- United States

- /

- Entertainment

- /

- NYSE:MSGE

A Fresh Look at Madison Square Garden Entertainment (MSGE) Valuation After Net Loss and Impairment Updates

Reviewed by Simply Wall St

Madison Square Garden Entertainment (MSGE) just released its quarterly and full-year earnings, and the numbers grabbed plenty of attention, especially for anyone deciding what to do next with the stock. Revenue for the quarter dropped versus last year, and the company swung from a profit to a net loss. Management also announced an impairment charge on long-lived assets, which added more complexity for investors tracking the story. When a company moves from profitability to loss while taking write-downs, it tends to shift the market’s mood quickly and turns the focus to what these signals might mean for future valuation.

This latest update comes at a time when MSGE’s shares have been a mixed bag. After a bump earlier in the summer, the stock is up around 10% year-to-date but remains down 6% compared to the same point last year. Short-term momentum has returned in the past three months, but the recent loss and impairment have added new risk to the outlook. Over the past year, results have been affected by lower revenues, shrinking profits, and a more cautious tone around growth, though annual net income managed to stay positive despite the fourth quarter hit.

With MSGE facing softer results and a market that is still trying to price in future earnings power, the key question is whether there is a genuine buying opportunity here or if investors are anticipating a tougher road ahead.

Most Popular Narrative: 13.3% Undervalued

According to community narrative, Madison Square Garden Entertainment is viewed as undervalued, with a projected fair value notably higher than its current share price. The narrative builds its case on anticipated growth in live events and premium hospitality, despite recent risks and volatility.

Ongoing investments in premium hospitality and suite renovations, combined with rising urban affluence and a focus on upgrading the guest experience, are expected to further boost ancillary and high-margin revenue streams. This could improve overall profitability.

Curious what is fueling this strong upside call? The narrative points to an ambitious leap in future profits and earnings quality, resting on a few key assumptions that may catch you off-guard. Can these projections actually pan out, or is there a twist behind the numbers? Those ready to go beyond the headlines will want to see the full story behind the bulls’ optimism on MSGE.

Result: Fair Value of $45.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, MSGE’s reliance on a handful of flagship venues and its sensitivity to consumer spending could unsettle the outlook if economic or industry trends shift rapidly. Find out about the key risks to this Madison Square Garden Entertainment narrative.Another View: SWS DCF Model

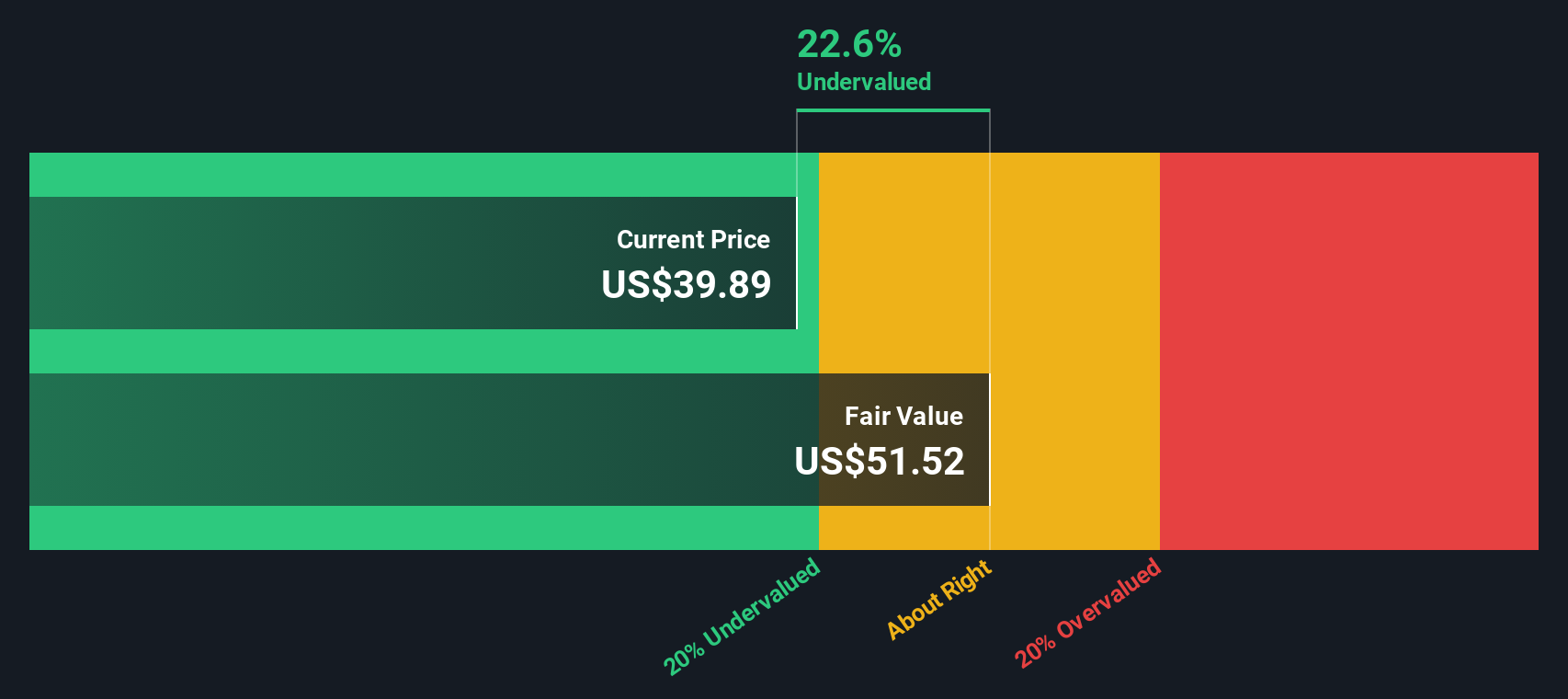

While the earlier value estimate relied on earnings multiples, our DCF model suggests MSGE could be even more undervalued. This approach analyzes projected cash flows and offers a different perspective on the potential upside. Could the market be overlooking something significant?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Madison Square Garden Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Madison Square Garden Entertainment Narrative

For those who want to dig deeper or come to their own conclusions, you can build your own narrative in just a few minutes. do it your way.

A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Stock Ideas?

The market is always changing, and sharp investors are constantly seeking fresh opportunities. There are many different ways to put your money to work, so don’t limit yourself to just one story. Give your portfolio a boost by exploring these handpicked stock ideas, each chosen for growth potential and financial stability:

- Take advantage of the artificial intelligence trend and find the latest AI penny stocks that are transforming industries with new applications and the potential for rapid development.

- Enhance your income with dividend stocks with yields > 3% that offer reliable dividend yields above 3 percent, helping your investments perform in any market environment.

- Explore the future by looking into quantum computing stocks, where innovative companies are advancing computing and shaping the technology landscape of tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGE

Madison Square Garden Entertainment

Through its subsidiaries, engages in live entertainment business.

Reasonable growth potential and fair value.

Market Insights

Community Narratives