- United States

- /

- Media

- /

- NYSE:ATUS

Altice USA, Inc. (NYSE:ATUS) Might Not Be As Mispriced As It Looks After Plunging 26%

The Altice USA, Inc. (NYSE:ATUS) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

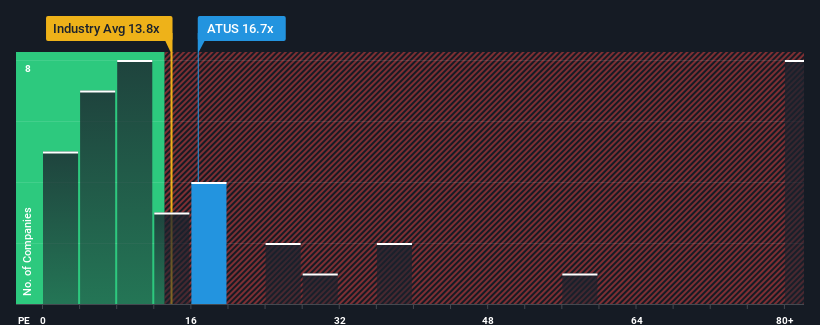

Even after such a large drop in price, there still wouldn't be many who think Altice USA's price-to-earnings (or "P/E") ratio of 16.7x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Altice USA has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Altice USA

How Is Altice USA's Growth Trending?

Altice USA's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 73%. This means it has also seen a slide in earnings over the longer-term as EPS is down 85% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 59% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's curious that Altice USA's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price falling into a hole, the P/E for Altice USA looks quite average now. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Altice USA's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Altice USA is showing 5 warning signs in our investment analysis, and 2 of those are a bit concerning.

You might be able to find a better investment than Altice USA. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ATUS

Altice USA

Provides broadband communications and video services under the Optimum brand in the United States, Canada, Puerto Rico, and the Virgin Islands.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives