- United States

- /

- Entertainment

- /

- NYSE:IMAX

IMAX’s (IMAX) Convertible Note Offering Could Be a Game Changer for Its Growth Flexibility

Reviewed by Sasha Jovanovic

- IMAX Corporation recently completed a fixed-income offering of US$220 million in 0.75% senior unsecured convertible notes due November 15, 2030, with features including callability and conversion rights.

- This move gives the company fresh capital while raising potential for future share dilution due to the convertible nature of the notes.

- We’ll examine how the issuance of convertible notes factors into IMAX’s capital structure, growth flexibility, and possible dilution risk.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

IMAX Investment Narrative Recap

To own IMAX shares, an investor needs confidence that premium theatrical experiences will keep delivering stronger growth than at-home entertainment, despite increasing industry challenges. The company’s US$220 million convertible note issuance strengthens the balance sheet but does not directly impact the most important near-term catalyst: sustained installation and upgrade momentum; however, it does introduce a heightened potential for future share dilution, which may become an issue if market conditions change.

Of the latest announcements, the new partnership with Cinemark Holdings for 17 additional IMAX systems stands out as most relevant. This expansion underlines IMAX's push to broaden its footprint in North and South America, directly supporting the current growth strategy centered on global system installations, still seen as a key driver for recurring revenue and cash flow.

In contrast, investors should be aware that the convertible nature of the new notes could increase dilution risk if...

Read the full narrative on IMAX (it's free!)

IMAX's projections indicate $466.0 million in revenue and $74.0 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.7% and a $41.2 million increase in earnings from the current $32.8 million.

Uncover how IMAX's forecasts yield a $37.18 fair value, a 6% upside to its current price.

Exploring Other Perspectives

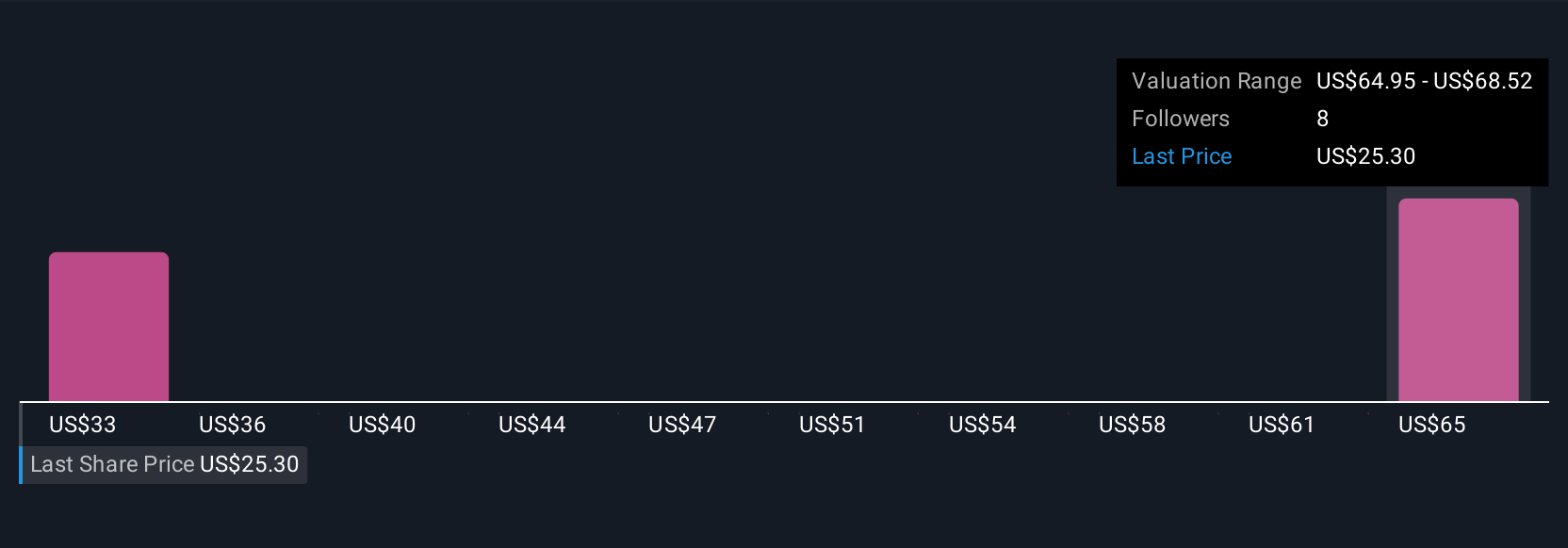

Three fair value estimates from the Simply Wall St Community span US$37.18 to US$58.70. While some expect strong installation growth to support valuation, others caution that dilution could affect returns, so be sure to explore these varied outlooks.

Explore 3 other fair value estimates on IMAX - why the stock might be worth as much as 67% more than the current price!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives