- United States

- /

- Entertainment

- /

- NYSE:AMC

AMC Entertainment (AMC) Is Up 5.9% After Eliminating $40 Million of Debt Without Issuing New Shares

Reviewed by Sasha Jovanovic

- AMC Entertainment Holdings announced in early October 2025 that it eliminated approximately US$40 million of Senior Secured Exchangeable Notes due 2030, with no new shares issued or cash used, as part of a July 2025 creditor agreement, bringing total debt reduction to US$183 million.

- This latest debt elimination aims to further strengthen AMC's balance sheet as the company positions itself to benefit from a recovering box office and upcoming film releases.

- We'll explore how AMC's latest debt reduction could alter its investment narrative by boosting financial flexibility and balance sheet strength.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

AMC Entertainment Holdings Investment Narrative Recap

To own shares of AMC Entertainment Holdings, investors need confidence in a full box office recovery and the company's ongoing ability to cut debt without diluting shareholders. The recent elimination of about US$40 million in Senior Secured Exchangeable Notes supports financial flexibility, but the most important short-term catalyst, upcoming blockbuster releases, and the key risk of structurally lower long-term theatrical attendance remain mostly unchanged by this news.

Among recent announcements, AMC's July 2025 debt refinancing and liability reductions stand out for improving balance sheet health and extending liquidity. These moves can help the company pursue high-impact content partnerships and premium experiences that might boost attendance if current trends hold.

In contrast, investors should remain aware that despite these achievements, AMC’s attendance is still well below pre-pandemic levels and...

Read the full narrative on AMC Entertainment Holdings (it's free!)

AMC Entertainment Holdings' outlook projects $5.7 billion in revenue and $541.4 million in earnings by 2028. This implies a 5.3% annual revenue growth and a $904.5 million increase in earnings from the current level of -$363.1 million.

Uncover how AMC Entertainment Holdings' forecasts yield a $3.34 fair value, a 9% upside to its current price.

Exploring Other Perspectives

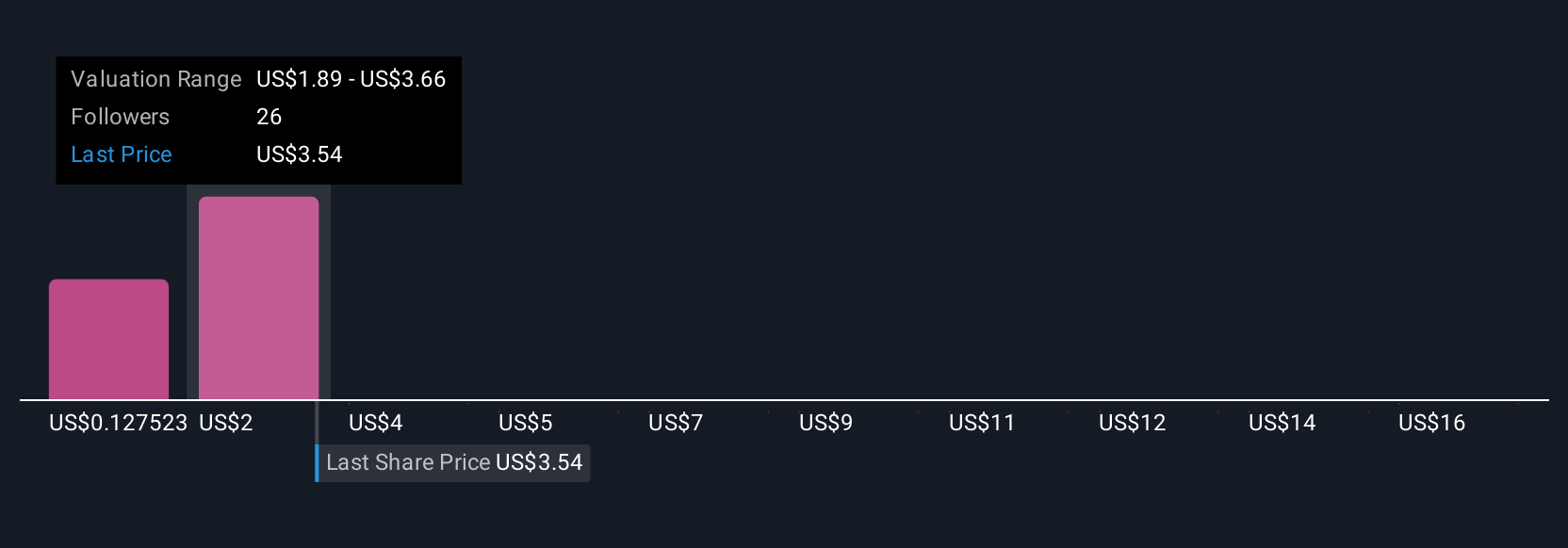

Six members of the Simply Wall St Community assessed AMC’s fair value between US$1.01 and US$17.77 per share. While investor optimism around debt reduction and premium offerings is visible, opinions often diverge, see how others approach the company’s evolving fundamentals.

Explore 6 other fair value estimates on AMC Entertainment Holdings - why the stock might be worth less than half the current price!

Build Your Own AMC Entertainment Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMC Entertainment Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AMC Entertainment Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMC Entertainment Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMC

AMC Entertainment Holdings

Through its subsidiaries, engages in the theatrical exhibition business in the United States and Europe.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives