- United States

- /

- Entertainment

- /

- NYSE:LYV

Live Nation (LYV): Assessing Valuation Following Recent Share Price Performance

Reviewed by Simply Wall St

Live Nation Entertainment (LYV) has drawn some fresh attention from investors lately, with its stock movement over the past month sparking renewed curiosity about the company’s long-term performance and current valuation landscape.

See our latest analysis for Live Nation Entertainment.

Live Nation’s shares have cooled off a bit in recent weeks, but when you zoom out, the story looks a lot brighter. The stock has posted an impressive 18.29% share price return so far this year, and a stellar 31.41% total shareholder return over the past year signals momentum is still on its side.

If you’re curious to see what else has been catching investors’ attention lately, this is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

Yet with strong returns and growth in the rearview mirror, the real question now is whether Live Nation’s current price reflects its future prospects, or if there is still a genuine buying opportunity left for investors.

Most Popular Narrative: 12% Undervalued

The current narrative places Live Nation’s fair value at $173.80, which is notably above its last close at $152.86. This signals the market could be missing a key catalyst for future growth that might justify a higher price tag.

Live Nation is in the early stages of expanding its presence across high-growth international markets such as Latin America (notably Mexico and Brazil) and APAC (notably Japan), leveraging surging demand for live events among younger, increasingly affluent urban populations globally. This is set to materially drive revenue growth through increased ticket sales, new venues, and event launches.

Want to know the real reason for this high target price? The narrative hinges on explosive expansion, bold margin projections, and a bet on next-level global demand. Discover which ambitious assumptions are driving this fair value; your backstage pass is just one click away.

Result: Fair Value of $173.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and rising competition in digital ticketing could undermine Live Nation’s growth story if these challenges are not addressed.

Find out about the key risks to this Live Nation Entertainment narrative.

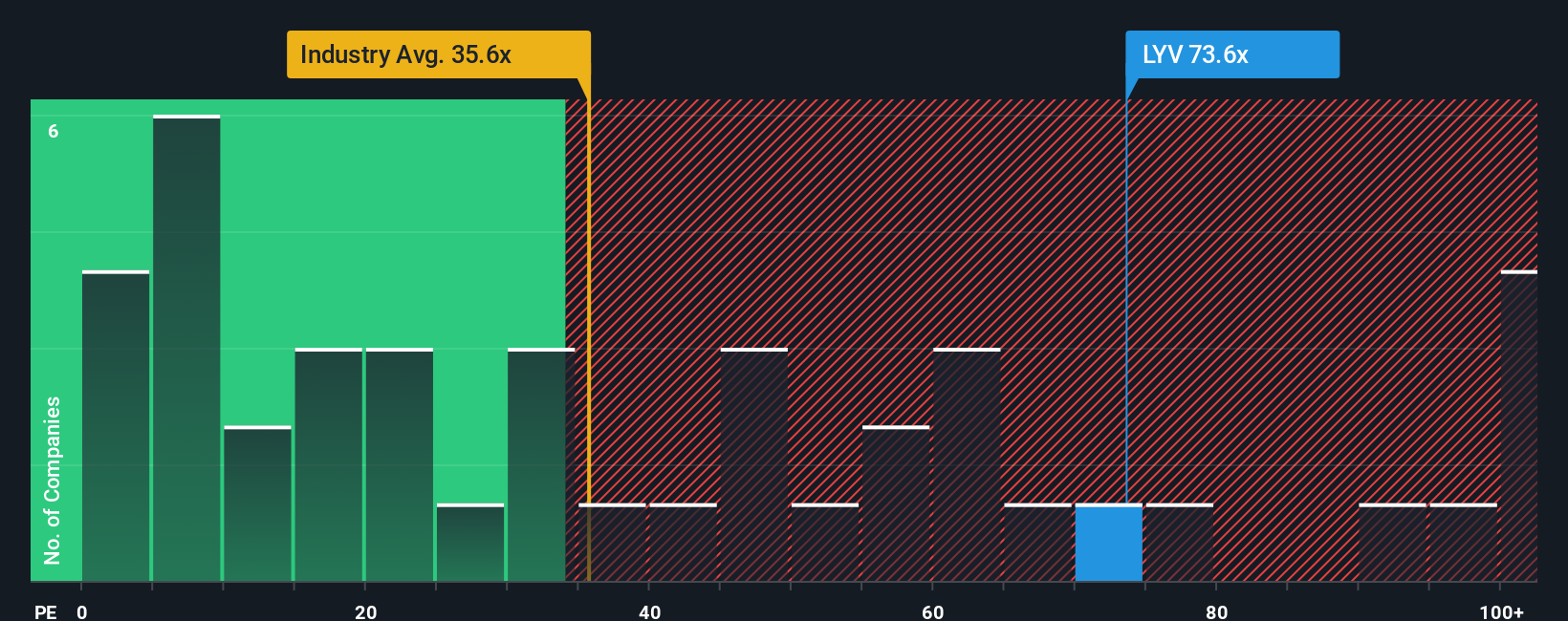

Another View: High Earnings Multiple Raises Questions

While the latest narrative sees Live Nation as undervalued, a glance at its current earnings multiple tells a more cautious story. The company trades at 64.7 times earnings, higher than its peers’ average of 63.1 and far above the industry average of 27.3. The fair ratio for the stock stands at just 27.8, suggesting a sizable gap between market optimism and fundamentals. Does this mean investors are paying too high a premium for growth, or is the market right to look past traditional measures?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Nation Entertainment Narrative

If you’d rather chart your own course or have a different perspective on Live Nation’s story, you can dive in and assemble your own view in just a few minutes: Do it your way

A great starting point for your Live Nation Entertainment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make the most of today’s opportunities by using Simply Wall St’s screener. Fresh investment angles are waiting for those who want to stay ahead. Take action now or risk missing out on tomorrow’s winners.

- Amplify your return potential by targeting value. Pursue these 877 undervalued stocks based on cash flows that are primed for upside based on rigorous cash flow analysis.

- Capitalize on growing healthcare innovation by identifying these 33 healthcare AI stocks at the forefront of medical AI transformation and real-world breakthroughs.

- Strengthen your portfolio’s income stream. Prioritize these 17 dividend stocks with yields > 3% that consistently offer yields above 3% for reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives