- United States

- /

- Media

- /

- NYSE:MNTN

Are Shares of MNTN Attractive After Declining 32% in 2025?

Reviewed by Bailey Pemberton

If you have found yourself tracking MNTN stock lately and wondering whether it is a hidden gem or a value trap, you are definitely not alone. After a tough stretch, with shares recently closing at $17.97 and down 3.7% over the past week, the company has extended its slide to 10.2% lower over the past month. Year to date, the decline sits at a steep 31.8%. Such rapid shifts have caught the eye of both risk-averse investors and bargain hunters asking whether the market is being too pessimistic or simply realistic.

The story is complicated by recent changes in the broader market landscape, as investors weigh cautious sentiment against hints of sector rotation. While news flow has not pointed to any single catalyst behind the decline, shifts in investor risk appetite have driven volatility across similar names, making it tricky to know whether MNTN's move is justified by fundamentals or just caught up in the crowd.

To make sense of this, let's turn to the numbers. MNTN's current valuation score comes in at 3 out of 6, meaning it appears undervalued on exactly half of the key criteria analysts use to find hidden value plays. That is not a slam dunk, but it is enough to warrant a closer look, especially for anyone seeking opportunities where the crowd might be overlooking something important. Up next, I will break down how the most common valuation methods stack up for MNTN, and later, introduce a more nuanced way to view whether the company is truly trading for less than it is worth.

Approach 1: MNTN Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and discounting them back to today, reflecting the time value of money. For MNTN, this approach provides a detailed look at how its future earning potential compares to its current market price.

MNTN’s latest reported Free Cash Flow stands at $46.73 Million, and analyst projections suggest robust growth over the next several years. Based on these estimates and further model extrapolation, MNTN’s Free Cash Flow is projected to climb significantly, reaching $132.5 Million by the end of 2029. Only five years of cash flow estimates are directly available from analysts. The remainder of the ten-year projection is calculated using longer-term growth assumptions.

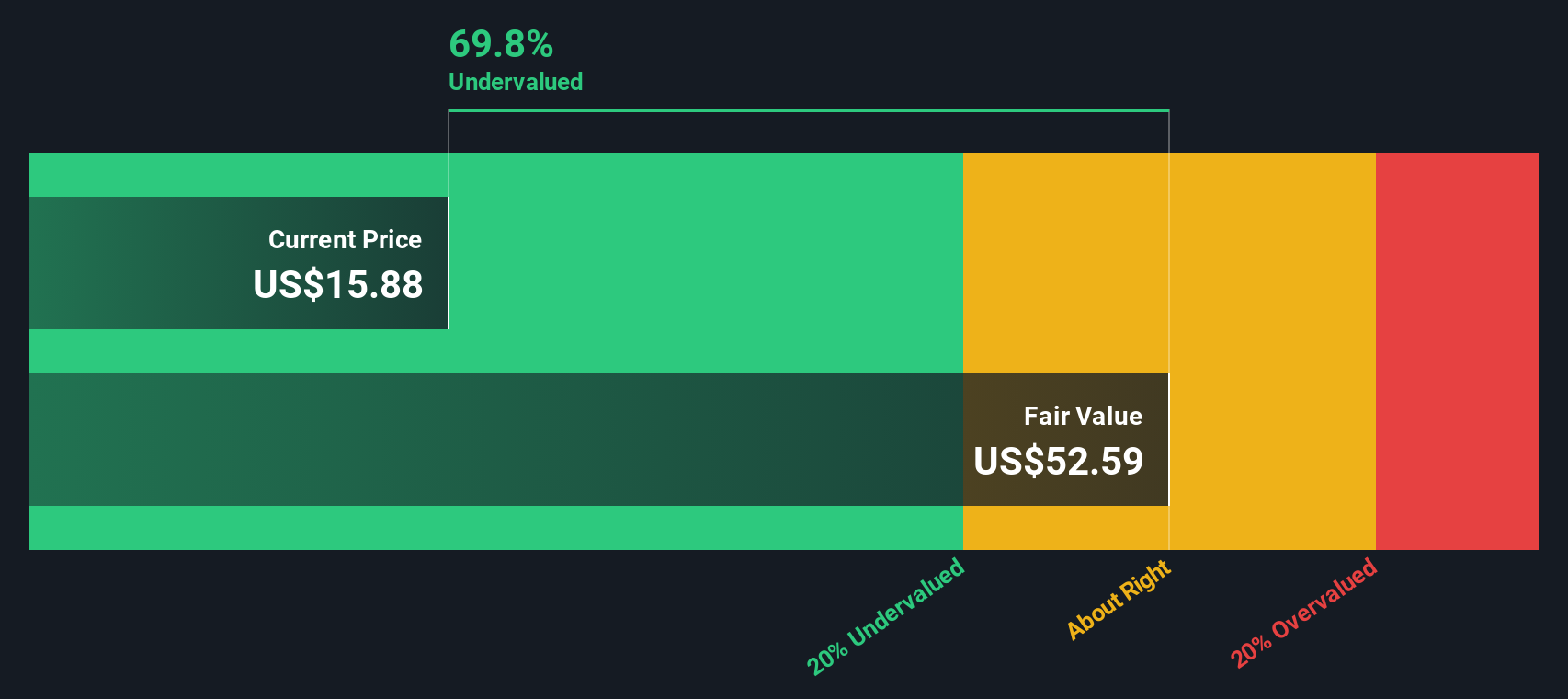

After discounting all projected cash flows to their present value, the DCF model produces an estimated fair value per share of $52.59. This figure is 65.8% higher than MNTN’s current share price of $17.97, which may suggest that the market is undervaluing the stock by a considerable margin based on these long-term cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MNTN is undervalued by 65.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: MNTN Price vs Sales

For companies like MNTN, which are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often the preferred valuation tool. Unlike earnings-based multiples, the P/S ratio looks at the company’s revenue relative to its market value. This makes it a useful measure for growth-oriented firms or those with slim profit margins.

What counts as a reasonable P/S ratio depends on expected growth, industry risk, and whether investors anticipate future profitability. High-growth companies typically justify higher P/S multiples. Mature or slow-growing ones are usually priced closer to or below their industry average.

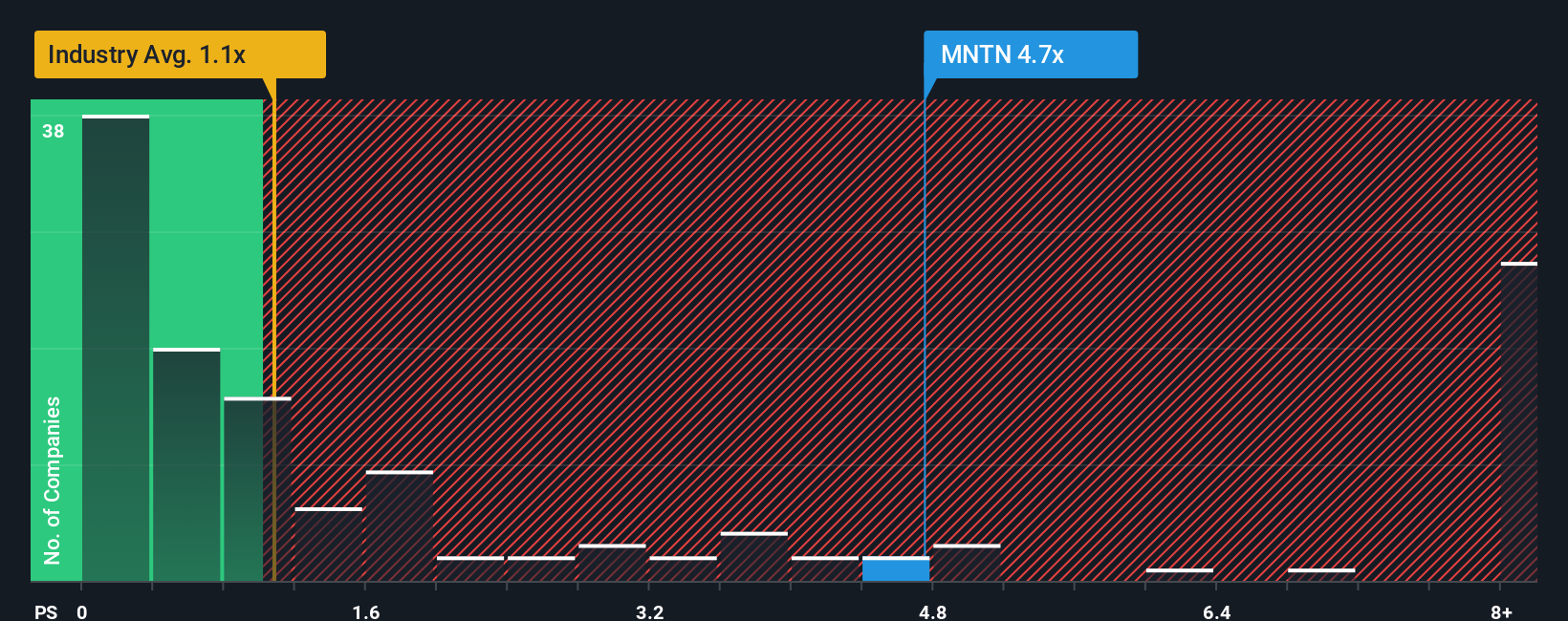

MNTN currently trades at a P/S ratio of 5.02x, which is well above the Media industry average of 1.06x and its peers at 1.58x. This premium suggests that investors expect significantly stronger growth or margin improvements than the typical Media company.

To gauge whether this multiple is justified, it helps to look at Simply Wall St’s Fair Ratio, a proprietary measure that accounts for factors such as MNTN’s growth prospects, profit margins, industry positioning, and market cap. The Fair Ratio adjusts for company-specific risks and strengths, providing a more nuanced way to judge value than simple industry averages.

In MNTN’s case, because the Fair Ratio is not materially different from its actual P/S ratio, the stock appears to be trading about where we would expect given its outlook and risk profile.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MNTN Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for a company, connecting what you believe about its future, such as growth rates and profit margins, to hard numbers for revenue, earnings, and ultimately, fair value. Narratives let you go beyond static models by linking your perspective directly to a financial forecast, then to an updated estimate of what the stock is worth.

This approach is easy and accessible, and it is already being used by millions on Simply Wall St’s Community page. Narratives make deciding when to buy or sell clearer by dynamically showing how your Fair Value compares with the latest share price and automatically updating as key news or earnings come out.

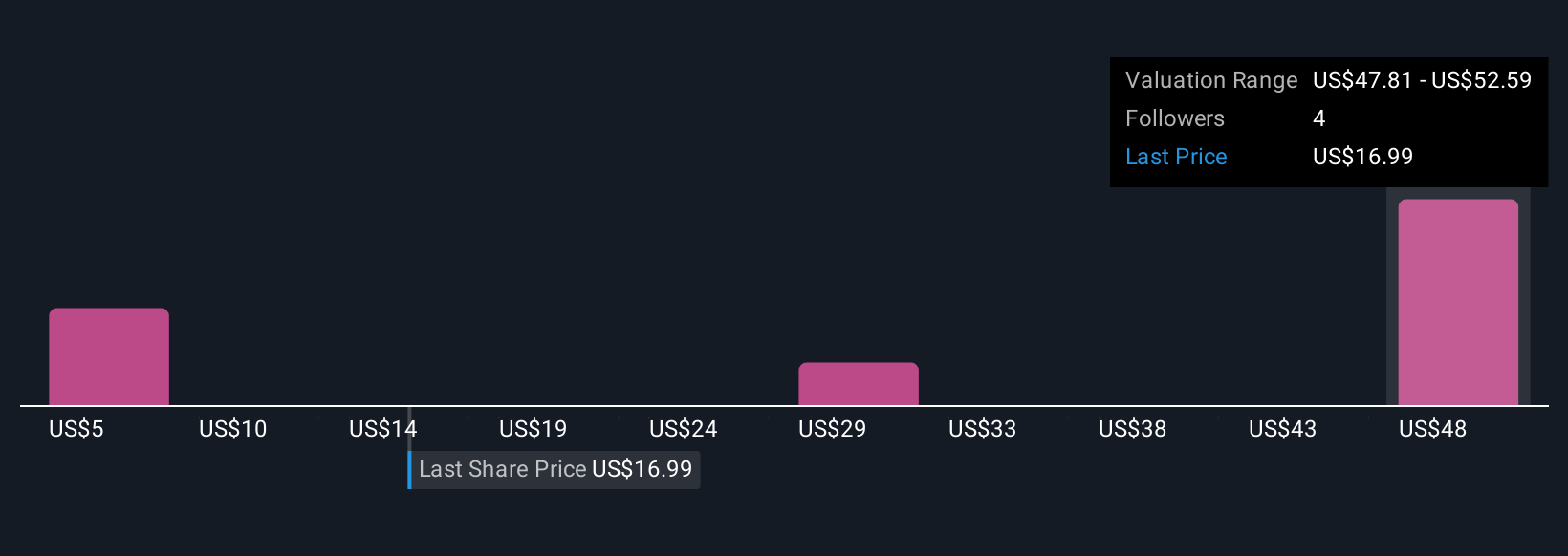

For example, some investors see MNTN's Narrative as highly optimistic, assigning a Fair Value around $55, while others, more cautious, believe it could be closer to $15. Narratives let you weigh these perspectives, understand the story behind each, and build your own view, helping you invest with confidence as new information emerges.

Do you think there's more to the story for MNTN? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNTN

MNTN

Operates a technology platform that brings performance marketing to Connected TV.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives