- United States

- /

- Media

- /

- NYSE:NMAX

What Does Newsmax’s 85% Share Plunge in 2025 Mean for Investors?

Reviewed by Bailey Pemberton

If you’re wondering whether to buy, hold, or walk away from Newsmax stock right now, you’re not alone. After all, the last few months have been a bit of a rollercoaster. The stock actually climbed 3.5% over the past week, a modest sign of life after a tough stretch. But zoom out, and things look dramatically different: Newsmax is down 4.5% over the last month, and the year-to-date return is a jaw-dropping minus 84.8%, a plunge that would make even seasoned investors do a double take. What’s driving these moves? Market sentiment around digital media and television industries has shifted, creating new uncertainties and opportunities. Newsmax has been caught right in the middle.

With share prices swinging sharply, it's tempting to see Newsmax as a potential bargain. To help us figure that out, let’s look at the company’s valuation. Measured against six different standard checks, Newsmax scores just a 1, meaning it’s considered undervalued in only one area out of six. That’s not the slam dunk some investors might hope for, but it’s not without its potential, either.

Still, standard valuation metrics rarely tell the whole story, especially in an industry as dynamic as this one. Stick with me as we break down exactly how analysts evaluate Newsmax’s worth using different valuation approaches. Keep an eye out, because I’ll show you a more insightful way to judge whether this company’s really a value play by the end of the article.

Newsmax scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Newsmax Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their value today. This approach aims to answer what the company is really worth now, based on what it could generate in the years ahead.

For Newsmax, the current Free Cash Flow stands at approximately $-82.3 Million, while forecasts suggest a return to positive territory over the next decade. Analysts expect Free Cash Flow to rise to around $21.5 Million by 2027. Future growth beyond analyst estimates was extrapolated, projecting that Free Cash Flow could climb steadily over the next ten years, reaching nearly $94.7 Million by 2035, according to Simply Wall St’s extended projections.

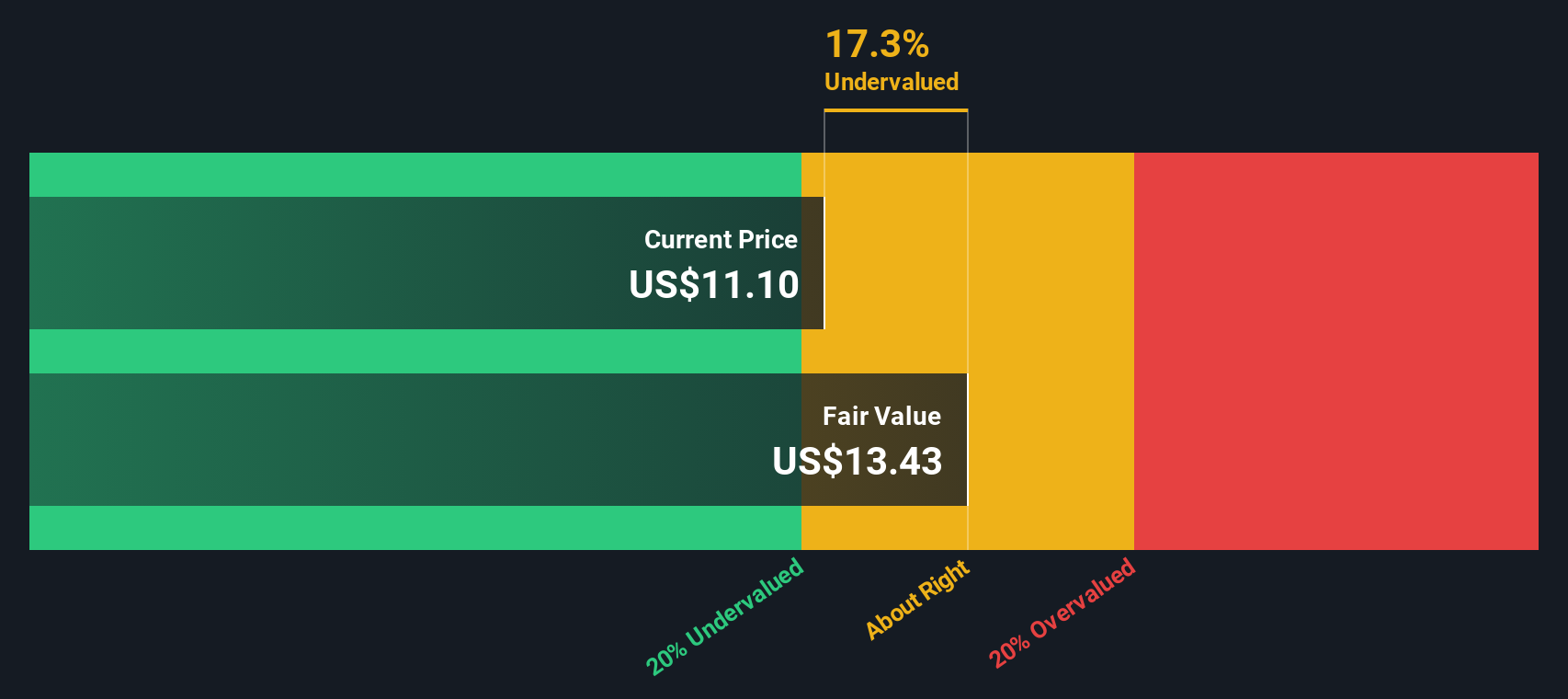

Taking these projections into account, the DCF model calculates an intrinsic value of $13.43 per share. This represents a 5.3% discount compared to the current price. In other words, Newsmax appears to be trading at about its fair value based on expected future cash flows.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Newsmax's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Newsmax Price vs Sales

For companies where current profits are slim or negative, analysts often turn to the Price-to-Sales (P/S) ratio as a key valuation metric. The P/S ratio helps investors compare what the market is willing to pay per dollar of sales, which can be especially useful in fast-changing industries like media where earnings can fluctuate sharply. Growth expectations and levels of risk heavily influence whether a company's P/S ratio is seen as high or low. Fast-growing, less risky firms usually command higher multiples. In contrast, slower growth or higher uncertainty pushes the fair range downward.

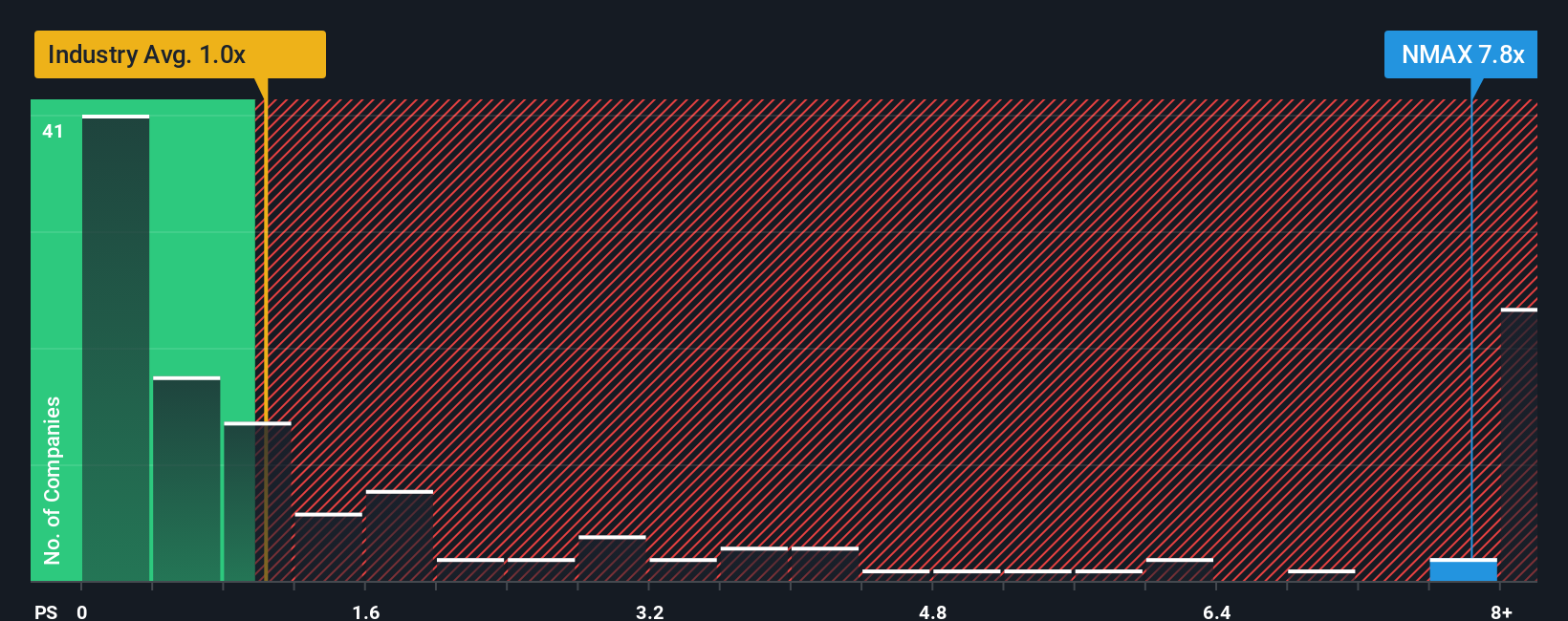

Newsmax currently trades at a P/S ratio of 8.97x. To add perspective, the average for its media industry peers sits at just 1.06x, and a selected peer group averages 0.66x. On the surface, Newsmax looks far more expensive than both its industry and immediate competitors on this metric.

This is where Simply Wall St’s Fair Ratio comes in. Unlike a raw industry or peer comparison, the Fair Ratio adjusts for Newsmax’s individual growth outlook, margins, market cap, and specific business risks. For Newsmax, the Fair Ratio works out to 1.65x. By directly comparing Newsmax’s actual P/S ratio to this Fair Ratio, we see that shares are priced well above what would be considered reasonable given its fundamentals and outlook.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Newsmax Narrative

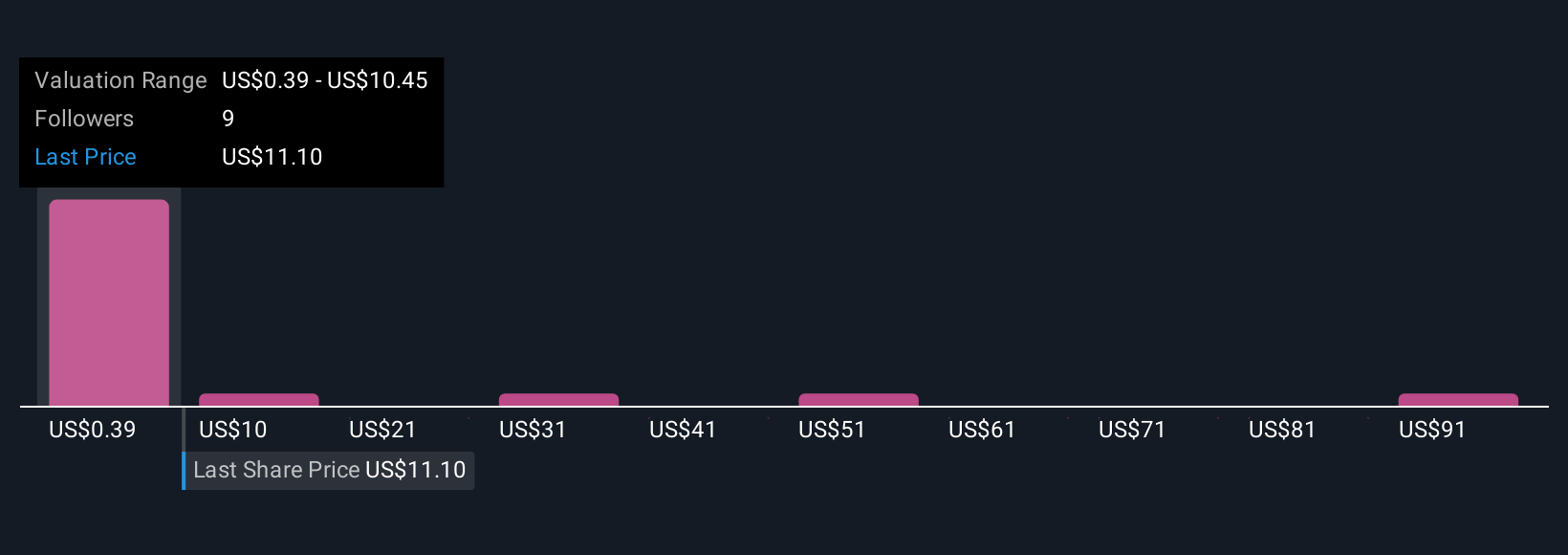

Earlier, we mentioned that there's an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply the story you tell about a company, the perspective you bring to the numbers, by using your own assumptions for fair value, future revenue, earnings, and margins. Narratives directly connect a company’s story to a financial forecast and then to an updated fair value, making them much more personal and actionable than traditional metrics alone.

Available right within Simply Wall St’s Community page, Narratives make it easy and accessible for anyone to formally express and share their investment outlook. Millions of investors are already using this tool. Narratives help you decide when to buy, hold, or sell by comparing your calculated fair value to the current market price. Even better, they update dynamically as new information, such as earnings reports or breaking news, comes in.

With Newsmax, for example, some investors see explosive growth ahead and set a high Narrative fair value, while others are much more cautious or pessimistic, landing on a much lower number. By turning your investment thesis into a Narrative, you empower yourself to react confidently and quickly, no matter what the market throws your way.

Do you think there's more to the story for Newsmax? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newsmax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMAX

Newsmax

Through its subsidiaries, operates as a television broadcaster and multi-platform content publisher in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives