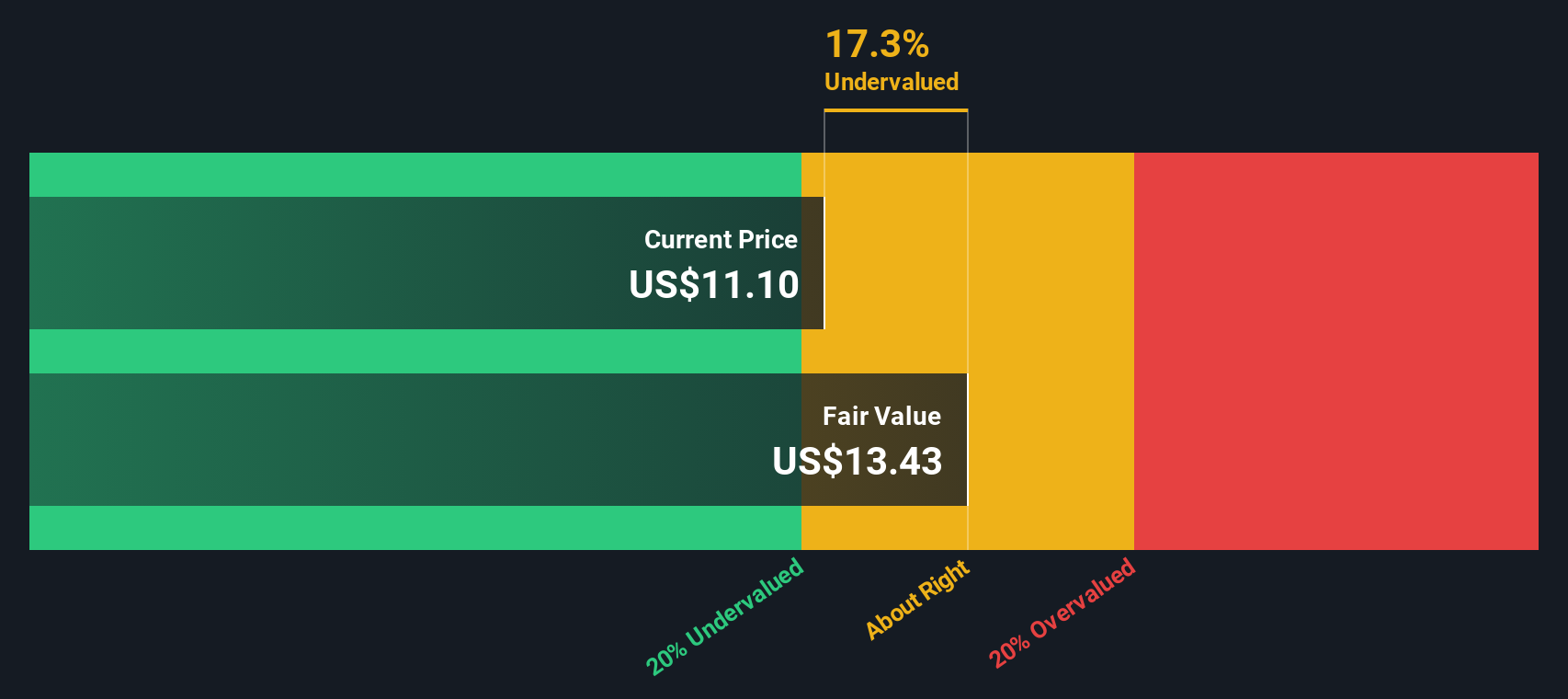

Using all these projections, the DCF analysis delivers an estimated fair value of $13.43 per share. This places the current share price at a 17.3% discount to the model’s intrinsic value, indicating that Newsmax stock is undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Newsmax is undervalued by 17.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Newsmax Price vs Sales

For evaluating companies in the media sector, the Price-to-Sales (P/S) ratio is often a preferred multiple, especially when a company’s profitability is still evolving. The P/S ratio gives investors a sense of how much they're paying for every dollar of revenue. This can be useful when earnings are negative or volatile, as is the case for Newsmax right now.

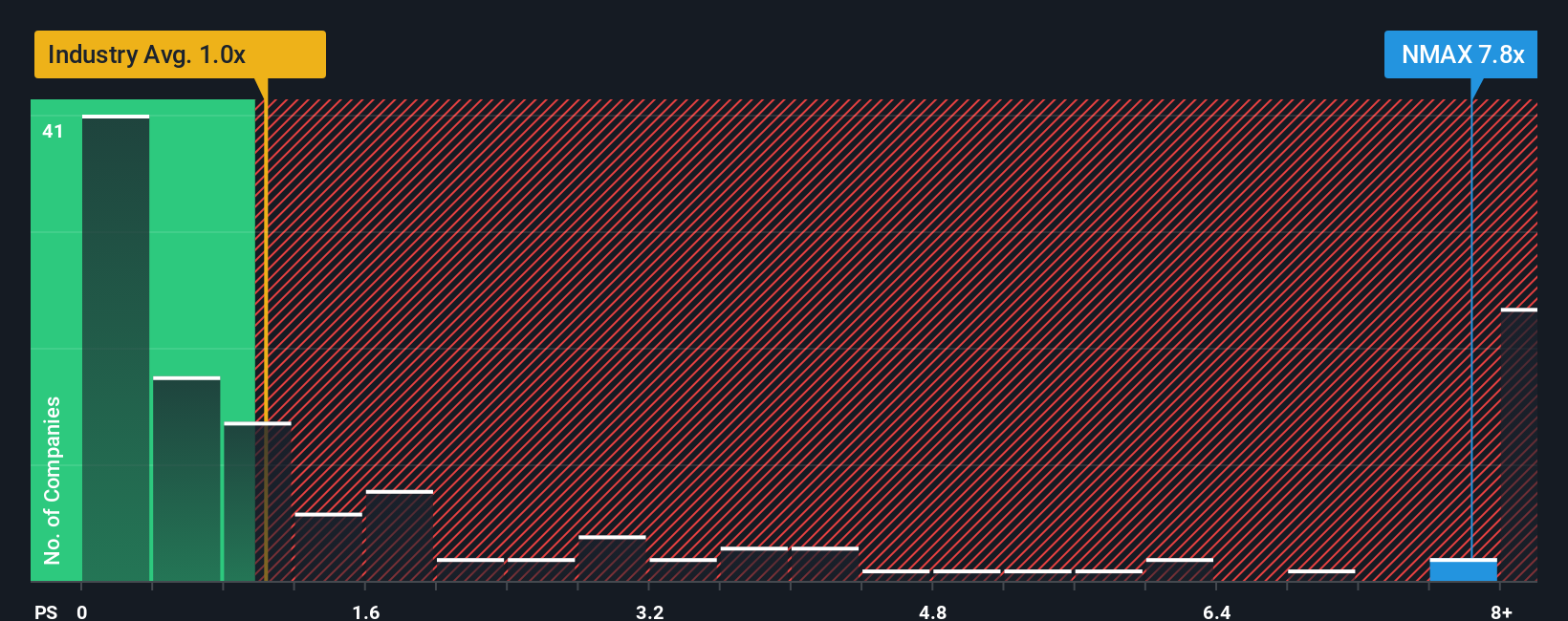

Generally, growth expectations and risks play a major role in what counts as a "normal" P/S ratio. Fast-growing businesses or companies operating in high-potential markets can justify higher multiples, while more mature or risky businesses tend to command lower ratios. For context, Newsmax's current P/S ratio stands at 7.83x. This is ahead of both the media industry average of 1.03x and the average of its direct peers at 0.63x.

This is where Simply Wall St’s Fair Ratio comes in, providing a custom benchmark of 1.57x for Newsmax. The Fair Ratio considers not just peer and industry multiples but also factors such as the company’s revenue growth prospects, profit margins, industry nuances, market cap, and key risks. This makes it a more reliable guide to where the stock’s valuation ought to be in today’s market.

Comparing Newsmax’s actual P/S of 7.83x to its Fair Ratio of 1.57x, the stock appears to be trading significantly above where fundamentals suggest it should be valued. This points to a potential overvaluation at current prices.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Newsmax Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind the numbers—your view of a company’s future, expressed through your own assumptions about its fair value, projected revenues, earnings, and profit margins.

Narratives connect the dots between a company’s story, its likely financial performance, and what you think it is really worth. On Simply Wall St’s Community page, investors can easily build and compare Narratives using a tool trusted by millions. Narratives make it straightforward to see when the fair value you estimate is above or below the current share price, helping you decide if it is the right time to buy or sell.

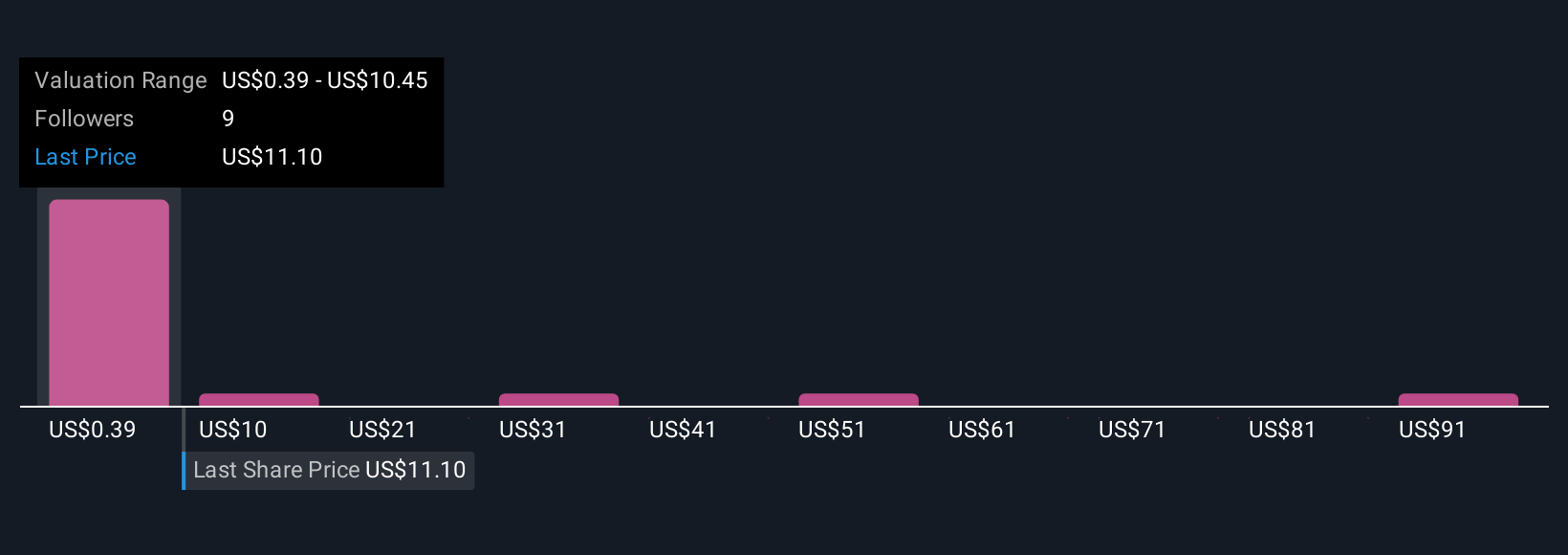

In addition, these Narratives update automatically as new developments and financial results emerge, ensuring your perspective always reflects the latest information. For example, some Newsmax Narratives project a fair value as high as $27 per share, while others estimate it as low as $5, showing how opinions and assumptions can vary widely among investors.

Do you think there's more to the story for Newsmax? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newsmax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMAX

Newsmax

Through its subsidiaries, operates as a television broadcaster and multi-platform content publisher in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives