- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

Does fuboTV’s Sports Expansion Justify Its 161% Surge in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if fuboTV is actually a bargain, or if the market hype has run away with expectations? You are not alone, and you are right to want a clear-eyed look at its value.

- fuboTV's stock has seen wild swings lately. It is up 1.1% this past week, down 7.1% over the month, but an eye-catching up 161% so far this year.

- Headlines have circled around fuboTV's expansion of its sports streaming offerings, including new partnerships with major leagues and platforms. This steady drumbeat of news has caught the attention of investors looking for sector disruption and could be shifting perceptions of both opportunity and risk.

- On our strict value checklist, fuboTV scores just 1 out of 6. Before you jump to conclusions, let us look at how the numbers stack up and why a more thoughtful approach to valuation might reveal something the basic checks miss.

fuboTV scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: fuboTV Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge whether the current stock price reflects the value the business is expected to generate over time.

For fuboTV, the DCF model uses the latest twelve months' Free Cash Flow (FCF) of $122.4 Million as a starting point. Over the next decade, analysts expect FCF to fluctuate, with projections reaching $117.2 Million by 2027 and, through further extrapolation, approximately $127.3 Million by 2035. These projections are based on a combination of analyst estimates for the earlier years and continuing trends estimated by Simply Wall St for the outer years.

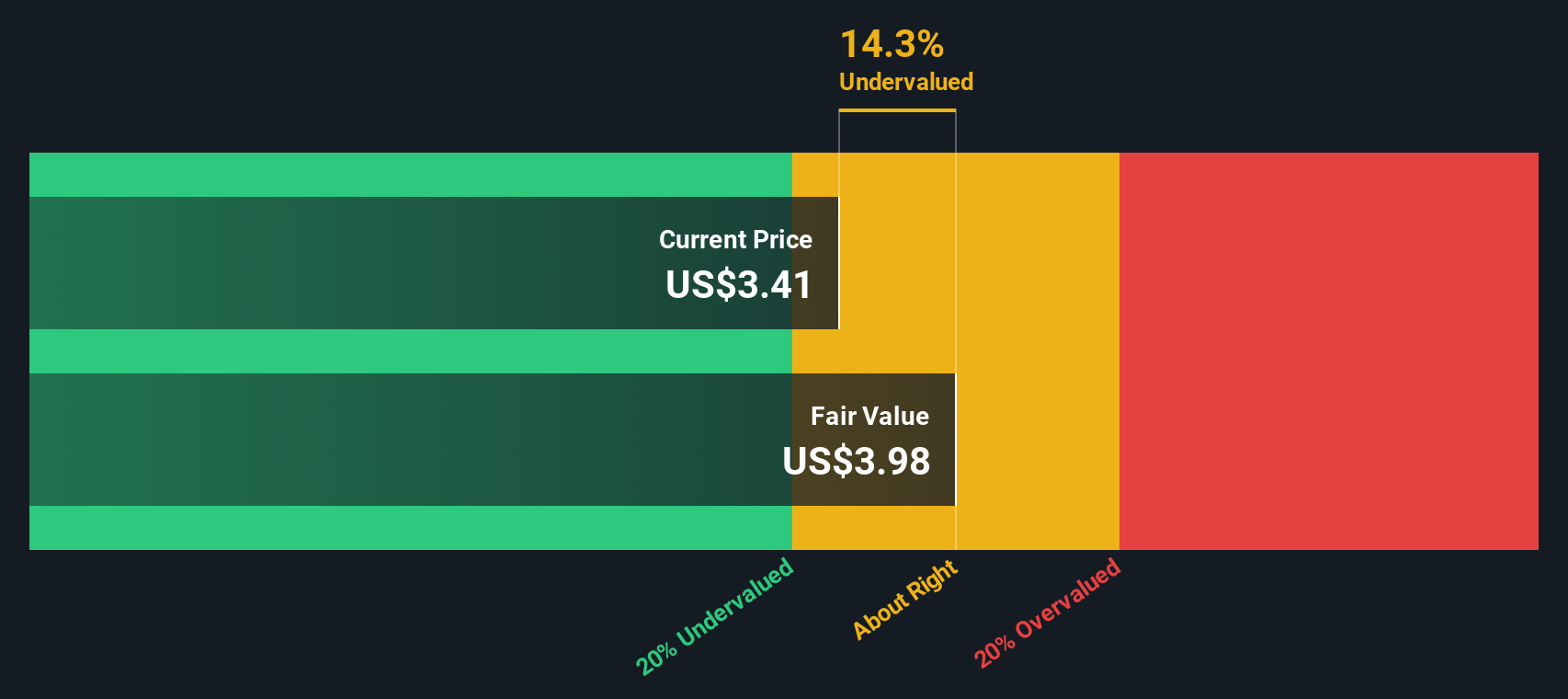

Based on this model, the intrinsic value of a fuboTV share is estimated at just $1.44. With the current share price far above this figure, the DCF model implies the stock is trading at a 154.9% premium compared to its calculated fair value.

This substantial gap suggests that, by the numbers, fuboTV is currently overvalued according to DCF analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests fuboTV may be overvalued by 154.9%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: fuboTV Price vs Earnings

For companies that are generating profits, the Price-to-Earnings (PE) ratio is a widely used way to assess whether a stock is priced appropriately. The PE tells you how much investors are paying for each dollar of earnings, which makes it especially useful for profitable firms like fuboTV.

What counts as a "normal" PE ratio depends on how quickly a company is expected to grow and how much risk is involved. If the company is growing rapidly and has manageable risks, a higher PE ratio might be justified. Conversely, slower growth or greater business risk tends to warrant a lower PE multiple.

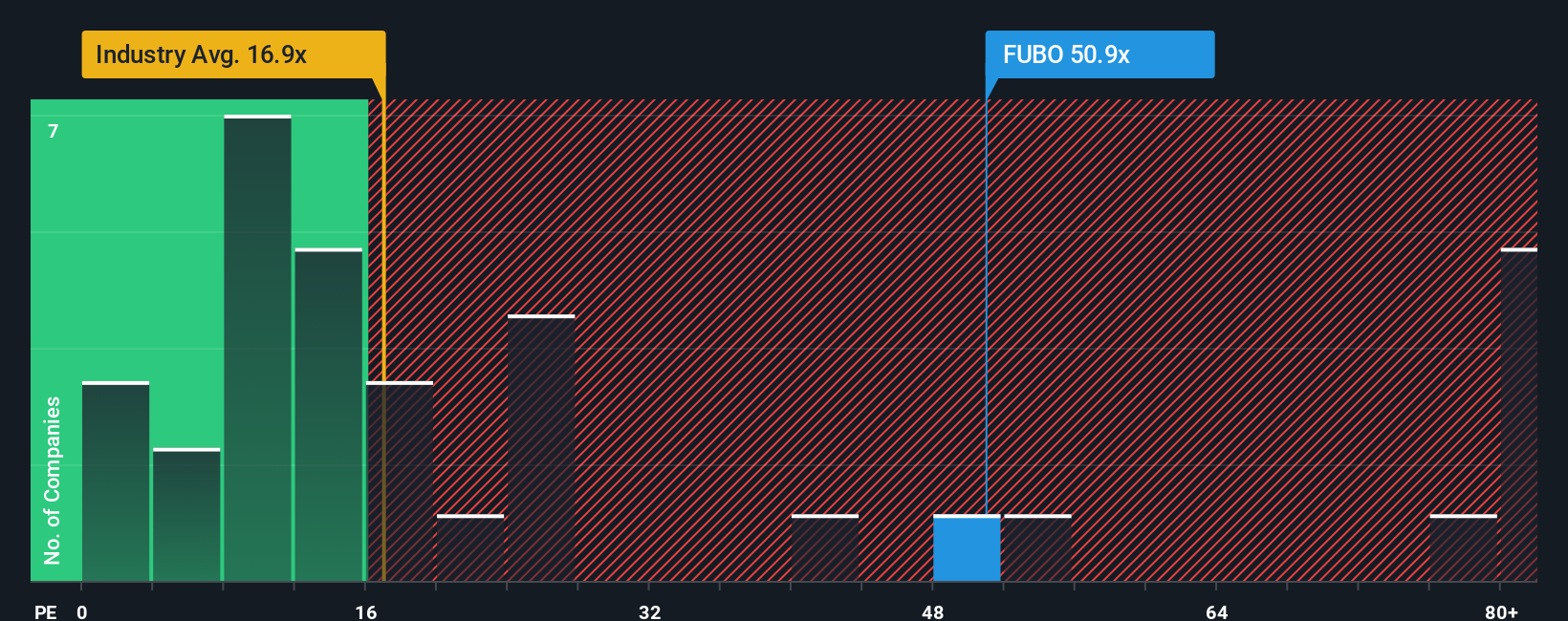

fuboTV currently trades at a PE ratio of 38.5x. For context, the average PE for the Interactive Media and Services industry is 16.1x, and the average of its peers is about 16.3x. Clearly, fuboTV’s multiple is more than double these benchmarks, suggesting lofty expectations are baked into its stock price.

However, looking at simple averages may miss important nuances. That is where Simply Wall St’s "Fair Ratio" comes in, which is 5.7x for fuboTV. The Fair Ratio estimates a company’s justified PE after weighing factors like earnings growth outlook, profit margins, industry dynamics, market cap, and specific risks. This makes it a more precise yardstick than comparing against averages alone.

When the actual PE of 38.5x for fuboTV is compared to its Fair Ratio of 5.7x, the stock appears meaningfully overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your fuboTV Narrative

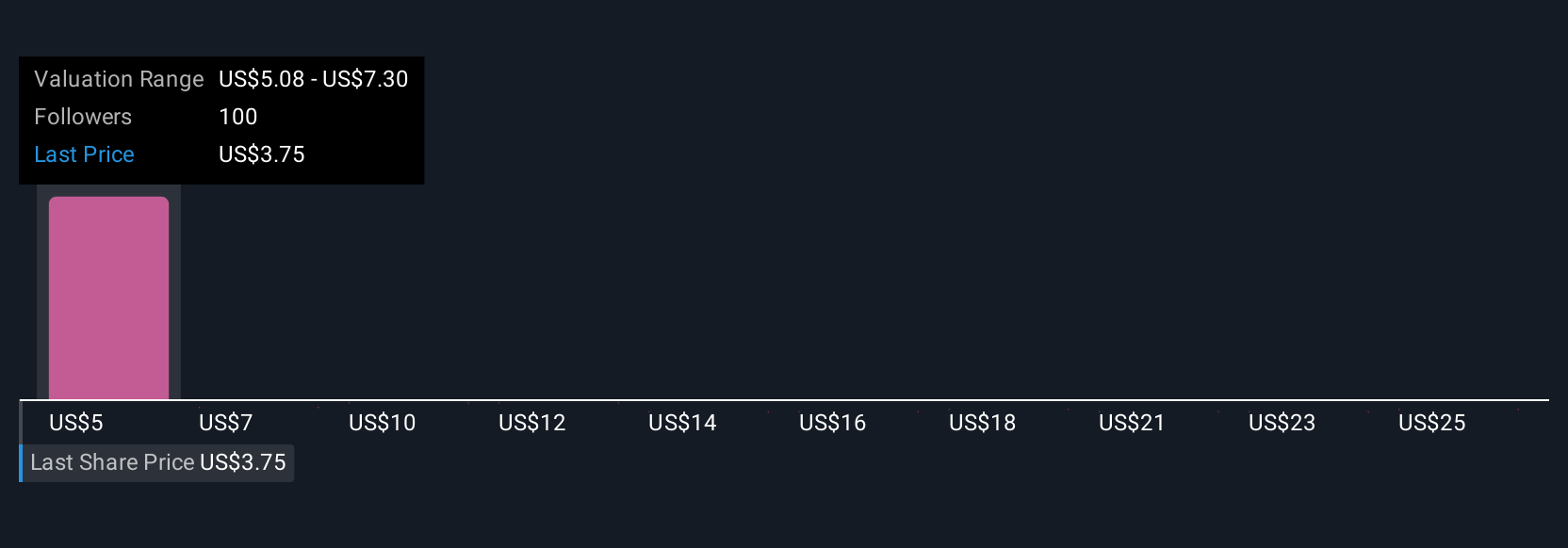

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you believe about fuboTV’s future, supported by your assumptions about how fast revenue, earnings, or margins can grow, and the fair value you think follows from that story. Narratives help you bring the numbers to life, linking your perspective on fuboTV’s business, your expectations for its future performance, and an updated calculation of what the stock should be worth right now.

This approach is much more flexible and personal than traditional tools; you can easily create or explore Narratives within the Community section of Simply Wall St, which millions of investors use every month. Narratives allow you to see how your view stacks up against others, and they are automatically updated as new news or earnings reports are released, so your estimates and fair value stay relevant. Importantly, by comparing your Narrative-based fair value to the current share price, it becomes clear when fuboTV is under- or overvalued for your outlook, which helps you make more informed buy or sell decisions.

For example, some investors currently estimate fuboTV’s fair value at $5.00 based on aggressive growth assumptions and market expansion, while others believe a more cautious $4.25 is realistic given profitability and competitive risks.

Do you think there's more to the story for fuboTV? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives