- United States

- /

- Biotech

- /

- NasdaqCM:CMPX

Top US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, the U.S. stock market is experiencing a notable upswing, with the S&P 500 and Nasdaq reaching record highs amid a post-election rally. For investors seeking opportunities outside of large-cap stocks, penny stocks—despite their somewhat outdated moniker—remain an intriguing area for potential growth. These smaller or newer companies often offer unique opportunities at lower price points, especially when they are backed by solid financial fundamentals and robust balance sheets.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.46 | $2B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.83 | $5.94M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $91.9M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.91M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.88 | $2.51B | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9381 | $86.31M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.81 | $401.48M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Compass Therapeutics (NasdaqCM:CMPX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Compass Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing antibody-based therapeutics for oncology and other diseases in the United States, with a market cap of approximately $228.40 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biopharmaceutical company.

Market Cap: $228.4M

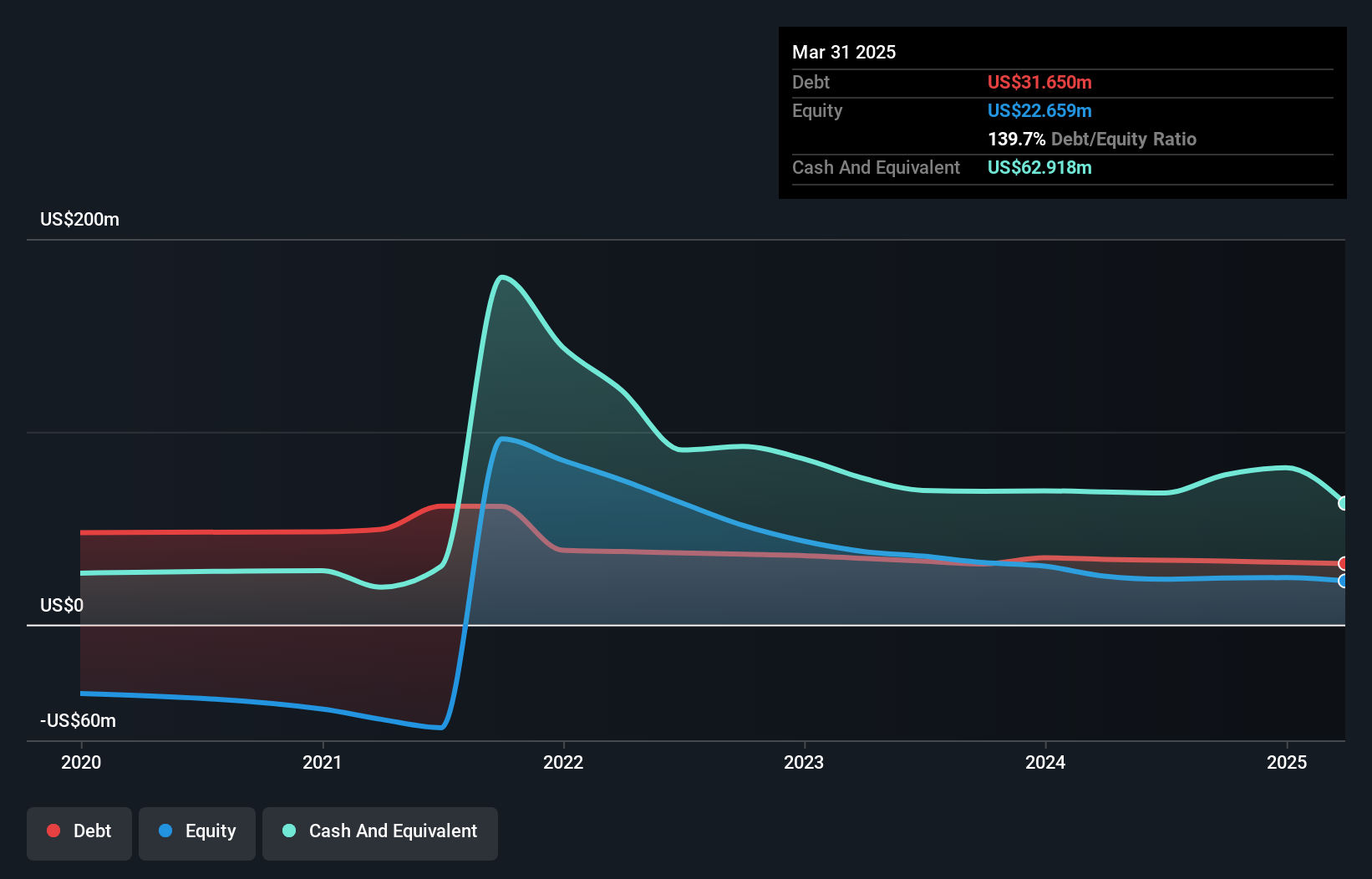

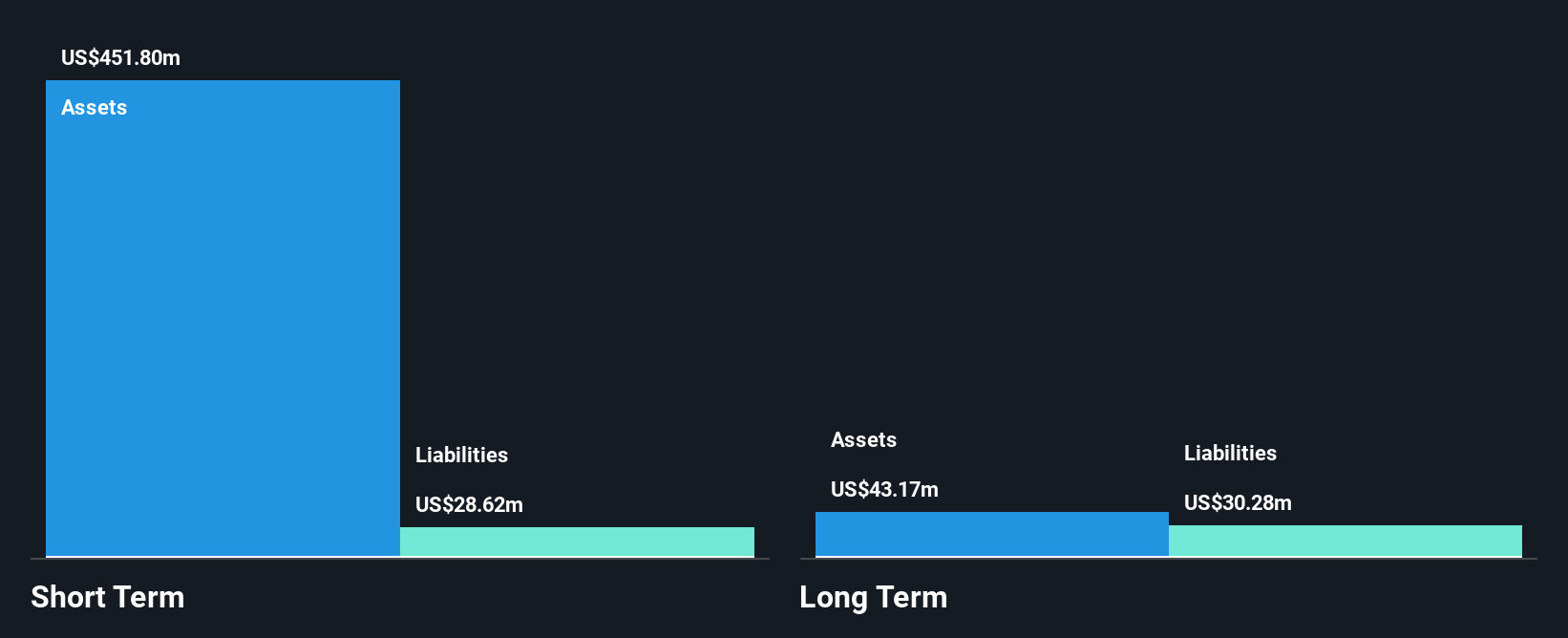

Compass Therapeutics, Inc., a clinical-stage biopharmaceutical company with a market cap of US$228.40 million, remains pre-revenue, reporting less than US$1 million in revenue. Despite being debt-free and having sufficient short-term assets to cover liabilities, the company has experienced shareholder dilution and is unprofitable with increasing losses over recent years. The management team is relatively new, which may impact strategic execution. Recent earnings reported a net loss of US$10.48 million for Q3 2024, consistent with previous periods. Although its cash runway appears stable for over two years under current conditions, profitability isn't anticipated soon.

- Unlock comprehensive insights into our analysis of Compass Therapeutics stock in this financial health report.

- Review our growth performance report to gain insights into Compass Therapeutics' future.

Kaltura (NasdaqGS:KLTR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kaltura, Inc. offers a range of software-as-a-service (SaaS) and platform-as-a-service (PaaS) solutions globally, with a market capitalization of approximately $336.81 million.

Operations: The company's revenue is derived from two primary segments: Media & Telecom, contributing $50.27 million, and Enterprise, Education and Technology, generating $127.32 million.

Market Cap: $336.81M

Kaltura, Inc., with a market cap of US$336.81 million, is unprofitable but shows potential in its financial structure. The company reported third-quarter revenue of US$44.3 million, a slight increase from the previous year, while reducing net losses to US$3.61 million from US$10.73 million. Despite shareholder dilution and negative return on equity (-152.34%), Kaltura's short-term assets exceed both short and long-term liabilities, indicating solid liquidity management. It maintains more cash than total debt and has a cash runway exceeding three years if it sustains current free cash flow levels despite shrinking by 3% annually.

- Jump into the full analysis health report here for a deeper understanding of Kaltura.

- Evaluate Kaltura's prospects by accessing our earnings growth report.

Nextdoor Holdings (NYSE:KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network connecting neighbors, businesses, and public services both in the United States and internationally, with a market cap of approximately $940.07 million.

Operations: The company generates revenue of $237.61 million from its Internet Information Providers segment.

Market Cap: $940.07M

Nextdoor Holdings, Inc., with a market cap of US$940.07 million, demonstrates financial resilience despite being unprofitable. The company reported third-quarter sales of US$65.61 million, up from the previous year, while net losses narrowed significantly to US$14.9 million from US$38.12 million. With short-term assets of US$469 million exceeding both short and long-term liabilities, it maintains strong liquidity and a cash runway over three years based on current free cash flow levels. Recent strategic initiatives include appointing Georg Petschnigg as Chief Design Officer to drive product transformation under the NEXT initiative, aiming for enhanced user engagement and revenue growth.

- Dive into the specifics of Nextdoor Holdings here with our thorough balance sheet health report.

- Explore Nextdoor Holdings' analyst forecasts in our growth report.

Seize The Opportunity

- Click through to start exploring the rest of the 706 US Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CMPX

Compass Therapeutics

A clinical-stage oncology-focused biopharmaceutical company, engages in developing antibody-based therapeutics to treat various human diseases in the United States.

Flawless balance sheet slight.