- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney (DIS) Valuation: Assessing Opportunities After Recent 5% Pullback in Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Walt Disney.

Disney’s 20.8% one-year total shareholder return stands out, even with the recent 5% monthly slip in share price. A combination of cautious optimism and ongoing big-picture shifts suggests the stock’s momentum is taking a breather as investors digest the latest developments and weigh the company’s ability to unlock value ahead.

If this changing momentum has you thinking about new opportunities, it could be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Given Disney’s recent returns and the current discount to analyst price targets, the question now is whether the recent pullback signals an undervalued opportunity or if the market has already accounted for the company’s future growth potential.

Most Popular Narrative: 15.8% Undervalued

Walt Disney’s widely followed narrative sets a fair value of $133.22, which is roughly $21 above the last close. Momentum and expectations are intersecting, fueling debate around just how much upside could be left.

The global expansion of Disney's cruise and theme park businesses, with major investments in new ships and park attractions, particularly in Asia and emerging markets, is set to capture increasing demand from rising middle class populations worldwide, boosting future revenue and earnings growth across geographies.

Curious about the math behind that target? There is a bold, quantitative blueprint built into these assumptions. Think future revenue lifts, ambitious margin forecasts, and a valuation framework that could surprise even seasoned Disney investors. Uncover the critical details that created this double-digit upside signal; there is more to the story than recent headlines suggest.

Result: Fair Value of $133.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high content and expansion costs, or audience shifts toward alternative platforms, could threaten Disney’s future streaming and experiences profitability.

Find out about the key risks to this Walt Disney narrative.

Another View: A Look Through Market Multiples

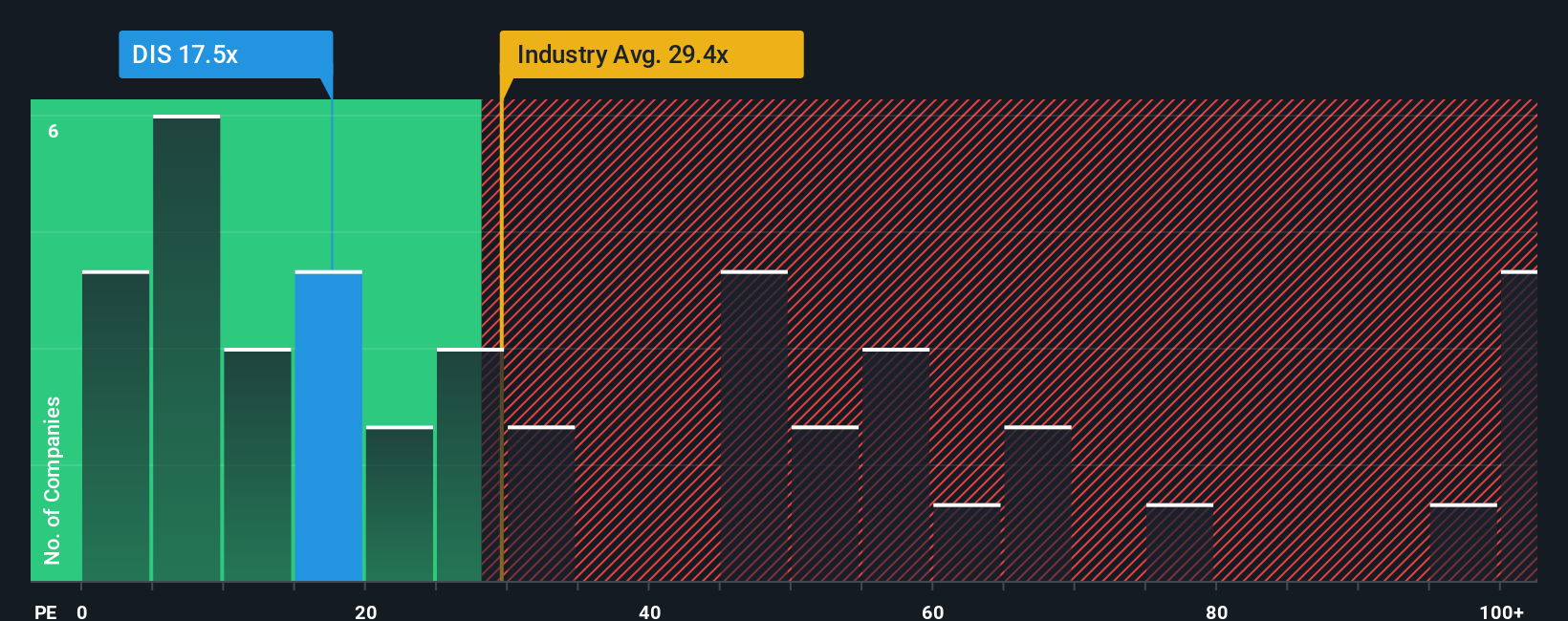

A second angle comes from the price-to-earnings ratio, where Disney trades at 17.5x, notably cheaper than its industry average of 30.1x and peer group average of 85.3x. Compared to a fair ratio of 25.5x, Disney's current pricing suggests the market is taking a conservative stance. Is this caution or an opening for value hunters?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you see the numbers differently or want to dig deeper on your own terms, you can build your own Walt Disney view in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Walt Disney.

Looking for more investment ideas?

Your next winning move could be just a click away. Don’t let an opportunity pass you by when smart investing ideas are this easy to find.

- Spot tomorrow’s leaders by targeting incredible value opportunities with these 904 undervalued stocks based on cash flows and see which stocks could be trading below their true worth.

- Supercharge your portfolio by tapping into the latest breakthroughs in healthcare innovation with these 31 healthcare AI stocks, where tech and medicine intersect for growth potential.

- Start earning while you invest by pursuing strong yields and consistent payouts with these 19 dividend stocks with yields > 3% that highlight top dividend payers in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives