- United States

- /

- Entertainment

- /

- NYSE:AMC

Is AMC (AMC) Using Franchise Events to Reinvent Its Premium Cinema Strategy?

Reviewed by Simply Wall St

- Warner Bros. Pictures announced that New Line Cinema’s "IT" returned to select AMC Dolby Cinema screens in the U.S. and internationally for a special one-night event, offering fans an exclusive preview of the upcoming HBO series "IT: Welcome to Derry."

- This collaboration leveraged both a globally recognized horror franchise and AMC’s premium cinema experiences to generate heightened audience engagement during a key moviegoing season.

- We’ll explore how the launch of AMC’s "Slash Pass" movie bundle and the strong performance of "The Conjuring: Last Rites" impact its investment thesis.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AMC Entertainment Holdings Investment Narrative Recap

To be a shareholder in AMC Entertainment Holdings today, you have to believe in a moviegoing recovery powered by differentiated, premium experiences that draw audiences despite ongoing shifts in entertainment habits. While the Warner Bros. and New Line Cinema "IT" Dolby Cinema event builds buzz and leverages exclusive content, it is unlikely to materially change the biggest short-term catalyst or risk: the industry’s struggle to regain pre-pandemic attendance levels and concerns over long-term box office stability.

The recent launch of the AMC "Slash Pass" stands out as particularly relevant, as it points to AMC's push to drive foot traffic and diversify revenue in partnership with major studio releases like "The Conjuring: Last Rites." Promotions like these support near-term attendance and provide valuable data on pricing flexibility, which may inform future efforts to strengthen the business relative to changing consumer preferences.

Yet, investors should be aware that despite upbeat attendance events and bundled movie passes, the contrast between attendance trends and ongoing capital expenditure needs could...

Read the full narrative on AMC Entertainment Holdings (it's free!)

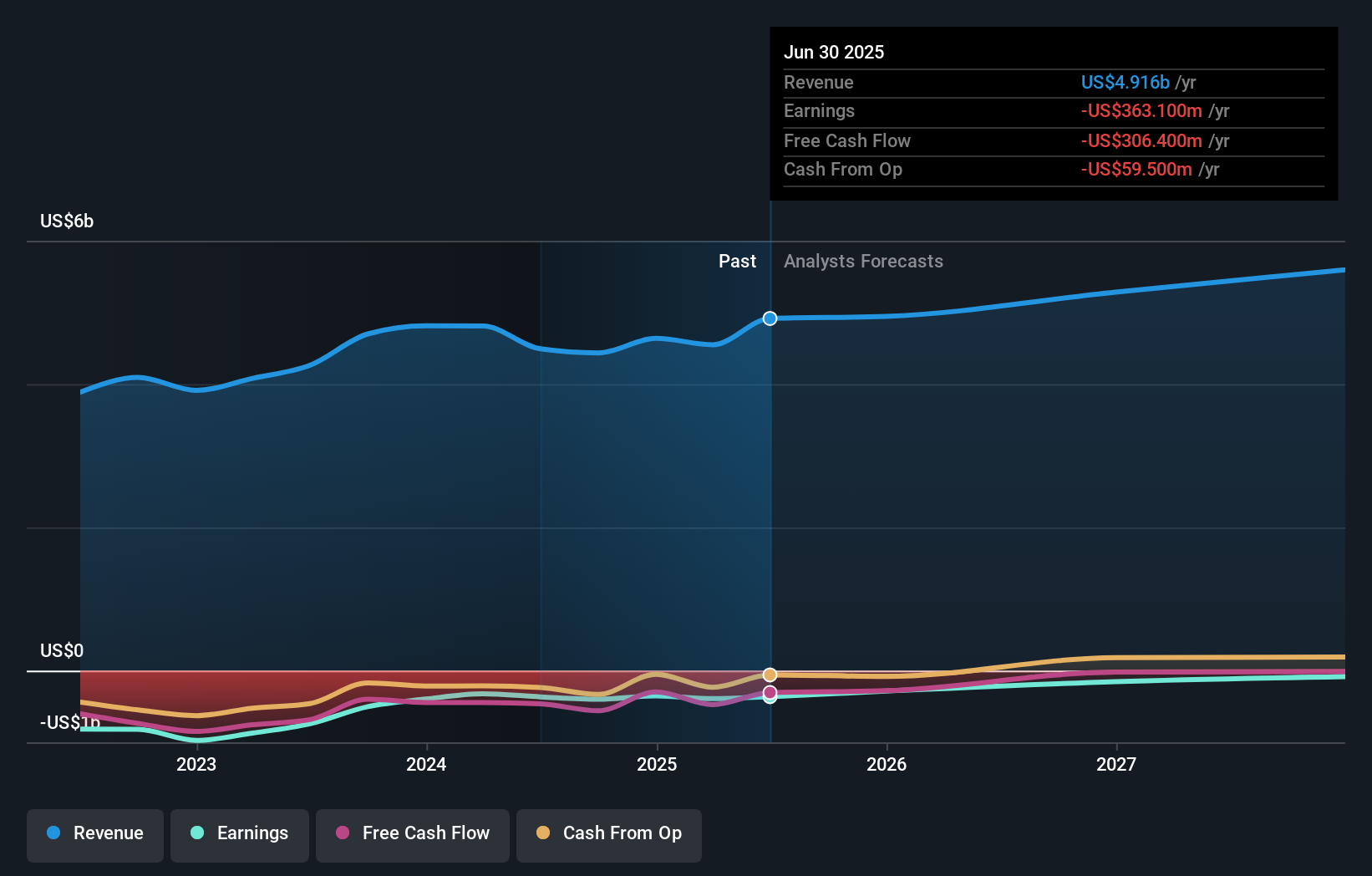

AMC Entertainment Holdings' forecast projects $5.7 billion in revenue and $541.4 million in earnings by 2028. This requires 5.3% annual revenue growth and an increase in earnings of $904.5 million from the current earnings of -$363.1 million.

Uncover how AMC Entertainment Holdings' forecasts yield a $3.34 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Six individual fair value estimates from the Simply Wall St Community range from US$1.01 to US$17.77 per share, reflecting a broad spectrum of expectations. As moviegoing recovery remains uncertain, you may want to explore these diverging viewpoints alongside the wider debate about long-term attendance risks.

Explore 6 other fair value estimates on AMC Entertainment Holdings - why the stock might be worth over 6x more than the current price!

Build Your Own AMC Entertainment Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMC Entertainment Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AMC Entertainment Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMC Entertainment Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMC

AMC Entertainment Holdings

Through its subsidiaries, engages in the theatrical exhibition business in the United States and Europe.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives