- United States

- /

- Entertainment

- /

- NYSE:MSGE

Madison Square Garden Entertainment (MSGE): Examining Valuation After Bold Analyst Earnings Growth Forecasts

Reviewed by Simply Wall St

Most Popular Narrative: 1.3% Undervalued

According to the most widely followed narrative, Madison Square Garden Entertainment is considered slightly undervalued, trading just below its estimated fair value based on detailed forecasts and risk assessments.

Sustained strong demand for live events and premium in-person experiences is translating into record ticket sales and advance bookings for fiscal '26. Concerts and special events at both the Garden and theaters are pacing ahead of prior years. This growth in volume and pricing is likely to drive meaningful increases in revenue and operating income.

Curious about what makes this valuation tick? The calculation hinges on powerful assumptions about accelerated growth, future profitability, and a sharply lowered earnings multiple. Want to uncover which financial drivers create the tight gap between the current price and fair value? The underlying math and market expectations might surprise you.

Result: Fair Value of $44.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the company’s heavy reliance on just a few venues and shifts in consumer spending patterns could quickly dampen the upbeat outlook.

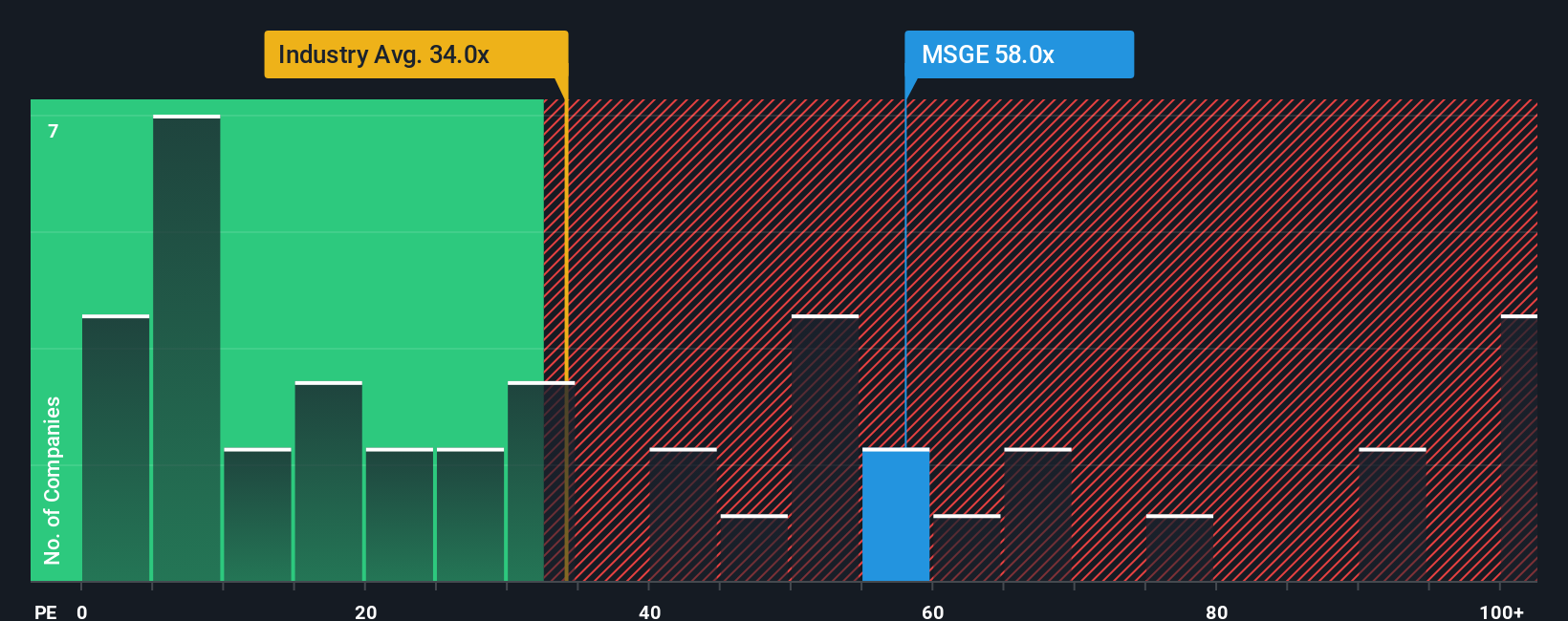

Find out about the key risks to this Madison Square Garden Entertainment narrative.Another View: What Do the Multiples Say?

Not everyone agrees Madison Square Garden Entertainment is undervalued. When valued using one of the most common market measures, the company actually looks expensive compared to industry norms. Could the optimism already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Entertainment Narrative

If you have a different take or want to shape your own perspective, you can dive into the numbers and craft your own view in just a few minutes. Do it your way

A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio by seizing fresh opportunities across the market. There are powerful trends waiting for you. Don’t let the next winner pass you by.

- Uncover companies redefining medical care by checking out a dynamic lineup of healthcare AI stocks trusted by health innovators everywhere.

- Catch the momentum with potential high-flyers as you scan penny stocks with strong financials backed by robust balance sheets and emerging growth stories.

- Boost your passive income and peace of mind by digging into dividend stocks with yields > 3% known for strong and reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGE

Madison Square Garden Entertainment

Through its subsidiaries, engages in live entertainment business.

Reasonable growth potential with low risk.

Market Insights

Community Narratives