- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

Do fuboTV’s 113% Rally and Sports Expansion Justify Its Current Share Price?

Reviewed by Bailey Pemberton

- Wondering whether fuboTV is trading at a bargain or already priced for perfection? You’re not alone. There has been plenty of chatter about where value really lies for this streaming stock.

- Its shares have seen wild swings lately, rising an eye-catching 113.5% year-to-date and 100.7% over the last year, but dropping by 11.7% in just the last week and finishing down 15.9% for the month.

- Recent headlines highlight ongoing excitement about fuboTV’s ability to capture cord-cutters and expand its sports offerings, fueling both optimism and volatility. The company’s continued push into exclusive sports broadcasting rights has caught the attention of growth-focused investors and added fresh energy to the stock’s story.

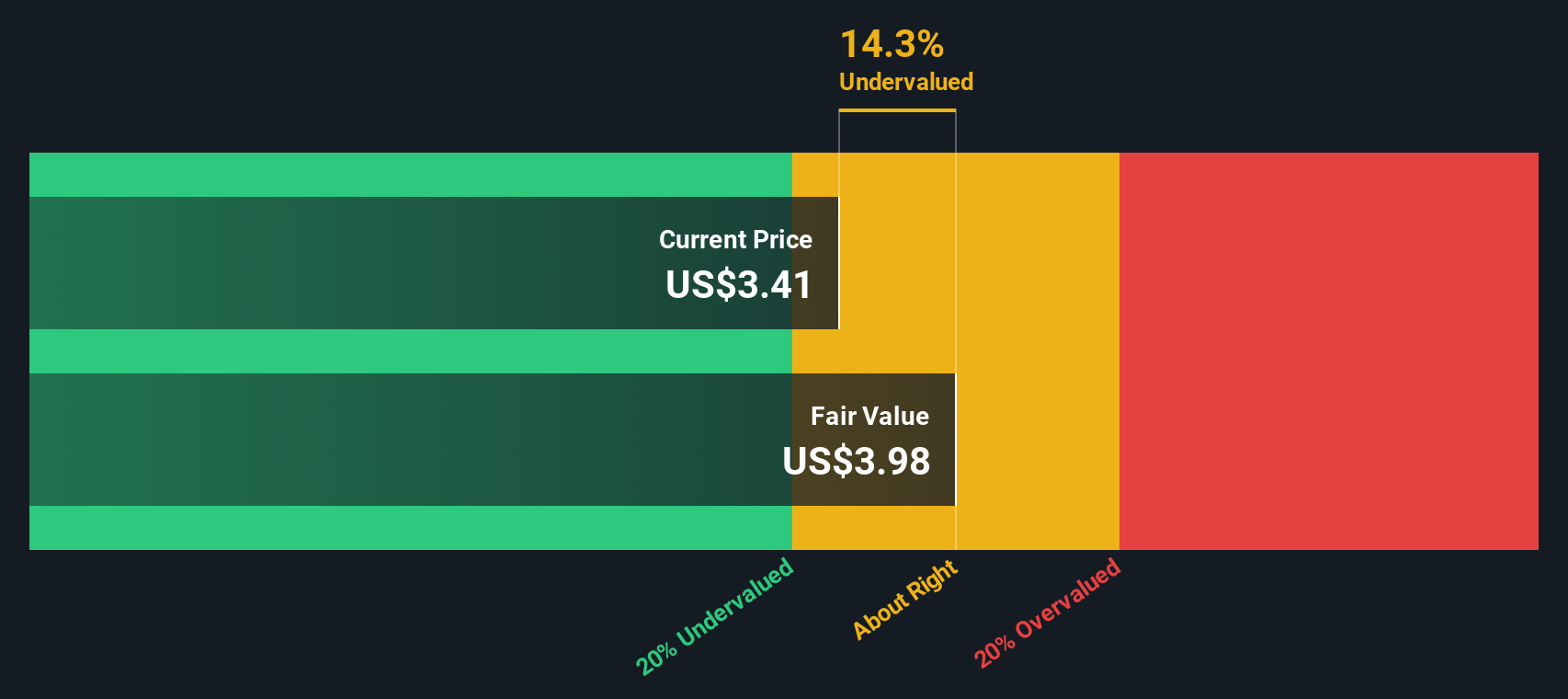

- fuboTV’s current valuation score comes in at 2 out of 6, pointing to potential undervaluation on just a couple of fronts. We’ll dig into what this score really means using traditional and alternative valuation models. Plus, stick around for an even smarter approach to understanding value that we’ll share at the end.

fuboTV scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: fuboTV Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s dollars. This helps investors judge what fuboTV might really be worth, beyond market hype or short-term trends.

For fuboTV, the most recent reported Free Cash Flow stands at $122 million. Analysts forecast incremental growth over the next few years, with FCF projected to reach $76 million by the end of 2027. Further into the future, DCF estimates suggest the company’s annual free cash flow could hover around $54 million to $53 million a decade from now. These long-range projections are extrapolated, not analyst-provided, reflecting the inherent uncertainty when looking so far ahead.

When cash flows are discounted based on a 2 Stage Free Cash Flow to Equity model, fuboTV’s intrinsic value calculates to $0.67 per share. Compared to the company’s recent trading price, this valuation implies the stock is trading at a 347.3% premium, indicating it could be significantly overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests fuboTV may be overvalued by 347.3%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

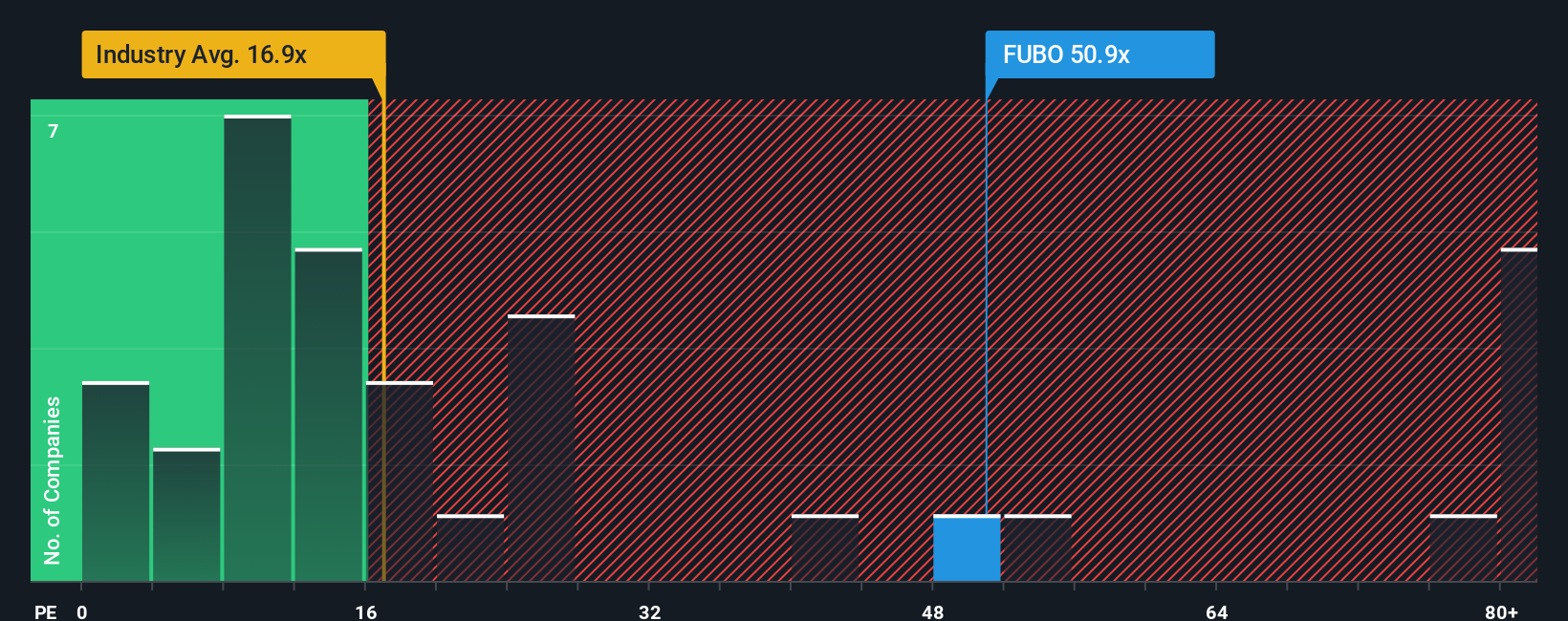

Approach 2: fuboTV Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely-used valuation tool that makes sense for profitable companies, as it compares a stock’s price to its earnings and helps investors weigh how much they are paying for each dollar of profit. In general, a higher PE ratio is justified when a company is expected to grow earnings rapidly or is perceived as lower risk. Slower growth or higher risk tends to warrant a lower PE multiple.

fuboTV is currently trading at a PE ratio of 31.6x. For context, the Interactive Media and Services industry averages 19.5x, while fuboTV’s closest peers trade at an average of 14.6x. Despite its higher than average PE, Simply Wall St calculates a “Fair Ratio” for fuboTV at 35.3x. This proprietary metric goes beyond basic industry averages or peer comparisons by factoring in fuboTV’s specific growth prospects, risks, profit margins, industry characteristics, and its market capitalization, providing a more tailored benchmark for fair value.

Comparing fuboTV’s actual PE ratio of 31.6x to its Fair Ratio of 35.3x, the stock is trading slightly below what would be justified by its fundamentals. Since the difference is less than 0.1 on an absolute basis, fuboTV’s share price appears to be about right relative to its growth and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

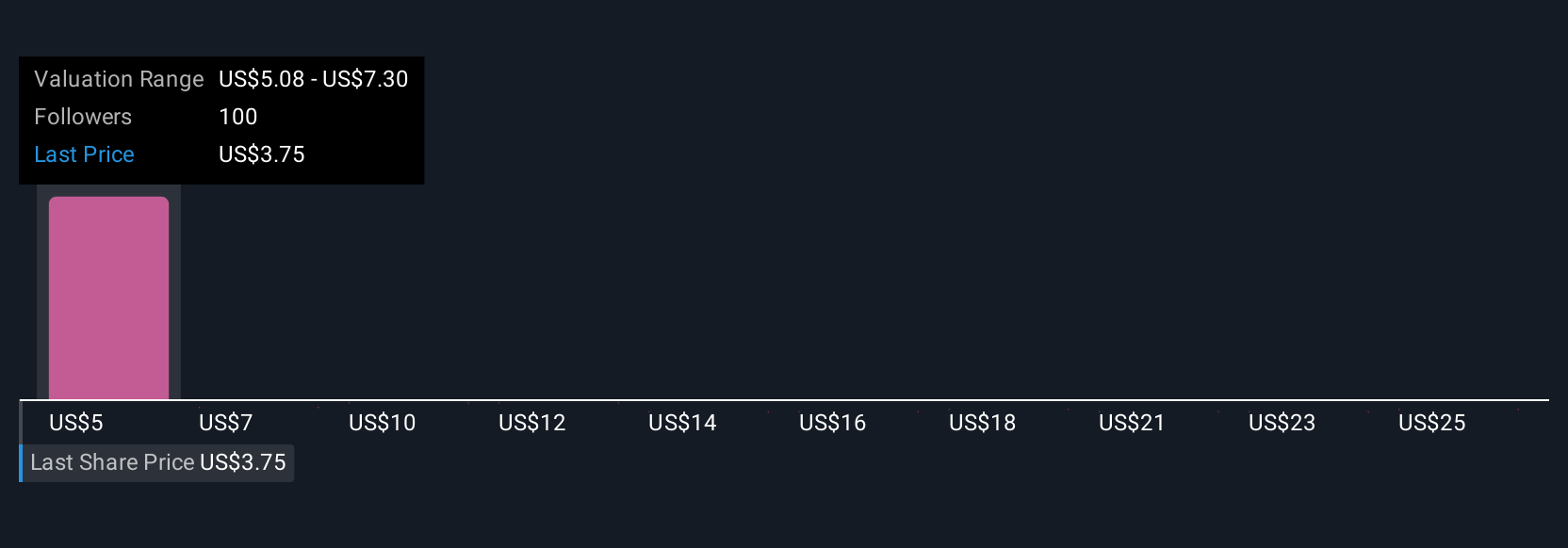

Upgrade Your Decision Making: Choose your fuboTV Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company’s future, connecting how you see fuboTV’s business evolving, what growth you expect, and the financial assumptions you believe are most likely. This approach translates your outlook into a clear, data-driven forecast and a fair value estimate.

Narratives bring the numbers to life by tying financial forecasts to the main reasons for optimism or caution. Are you supporting fuboTV to gain an edge with exclusive sports bundles and improved ad technology, or do you anticipate that subscriber churn and content challenges may limit its progress? On Simply Wall St’s Community page, Narratives enable anyone to share their view and instantly see if fuboTV appears overvalued or attractively priced at today’s levels.

What makes Narratives even more powerful is that they update automatically as new information comes in, such as significant news, earnings reports, or deal announcements. This ensures that your estimate of fair value remains current. For example, the most optimistic Narrative for fuboTV sets a fair value at $5.00 per share, while the most cautious estimates it at $4.25. This demonstrates how the same facts can lead to very different investment perspectives.

Do you think there's more to the story for fuboTV? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success