- United States

- /

- Entertainment

- /

- NYSE:IMAX

IMAX (IMAX) Valuation: Assessing Fresh Investor Interest After Landmark The Shining Release Announcement

Reviewed by Simply Wall St

IMAX (NYSE:IMAX) is creating buzz by bringing Stanley Kubrick’s The Shining to IMAX theaters for the first time, starting December 12, 2025. This move taps into classic cinema nostalgia for a new audience.

See our latest analysis for IMAX.

IMAX’s strategy of bringing cinematic classics to its theaters is resonating with the market and fueling momentum in the share price over the past few months. The company’s 1-month share price return of nearly 9% and a remarkable 36% gain over the past 90 days highlight surging optimism. The 1-year total shareholder return of 45% and more than doubling of value over three and five years point to steady, long-term strength.

If you’re curious about what other high-growth leaders with strong inside ownership are making moves, broaden your search and discover fast growing stocks with high insider ownership

But with IMAX shares gaining sharply and trading just below analyst targets, is the stock still undervalued, or has the market already priced in the company’s next stage of blockbuster growth?

Most Popular Narrative: 5.9% Undervalued

The latest widely followed narrative values IMAX shares about 6% above the last closing price of $35, reflecting optimism for further gains if growth materializes as expected. This analysis has become the reference point for investors weighing IMAX's potential versus its current valuation.

Rapid acceleration of new system installations and a replenishing, geographically diverse backlog, driven by consumer demand for premium, differentiated out-of-home entertainment, positions IMAX for continued growth in both top-line revenue and recurring cash flows as its global footprint expands. This is especially true in high per screen average markets like North America, Japan, and Australia.

Curious what fuels this upbeat price? Behind the scenes, the narrative is anchored by bold projections for global expansion, profit margin leaps, and a rich pipeline that could transform IMAX’s earnings profile. Discover the assumptions that could redefine what investors expect from this cinema leader.

Result: Fair Value of $37.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts toward at-home entertainment and heavy reliance on blockbuster releases could quickly change the current growth expectations for IMAX.

Find out about the key risks to this IMAX narrative.

Another View: High Multiple Signals a Cautious Market

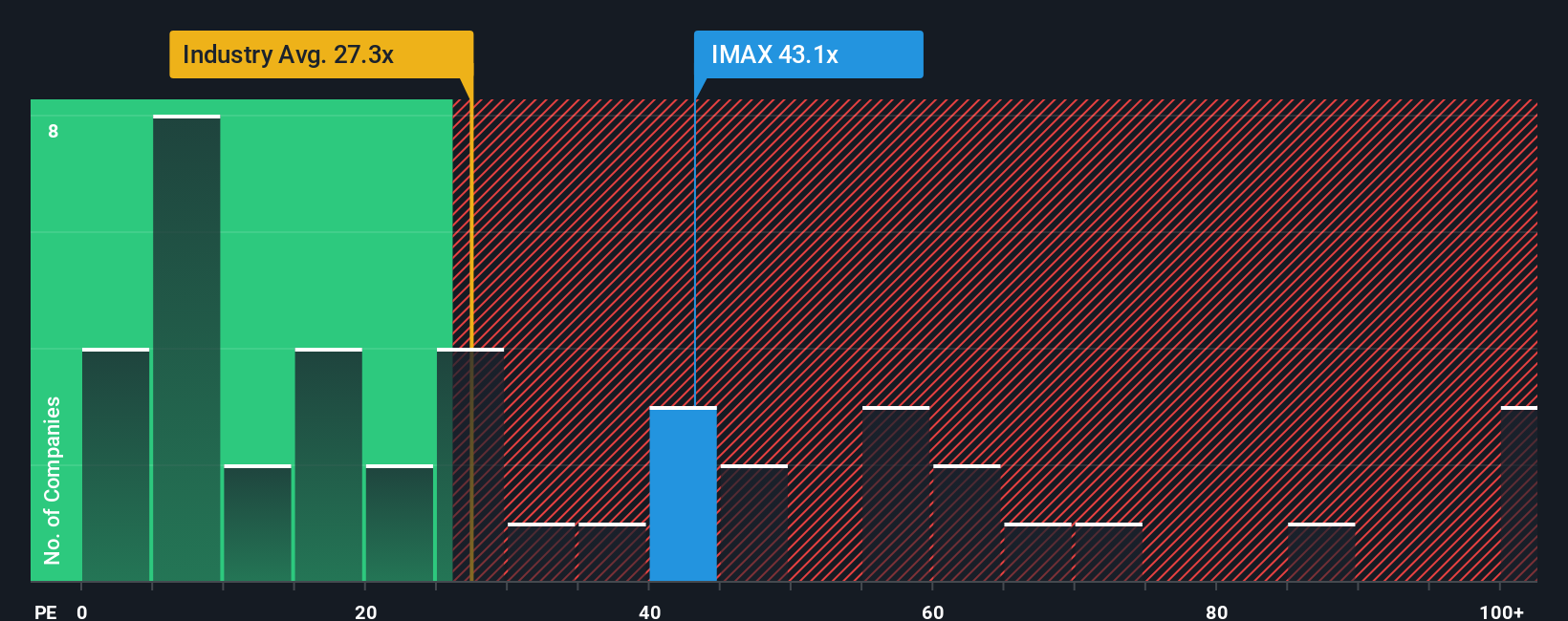

Taking a step back from the growth-driven optimism, IMAX trades at a 47.6x ratio, which is more than double the US Entertainment industry average of 20x. This gap signals that higher expectations are already reflected in the price, and it also increases valuation risk if the company does not perform as anticipated. For comparison, the fair ratio is just 17.7x, indicating that the market could still reassess IMAX’s premium. Will the story remain this strong, or could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IMAX Narrative

If you see things differently or want to test your own ideas, step in and build a personal outlook backed by the facts. You can do it yourself in minutes. Do it your way

A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your portfolio with fast-moving opportunities the market can’t ignore. Let Simply Wall Street’s powerful screener help you spot what others might miss next.

- Boost your potential returns by jumping on these 886 undervalued stocks based on cash flows, a selection of companies trading below their cash flow value.

- Unlock passive income opportunities by targeting these 16 dividend stocks with yields > 3%, which offers yields over 3% for income-focused investors.

- Tap into the technology of tomorrow by seizing these 26 quantum computing stocks, which highlights innovation in quantum computing applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives