- United States

- /

- Media

- /

- OTCPK:AUDA.Q

Some Entercom Communications Corp. (NYSE:ETM) Analysts Just Made A Major Cut To Next Year's Estimates

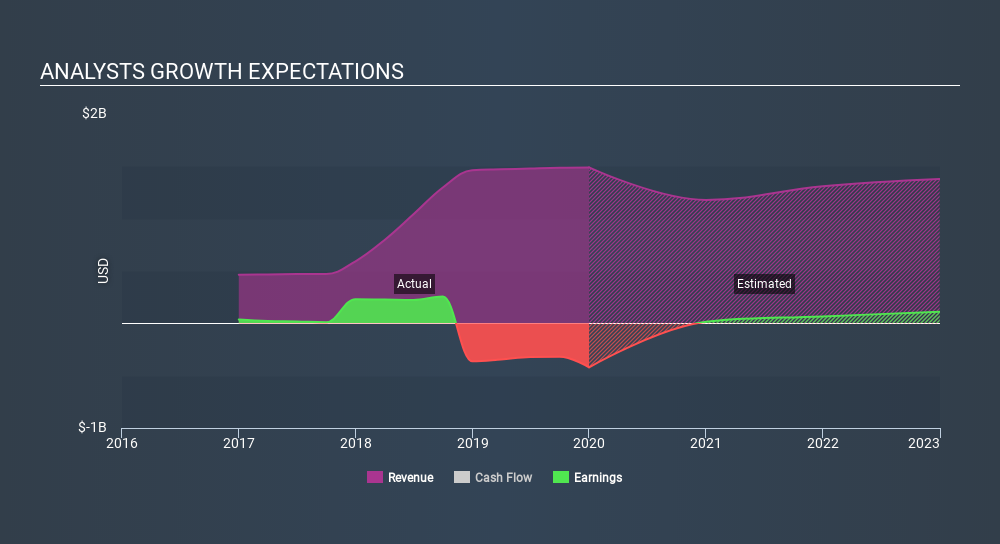

The latest analyst coverage could presage a bad day for Entercom Communications Corp. (NYSE:ETM), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business. Bidders are definitely seeing a different story, with the stock price of US$1.32 reflecting a 31% rise in the past week. Whether the downgrade will have a negative impact on demand for shares is yet to be seen.

Following the latest downgrade, the current consensus, from the four analysts covering Entercom Communications, is for revenues of US$1.2b in 2020, which would reflect a substantial 21% reduction in Entercom Communications' sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.24 per share this year. Previously, the analysts had been modelling revenues of US$1.4b and earnings per share (EPS) of US$0.49 in 2020. Indeed, we can see that the analysts are a lot more bearish about Entercom Communications' prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Entercom Communications

It'll come as no surprise then, to learn that the analysts have cut their price target 50% to US$1.88. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Entercom Communications analyst has a price target of US$3.50 per share, while the most pessimistic values it at US$1.00. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast revenue decline of 21%, a significant reduction from annual growth of 35% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.2% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Entercom Communications is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Entercom Communications. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Entercom Communications' revenues are expected to grow slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Entercom Communications going out to 2022, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:AUDA.Q

Audacy

A multi-platform audio content and entertainment company, engages in the radio broadcasting business in the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives