- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

fuboTV (NYSE:FUBO) Announces Multi-Year Deal With Weigel For Expanded Channel Lineup

Reviewed by Simply Wall St

fuboTV (NYSE:FUBO) recently announced a multi-year partnership with Weigel Broadcasting Co., enhancing its content offerings with seven new networks, which potentially contributed to an 11% rise in its share price over the last quarter. During this period, fuboTV also reported strong Q1 earnings, with significant revenue growth and a return to profitability, potentially bolstering investor confidence. Additionally, the launch of innovative viewing features and new sports partnerships expanded their service appeal. Despite some market volatility, fuboTV's developments likely added weight to its performance, with the company's stock performing in alignment with broader market trends.

The recent collaboration between fuboTV and Weigel Broadcasting Co., coupled with significant Q1 earnings growth, has played a crucial role in strengthening the company's position within the pay TV industry. As a product of these developments, fuboTV has made significant strides toward competitive growth by offering a broader range of content and innovative viewing features. Despite challenges such as decreasing ad revenues and subscriber numbers, the company’s strategic moves aim to bolster its economic stability, as evidenced by its massive on-market total return of 186.44% over the last year. This performance indicates a promising trajectory in the face of rising competition and underscores fuboTV's adaptability in a rapidly changing market.

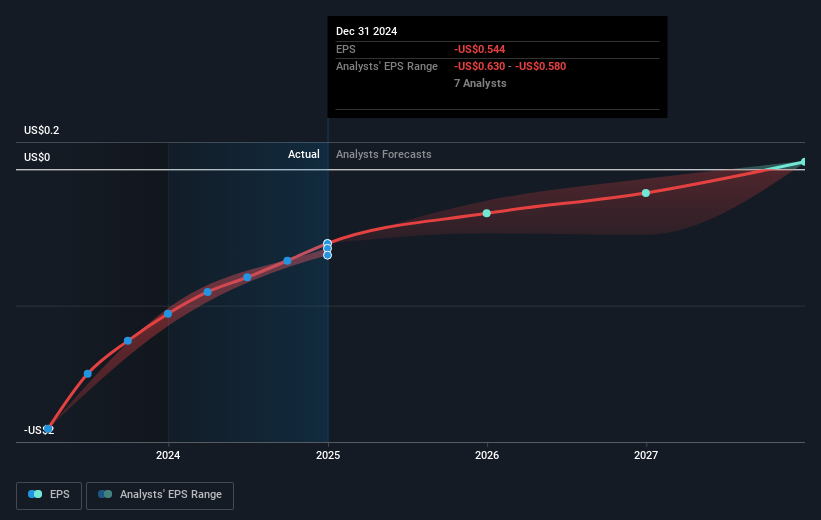

In relation to the broader industry, fuboTV surpassed the US Interactive Media and Services industry, which had an 8.6% return over the past year. However, market volatility remains a consideration as competitors intensify in the ad-supported streaming space. Analysts predict revenue will grow at a moderate 4.5% annually, projecting to reach US$2.2 billion by 2028, while earnings forecasts are set to climb to US$24.1 million. Notably, the consensus analyst price target is US$4.81, representing a potential 35.6% increase from the current share price of US$3.10, suggesting room for growth provided the company addresses its competitive and revenue challenges effectively.

Get an in-depth perspective on fuboTV's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives