Although not as bad as some of its competitors, The Walt Disney Company (NYSE: DIS) still experienced a decline of over 30% year-to-date. In a market turmoil, investors tend to shy away from companies that rely on subscription entertainment.

However, Disney is a diversified player in that space and even managed to grow its subscriptions. Yet, growth comes with a large content bill.

Check out our latest analysis for Walt Disney

Earnings Results

- Non-GAAP EPS: US$1.08 (miss by US$0.11)

- Revenue: US$19.24b (miss by US$800m)

Per segment:

- Media and Entertainment Distribution: US$13.62b

- Parks, Experiences, and Products: US$6.65b

Revenue growth: +23.3% Y/Y

While revenue missed the mark, it is essential to note that the company recognized US$1b reductions due to early license terminations for film and television content of the previous years to use it primarily on their direct-to-customer services. However, considering the media and entertainment segment contributes to a vast majority of the revenues, this was arguably a good move.

Disney+ added 8 million subscriptions vs. an expected 5, bringing the total to 138 million. The service will be expanding its global reach to 106 countries this summer, but costs of content are ramping up by US$900m in the next quarter. The total content bill in this fiscal year should reach US$32b.

How Much Debt Does Walt Disney Carry?

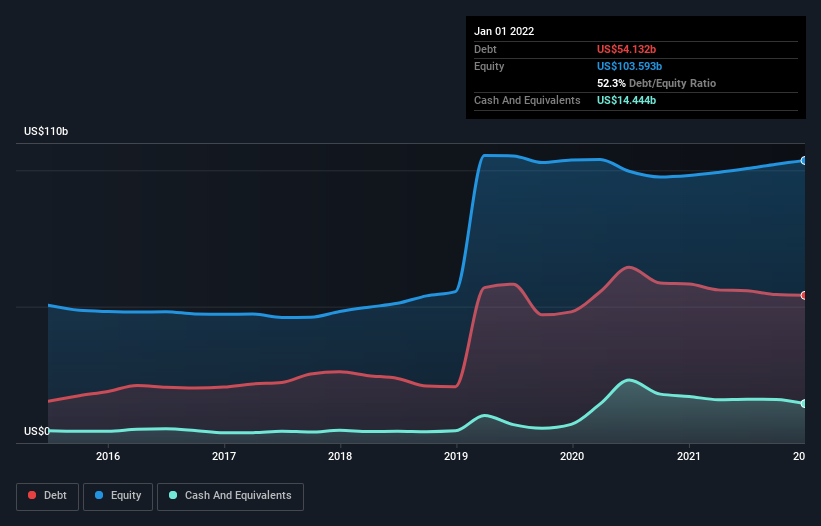

The chart below, which you can click on for greater detail, shows that Walt Disney had US$54.1b in debt in January 2022, about the same as the year before. It does have US$14.4b in cash, offsetting this, leading to net debt of about US$39.7b.

A Look At Walt Disney's Liabilities

The latest balance sheet data shows that Walt Disney had liabilities of US$30.0b due within a year and liabilities of US$69.7b falling due after that. Meanwhile, it had cash of US$14.4b and US$14.9b worth of receivables due within a year. So its liabilities total US$70.4b more than the combination of its cash and short-term receivables. In absolute terms, this sounds like a lot but compared to the US$190b market cap, it looks manageable.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) cover its interest expense (or its interest cover, for short).

Walt Disney has a debt to EBITDA ratio of 3.8, and its EBIT covered its interest expense 4.3 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The silver lining is that Walt Disney grew its EBIT by 357% last year, although we must consider that any comparisons with 2020 are heavily skewed. You can check out this free report showing analyst profit forecasts for Disney's future.

Finally, a business needs free cash flow to pay off debt. In the last three years, Walt Disney created free cash flow amounting to 18% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Adjusted for the license termination expenses, Disney's earnings report doesn't look bad. Unfortunately, it would take extraordinary news to turn the stock around in the current market environment.

While the management booked solid Disney+ subscription growth, it needs to be pointed out that most of it came from the Indian market, where the average revenue per user is much lower than in comparison to the U.S. market. On the other hand, the box office might offer a surprising boost in the ongoing quarter as Doctor Strange, the latest installment in the Marvel Cinematic Universe, made an excellent global debut earning at least US$450 million. So far, more sequels are scheduled later this year, with Thor, Black Panther, and Avatar 2 being potentially big winners.

When it comes to the balance sheet, the positive news is that the company grew its cash flow to US$1.77b, much better compared to US$1.39b for the same period last year. With so many potential successes in the pipeline, we'd be watching closely to see what the company will do with that cash flow: reduce debt, reinstate the dividend or go all-in on growth. Those decisions will be up to the management.

The balance sheet is the obvious place to start when analyzing debt levels. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Walt Disney.

Sometimes it's easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:DIS

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives