- United States

- /

- Media

- /

- NYSE:BOC

Further weakness as Boston Omaha (NYSE:BOC) drops 7.3% this week, taking one-year losses to 14%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Boston Omaha Corporation (NYSE:BOC) shareholders over the last year, as the share price declined 14%. That falls noticeably short of the market decline of around 4.6%. However, the longer term returns haven't been so bad, with the stock down 7.0% in the last three years. It's down 20% in about a month.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Boston Omaha

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Boston Omaha grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

Boston Omaha's revenue is actually up 25% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

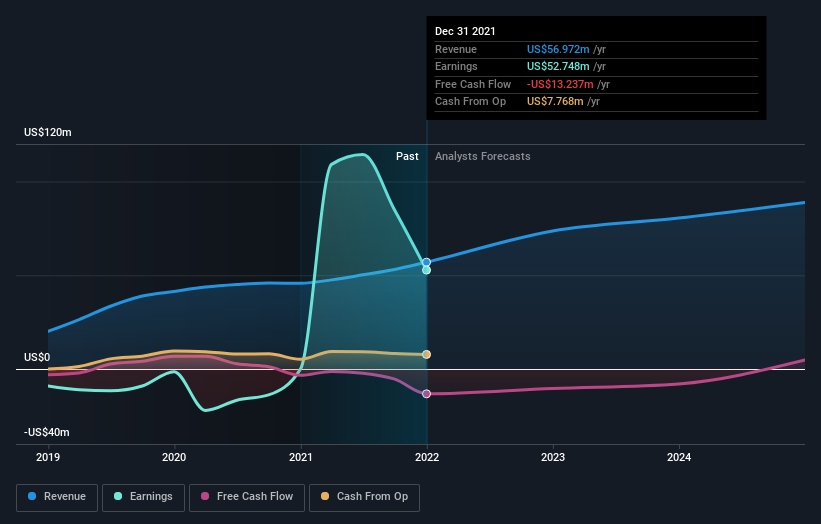

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Boston Omaha has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Boston Omaha stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Boston Omaha shareholders are down 14% for the year, falling short of the market return. The market shed around 4.6%, no doubt weighing on the stock price. Shareholders have lost 2.3% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Boston Omaha better, we need to consider many other factors. Even so, be aware that Boston Omaha is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Boston Omaha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BOC

Boston Omaha

Engages in the outdoor billboard advertising business in the southeast United States.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives