- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney (DIS): A Fresh Look at Valuation as Share Price Moves Within a Narrow Range

Reviewed by Kshitija Bhandaru

Walt Disney (DIS) shares have been moving within a fairly narrow range, with modest gains over the past week and a slight dip this month. Investors are keeping an eye on recent performance as the market digests the company's latest numbers.

See our latest analysis for Walt Disney.

Disney’s share price has edged lower over the past month; however, the company’s one-year total shareholder return of nearly 15% signals solid momentum is still in play, especially when compared to its broader multi-year performance. Recent headlines and evolving sector trends continue to shape investor sentiment as the media giant navigates both ongoing challenges and fresh opportunities.

If you’re curious about what other entertainment and media leaders are offering investors lately, it might be time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and solid longer-term returns, the real question is whether Disney is an underrated value play right now or if the market has already factored in its future growth prospects.

Most Popular Narrative: 16.9% Undervalued

According to the widely followed narrative, Walt Disney's fair value estimate is notably ahead of where shares last closed. This suggests room for upside as the company's latest strategic moves play out.

The global expansion of Disney's cruise and theme park businesses, with major investments in new ships and park attractions, particularly in Asia and emerging markets, is set to capture increasing demand from rising middle class populations worldwide, boosting future revenue and earnings growth across geographies.

Curious what’s powering this bullish view? There is a bold growth play buried in Disney’s evolving business model and some eye-opening profit projections under the surface. If you're ready to uncover the full earnings assumptions and the pivotal financial drivers behind Disney’s latest valuation, take a closer look and see what sets this forecast apart.

Result: Fair Value of $133.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent creative focus on sequels, along with surging costs in streaming and experiences, could quickly challenge Disney’s growth story if trends shift unexpectedly.

Find out about the key risks to this Walt Disney narrative.

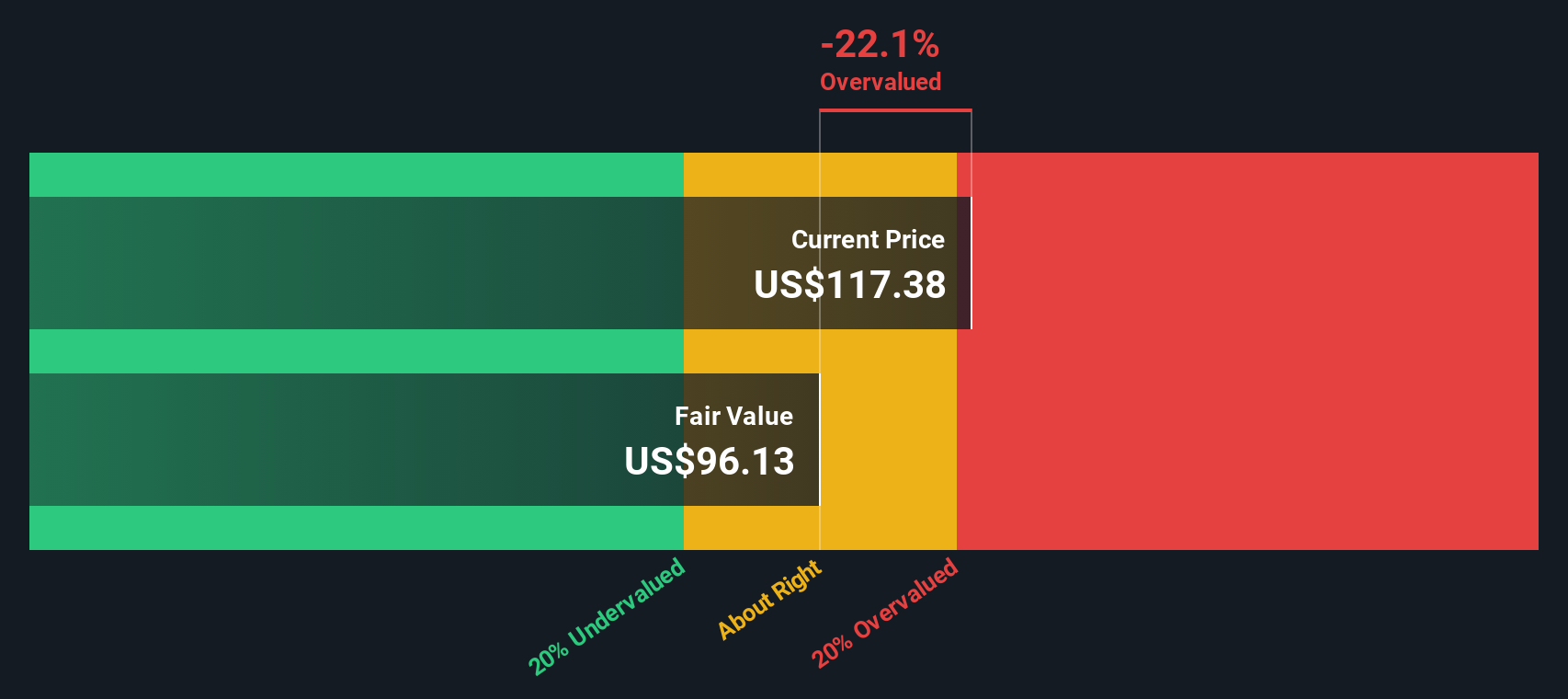

Another View: SWS DCF Model Shows a Slightly Different Picture

While analysts see upside potential, our DCF model paints a more reserved outlook for Disney. Based on our cash flow estimates, Disney shares are actually trading modestly above our calculated fair value of $105.66. This suggests a possible overvaluation by this approach. Does this mean the market is too optimistic, or could Disney still outperform expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you see things differently, or would rather dig into the data on your own terms, it takes less than three minutes to build your own view here: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Walt Disney.

Looking for More Investment Ideas?

Don't limit your potential; there’s a world of opportunities waiting. Make your next smart move and set yourself up for tomorrow’s strongest results:

- Capitalize on steady income by reviewing these 18 dividend stocks with yields > 3% offering robust yields above 3% in today’s market.

- Unleash your curiosity with these 79 cryptocurrency and blockchain stocks pushing boundaries in digital assets and reshaping the future of finance.

- Spot emerging trends through these 33 healthcare AI stocks that are transforming healthcare solutions using artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives