- United States

- /

- Media

- /

- NYSE:NIQ

NIQ Global Intelligence (NIQ): Evaluating Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

NIQ Global Intelligence (NIQ) has seen some recent movement on the NYSE, prompting investors to take a closer look at the company’s latest performance numbers and valuation. The stock’s trends over the past month may warrant a fresh review.

See our latest analysis for NIQ Global Intelligence.

After rallying sharply with a 16.8% seven-day share price return, NIQ Global Intelligence has seen volatility resume as momentum cools. The current share price of $14.02 leaves the stock down 1.2% over the past month and roughly 26% lower since the start of the year. This suggests investors are still digesting recent swings and re-evaluating NIQ’s growth outlook.

If you’re tracking shifts like these, consider broadening your search and discover fast growing stocks with high insider ownership.

With the share price well below analyst targets and a recent dip after earlier gains, is NIQ Global Intelligence trading at an attractive discount, or has the market already factored in its next stage of growth?

Price-to-Sales Ratio of 1x: Is it justified?

NIQ Global Intelligence is currently trading at a price-to-sales (P/S) ratio of 1x, putting its share price slightly below both peer and industry averages. With the stock showing over 26% declines year-to-date and recent volatility, this multiple offers clues to how the market is weighing future prospects.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of the company's revenue. This metric is especially relevant for companies that are not yet consistently profitable, such as NIQ Global Intelligence. In the media sector, P/S can indicate if investors expect growth or are cautious about sustained losses. For NIQ, the low P/S suggests that current revenue is not being awarded a substantial premium, reflecting investor uncertainty about the company's path to profitability.

Compared to the US Media industry average of 1.1x and a peer average of 2.1x, NIQ's P/S of 1x reflects a discount in market confidence. The market is pricing NIQ lower than many direct competitors, a sign that analysts and investors are reserving judgment until profitability improves or growth accelerates. There is insufficient data to determine a fair price-to-sales ratio benchmark for NIQ, which adds an extra layer of uncertainty to the valuation picture.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1x (UNDERVALUED)

However, ongoing net losses and limited visibility into sustained profitability remain key risks. These factors could undermine the case for NIQ Global Intelligence’s recovery.

Find out about the key risks to this NIQ Global Intelligence narrative.

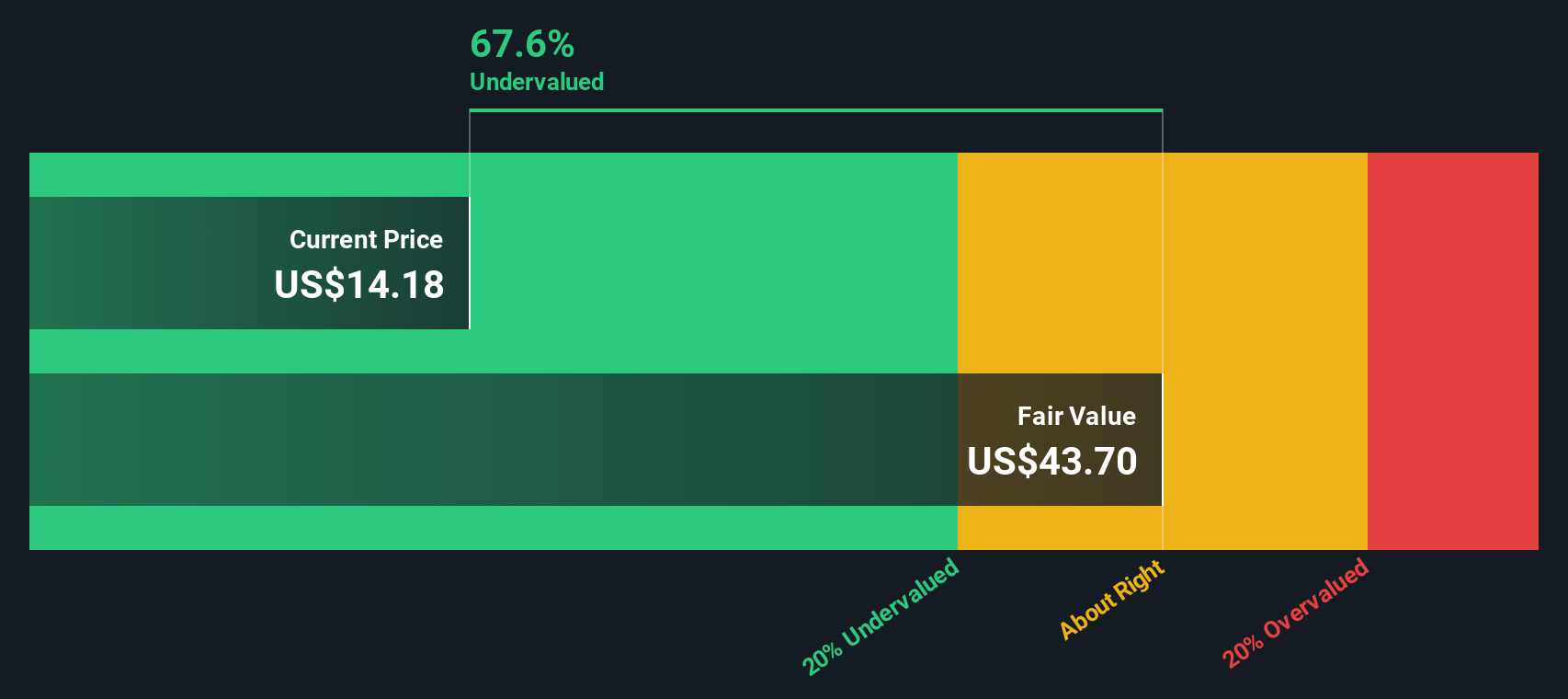

Another View: SWS DCF Model Sees Even Deeper Value

While the price-to-sales ratio suggests NIQ Global Intelligence looks inexpensive relative to peers, our DCF model presents an even stronger case for undervaluation. Based on forecast cash flows, the DCF estimate places fair value at $41.45 per share, which is almost triple the current price. Could the market be missing a major turnaround story here, or does real risk still lurk beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NIQ Global Intelligence for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NIQ Global Intelligence Narrative

If you’d rather chart your own course or dive deeper into the data, you have the freedom to shape your own view of NIQ Global Intelligence in under three minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding NIQ Global Intelligence.

Looking for more investment ideas?

Don't settle for just one opportunity. Make your next move with confidence by leveraging the right tools. Seize the advantage with smart screener picks below.

- Accelerate your search for stocks with robust financials by starting with these 3585 penny stocks with strong financials, which punch above their weight and show real staying power.

- Capture income with yield-focused companies using these 15 dividend stocks with yields > 3%, and maximize your returns with proven dividend payers over 3%.

- Spot tomorrow’s breakthroughs when you use these 27 AI penny stocks to get ahead of the curve in artificial intelligence and machine learning plays.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIQ Global Intelligence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIQ

NIQ Global Intelligence

A consumer intelligence company, provides software applications and analytics solutions.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives