- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

Could the Fubo Channel Store Shape fuboTV's (FUBO) Path to Sustainable Subscriber Growth?

Reviewed by Sasha Jovanovic

- Earlier this month, FuboTV Inc. launched the Fubo Channel Store, a central hub within its platform allowing subscribers seamless access to a range of premium standalone plans, including services from several regional sports networks and streaming partners like DAZN One and Paramount+ with Showtime.

- This move follows FuboTV’s recent earnings report for the third quarter, which showed a sharp reduction in net loss year-over-year despite a modest revenue decline, reflecting ongoing operational improvements aimed at supporting long-term financial health.

- We'll explore how the introduction of the Fubo Channel Store could influence FuboTV’s investment narrative and outlook on subscription growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

fuboTV Investment Narrative Recap

For investors to back fuboTV, belief in the company’s ability to reverse declining subscriptions and stabilize revenue is essential. The launch of the Fubo Channel Store could help counteract subscription fatigue by streamlining access to premium content, but may not immediately resolve the underlying risk of subscriber churn, which remains the most pressing near-term concern. While this new feature may modestly support user retention, the risk to top-line growth from ongoing content fragmentation persists.

The August launch of Fubo Sports, a more affordable, sports-centric option, stands out as especially relevant alongside the Channel Store rollout. Both offerings seek to strengthen FuboTV’s appeal in a crowded streaming market, potentially supporting efforts to attract or keep price-sensitive sports fans, a crucial catalyst as the company tries to grow its base.

However, investors should also consider that even as Fubo enhances subscriber access, the risk of losing key content partnerships might have an even greater impact on...

Read the full narrative on fuboTV (it's free!)

fuboTV's narrative projects $1.8 billion revenue and $200.4 million earnings by 2028. This requires 3.8% yearly revenue growth and a $112.7 million earnings increase from $87.7 million today.

Uncover how fuboTV's forecasts yield a $4.50 fair value, a 25% upside to its current price.

Exploring Other Perspectives

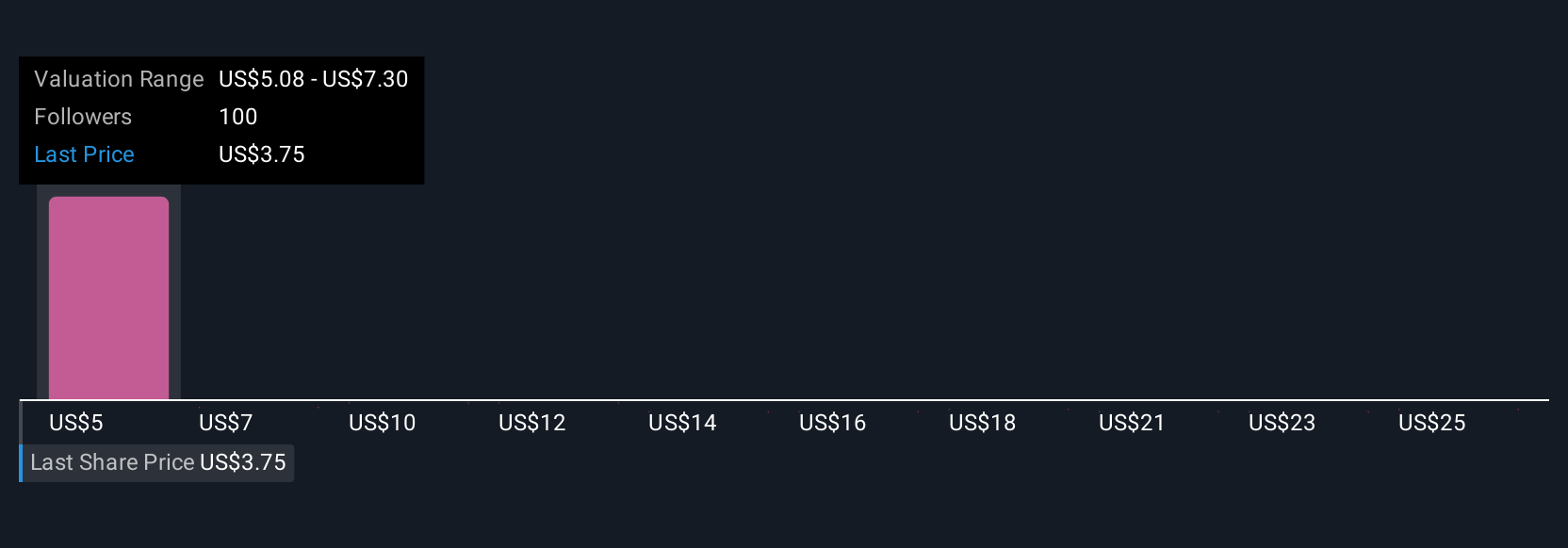

Fair value estimates from 21 Simply Wall St Community users range widely, from US$0.68 up to US$18.62. With subscriber declines as a core challenge, the broad spread in views reflects just how differently you can see fuboTV's future and invites you to review several perspectives before making up your mind.

Explore 21 other fair value estimates on fuboTV - why the stock might be worth less than half the current price!

Build Your Own fuboTV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free fuboTV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate fuboTV's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives