- United States

- /

- Entertainment

- /

- OTCPK:YVRL.F

Did You Manage To Avoid Liquid Media Group's (NASDAQ:YVR) 47% Share Price Drop?

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Liquid Media Group Ltd. (NASDAQ:YVR) shareholders over the last year, as the share price declined 47%. That falls noticeably short of the market return of around 11%. Liquid Media Group may have better days ahead, of course; we've only looked at a one year period. More recently, the share price has dropped a further 39% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Liquid Media Group

With just CA$430,233 worth of revenue in twelve months, we don't think the market considers Liquid Media Group to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Liquid Media Group can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

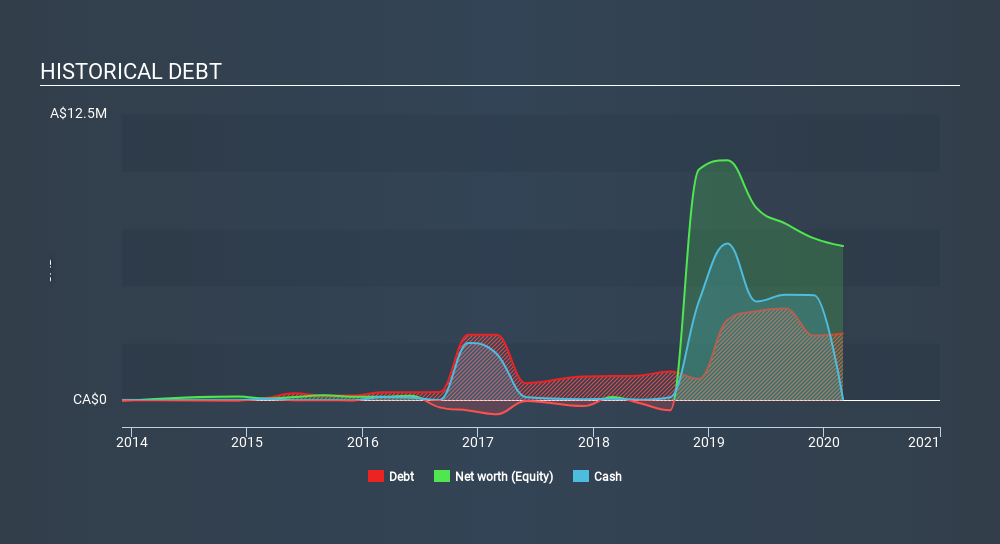

Liquid Media Group had liabilities exceeding cash by CA$8.2m when it last reported in February 2020, according to our data. That makes it extremely high risk, in our view. But since the share price has dived -47% in the last year , it looks like some investors think it's time to abandon ship, so to speak. The image below shows how Liquid Media Group's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While Liquid Media Group shareholders are down 47% for the year, the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 22% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 6 warning signs we've spotted with Liquid Media Group (including 4 which is don't sit too well with us) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OTCPK:YVRL.F

Liquid Media Group

Provides business solutions empowering independent TV and content creators to package, finance, deliver, and monetize their intellectual property worldwide.

Low risk with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026