- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

FuboTV (FUBO): Evaluating Valuation After Earnings Beat and Channel Store Launch

Reviewed by Simply Wall St

FuboTV (FUBO) just released its third quarter results, delivering a much smaller net loss than last year and turning a profit for the first nine months. Following its earnings report, the company introduced the Fubo Channel Store, its latest move to broaden subscriber options and streamline access to premium content.

See our latest analysis for fuboTV.

After surging over 150% year to date, fuboTV’s share price has cooled slightly in recent weeks, despite standout milestones like its narrowed losses and new Channel Store launch. For context, its one-year total shareholder return is up 139%, reflecting the improved outlook and recent product momentum. In the longer term, the five-year total shareholder return still highlights how volatile growth stories can be.

If you're weighing where opportunity might be building next, this is the perfect time to expand your search and discover fast growing stocks with high insider ownership

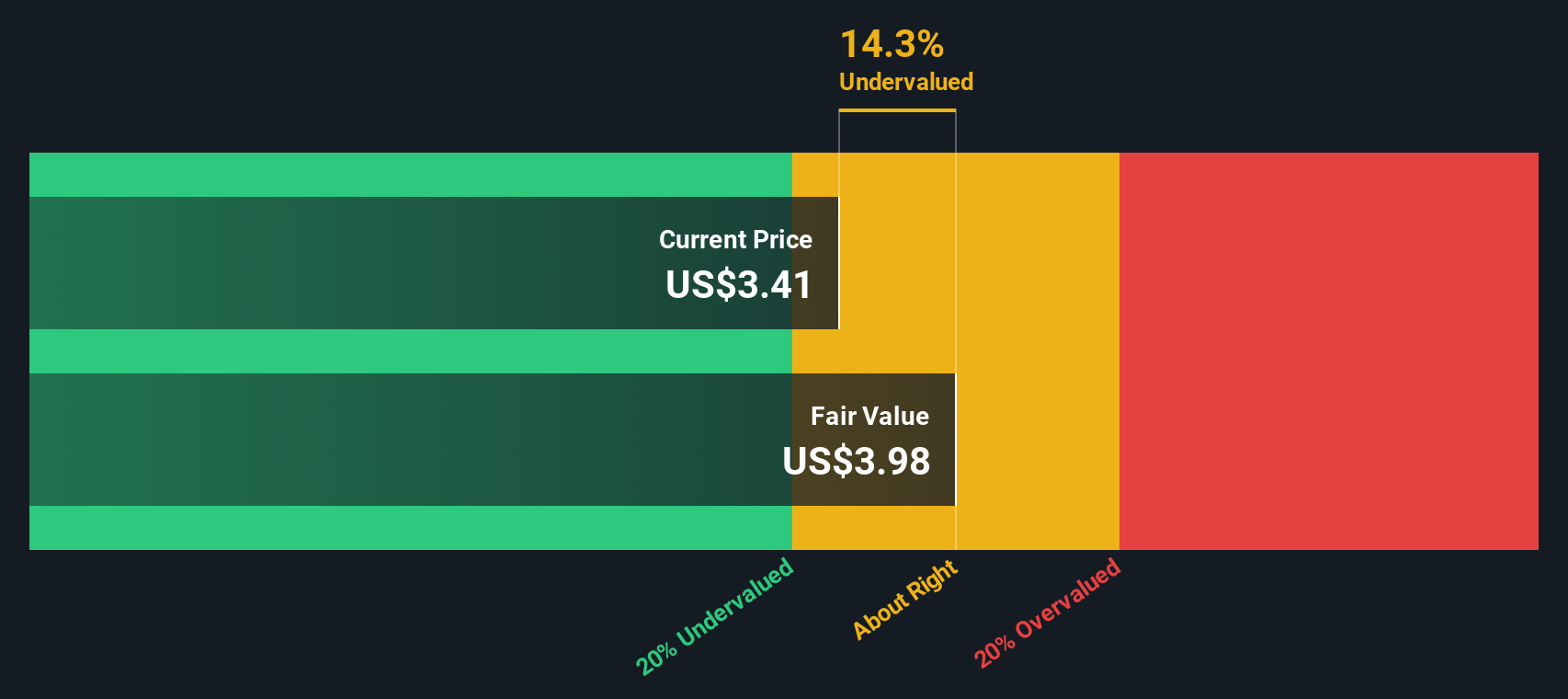

With the stock pulling back after explosive gains, investors are debating if fuboTV shares are still trading at attractive levels or whether the market has already priced in the company’s turnaround and growth prospects.

Most Popular Narrative: 19.8% Undervalued

With a consensus fair value of $4.50 and the latest close at $3.61, the narrative presents a bullish case supported by product innovation and improving financials. Consensus analysts anticipate more upside ahead, hinging on several material growth drivers.

Expansion of content partnerships (e.g., with DAZN), including distribution of exclusive sports rights and FAST channels, enhances differentiation and could drive higher average revenue per user (ARPU) and sustained premium subscription growth.

Want to uncover what fuels this ambitious projection? The narrative is built on transformative content deals and a bold roadmap for revenue and margin growth. Find out which key financial levers and evolving industry dynamics could make or break this target.

Result: Fair Value of $4.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent subscriber declines and intense competition from larger streaming providers could quickly reverse bullish expectations if these trends continue to accelerate.

Find out about the key risks to this fuboTV narrative.

Another View: DCF Model Challenges the Bullish Case

While analysts see fuboTV as undervalued based on future earnings and market multiples, our SWS DCF model paints a more cautious picture. According to this approach, the current price is actually above its estimated intrinsic value. This could signal that much of the upside is already reflected in today’s valuation. Does the DCF tell a truth the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out fuboTV for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own fuboTV Narrative

If you’re eager to look beyond consensus and shape your own view of fuboTV, it takes just minutes to build a custom outlook and see where your research leads. Do it your way

A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on momentum by searching for stocks set to disrupt markets. Don’t stay on the sidelines while others spot the best growth prospects first.

- Uncover income opportunities and start earning from these 16 dividend stocks with yields > 3% offering solid yields above 3%.

- Tap into the exponential potential of breakthrough tech by browsing these 25 AI penny stocks primed to shape tomorrow’s economy.

- Catch early-stage movers with explosive upside among these 3585 penny stocks with strong financials backed by strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives