- United States

- /

- Media

- /

- OTCPK:AUDA.Q

Entercom Communications'(NYSE:ETM) Share Price Is Down 47% Over The Past Five Years.

It is doubtless a positive to see that the Entercom Communications Corp. (NYSE:ETM) share price has gained some 191% in the last three months. But over the last half decade, the stock has not performed well. After all, the share price is down 47% in that time, significantly under-performing the market.

See our latest analysis for Entercom Communications

Given that Entercom Communications didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Entercom Communications grew its revenue at 29% per year. That's better than most loss-making companies. Shareholders are no doubt disappointed with the loss of 8%, each year, in that time. You could say that the market has been harsh, given the top line growth. If that's the case, now might be the smart time to take a close look at it.

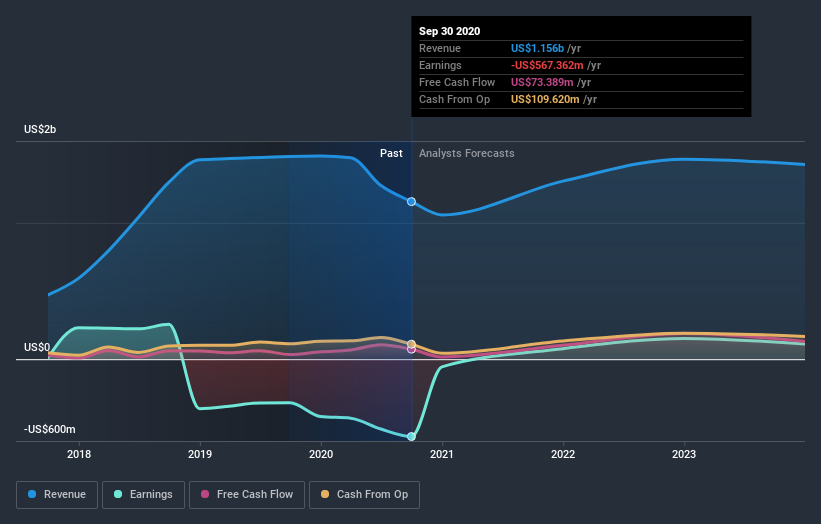

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Entercom Communications

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Entercom Communications' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Entercom Communications shareholders, and that cash payout explains why its total shareholder loss of 38%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Entercom Communications provided a TSR of 30% over the year. That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 7% over the last five years. While 'turnarounds seldom turn' there are green shoots for Entercom Communications. It's always interesting to track share price performance over the longer term. But to understand Entercom Communications better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Entercom Communications you should be aware of.

Entercom Communications is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Entercom Communications or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:AUDA.Q

Audacy

A multi-platform audio content and entertainment company, engages in the radio broadcasting business in the United States.

Moderate and slightly overvalued.

Market Insights

Community Narratives