- United States

- /

- Entertainment

- /

- NYSE:CNK

How Cinemark Holdings’ (CNK) Event Content Strategy May Shift Its Investment Narrative

Reviewed by Sasha Jovanovic

- Great American Media, in partnership with Fathom Entertainment, recently announced the exclusive nationwide theatrical release of "Another Sweet Christmas," premiering from November 30 to December 2 and featuring special bonus content for attendees.

- This marks the first time a Great American Christmas Original will debut on the big screen, highlighting the growing importance of event-driven content distribution and Cinemark Holdings' role as a co-owner of Fathom Entertainment.

- We'll explore how Cinemark's participation in exclusive event releases like this could shape its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cinemark Holdings Investment Narrative Recap

To believe in Cinemark Holdings as an investment, you need confidence that consumer demand for out-of-home entertainment and the strength of event-driven box office programming will continue to offset challenges from streaming competition and content disruptions. The recent partnership for the nationwide release of "Another Sweet Christmas" with Fathom Entertainment showcases Cinemark’s push into exclusive events, but this alone is unlikely to materially impact the company's near-term earnings, which remain closely tied to studio film slates and blockbuster performance, the biggest catalyst and risk for the business today.

Of recent announcements, Cinemark’s July expansion with CJ 4DPLEX to add 20 new SCREENX locations is particularly relevant, signaling a continued focus on premium offerings designed to attract audiences seeking enhanced theater experiences, an important catalyst for higher per-visit spending and mitigating attendance volatility tied to film cycles.

But with the increasing concentration of box office success in only a few blockbusters, investors should also be conscious of...

Read the full narrative on Cinemark Holdings (it's free!)

Cinemark Holdings is forecast to achieve $3.7 billion in revenue and $297.4 million in earnings by 2028. This outlook assumes annual revenue growth of 5.0%, with earnings increasing by approximately $8.6 million from the current $288.8 million.

Uncover how Cinemark Holdings' forecasts yield a $33.91 fair value, a 28% upside to its current price.

Exploring Other Perspectives

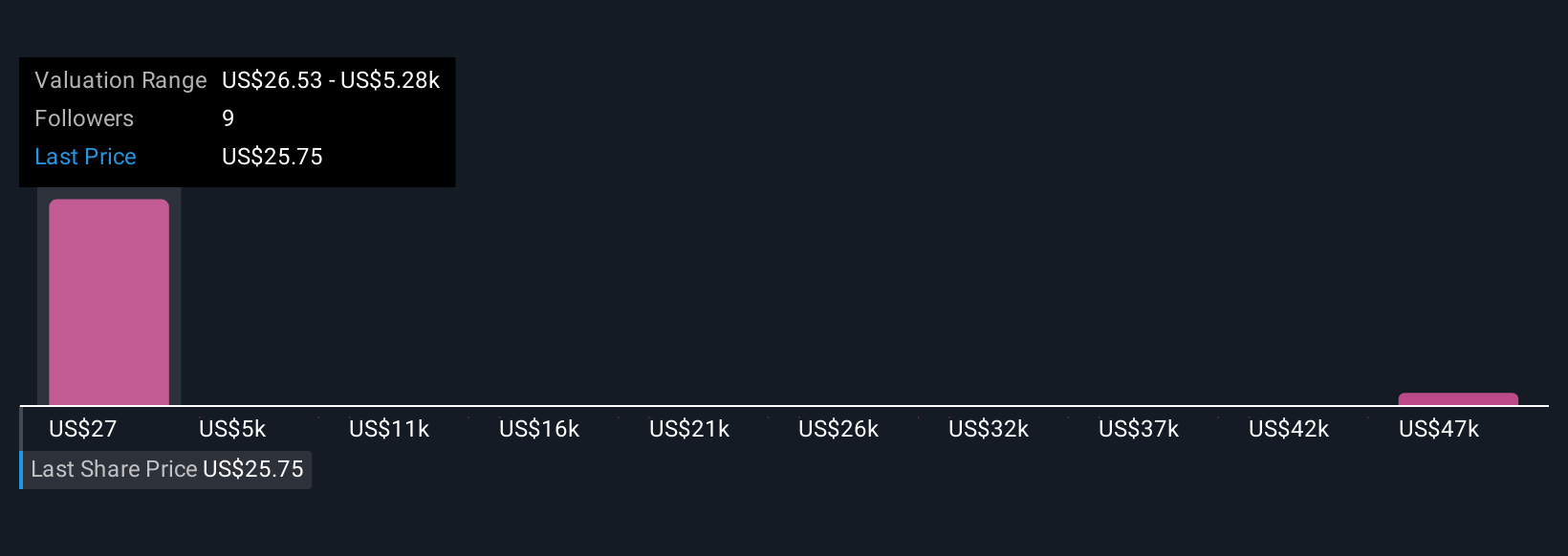

Four Simply Wall St Community members offered fair values for Cinemark ranging from US$26.53 to US$52,608.36. While many see growth in premium formats as a catalyst, others highlight sensitivity to film release cycles, underscoring why broader perspectives matter.

Explore 4 other fair value estimates on Cinemark Holdings - why the stock might be a potential multi-bagger!

Build Your Own Cinemark Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cinemark Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cinemark Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cinemark Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNK

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives