- United States

- /

- Media

- /

- NYSE:BOC

Boston Omaha Corporation's (NYSE:BOC) Earnings Haven't Escaped The Attention Of Investors

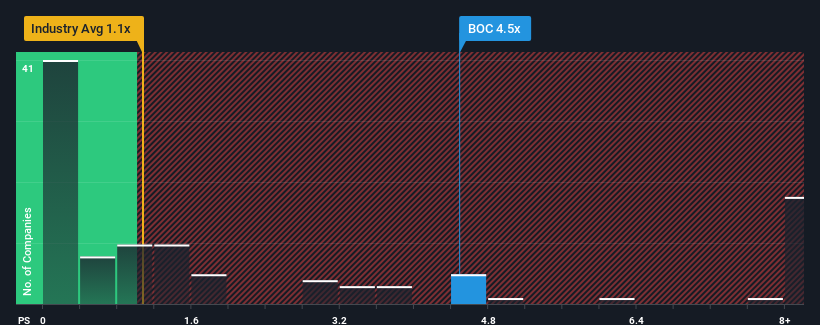

When close to half the companies in the Media industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, you may consider Boston Omaha Corporation (NYSE:BOC) as a stock to avoid entirely with its 4.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Boston Omaha

How Has Boston Omaha Performed Recently?

With revenue growth that's superior to most other companies of late, Boston Omaha has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Boston Omaha.How Is Boston Omaha's Revenue Growth Trending?

In order to justify its P/S ratio, Boston Omaha would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 108% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 8.7% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.4%, which is noticeably less attractive.

With this information, we can see why Boston Omaha is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Boston Omaha's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Boston Omaha that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Boston Omaha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOC

Boston Omaha

Engages in the outdoor billboard advertising business in the southeast United States.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives