- United States

- /

- Entertainment

- /

- NYSE:MSGS

There's Reason For Concern Over Madison Square Garden Sports Corp.'s (NYSE:MSGS) Price

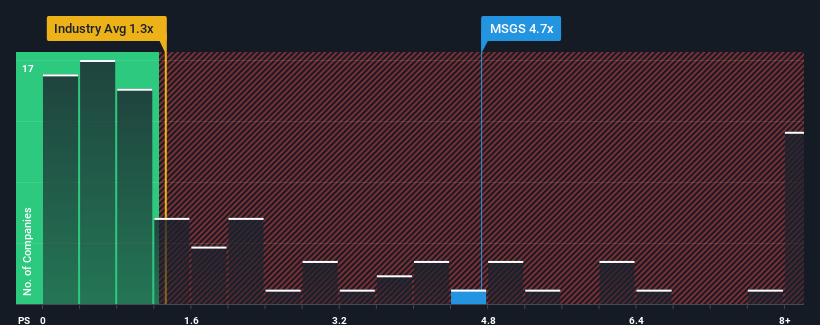

When you see that almost half of the companies in the Entertainment industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, Madison Square Garden Sports Corp. (NYSE:MSGS) looks to be giving off strong sell signals with its 4.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Madison Square Garden Sports

How Has Madison Square Garden Sports Performed Recently?

Madison Square Garden Sports hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Madison Square Garden Sports.How Is Madison Square Garden Sports' Revenue Growth Trending?

In order to justify its P/S ratio, Madison Square Garden Sports would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 254% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 2.8% per annum during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Madison Square Garden Sports' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Madison Square Garden Sports' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Madison Square Garden Sports trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Madison Square Garden Sports (2 are significant) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGS

Madison Square Garden Sports

Operates as a professional sports company in the United States.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives