- United States

- /

- Entertainment

- /

- NYSE:MSGS

The Bull Case For Madison Square Garden Sports (MSGS) Could Change Following Full-Year Net Losses - Learn Why

Reviewed by Simply Wall St

- On August 12, 2025, Madison Square Garden Sports Corp. reported fourth quarter and full-year results showing sales of US$203.96 million and US$1.04 billion, respectively, with both periods registering net losses compared to profits a year ago.

- This marks a reversal from prior profitability, reflecting challenges in the company’s operational performance and signaling increased pressure on its current business model.

- We’ll explore how the company’s move to a full-year net loss could reshape its investment narrative and future earnings assumptions.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Madison Square Garden Sports Investment Narrative Recap

To be a shareholder in Madison Square Garden Sports, you need conviction in the future value of its core sports franchises and confidence that upcoming national media rights increases and global sponsorships will compensate for recent profit setbacks. The company’s move to a full-year net loss highlights increased earnings volatility and raises short-term uncertainty around whether revenue catalysts, like national broadcast deals, will offset shrinking local media fees and rising player costs, both of which now carry greater weight in the investment case.

Of all recent company announcements, MSGS’s removal from multiple Russell Growth indices in late June stands out as directly related. This development could influence near-term trading, affecting institutional flows during a period when the business is under greater operational scrutiny, and makes future performance even more dependent on core catalysts like upcoming national media rights negotiations and renewed fan engagement strategies.

In contrast, the impact of shrinking local media agreements on recurring revenue is a risk that investors should be prepared for, as...

Read the full narrative on Madison Square Garden Sports (it's free!)

Madison Square Garden Sports' outlook forecasts $1.1 billion in revenue and $97.5 million in earnings by 2028. Achieving this would require annual revenue growth of 1.7% and an earnings increase of $119.9 million from the current level of -$22.4 million.

Uncover how Madison Square Garden Sports' forecasts yield a $258.20 fair value, a 31% upside to its current price.

Exploring Other Perspectives

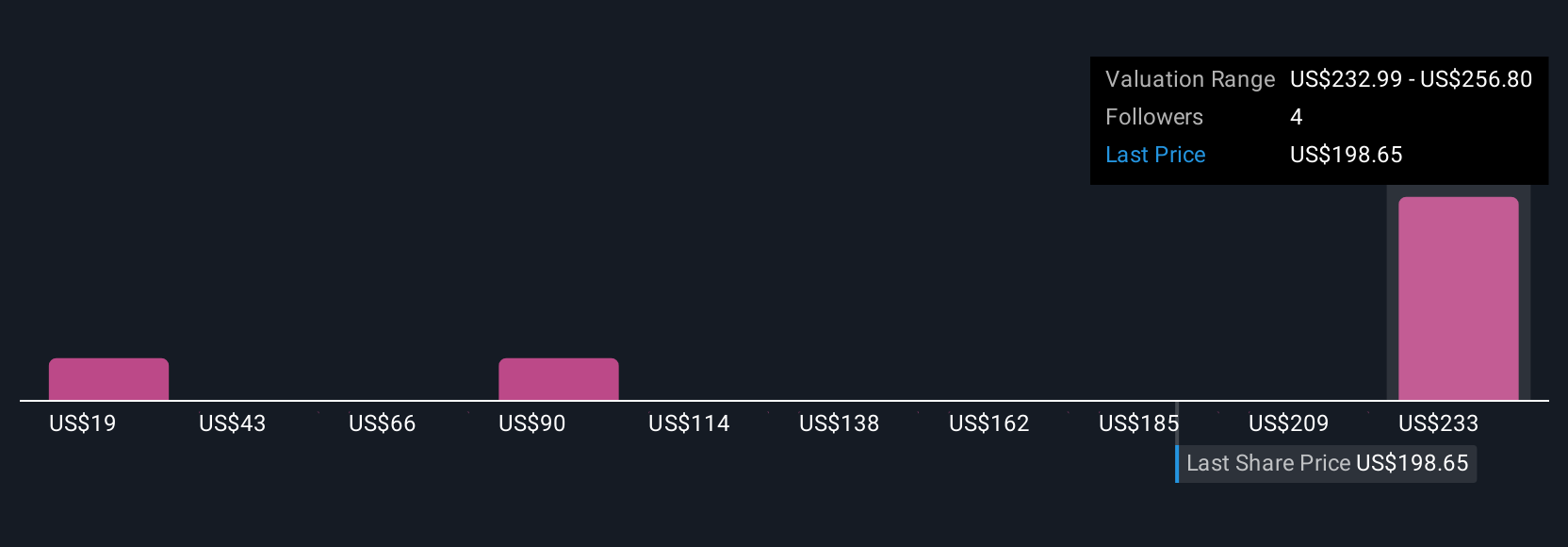

Fair value opinions from the Simply Wall St Community span from just US$19 to US$258 per share, reflecting dramatically different assumptions among three contributors. Meanwhile, shrinking local media rights fees may drive further debate on the company’s prospects and what supports its longer-term value.

Explore 3 other fair value estimates on Madison Square Garden Sports - why the stock might be worth less than half the current price!

Build Your Own Madison Square Garden Sports Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madison Square Garden Sports research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Madison Square Garden Sports research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madison Square Garden Sports' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGS

Madison Square Garden Sports

Operates as a professional sports company in the United States.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives