- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

WEBTOON Entertainment (WBTN): Reassessing Valuation After Class Action Complaint Proceeds and Governance Scrutiny Rises

Reviewed by Simply Wall St

WEBTOON Entertainment (WBTN) is back in the spotlight after a U.S. District Court refused to dismiss a securities fraud class action, prompting a fresh shareholder investigation into its IPO era user metrics and disclosures.

See our latest analysis for WEBTOON Entertainment.

That backdrop helps explain why WEBTOON’s 1 year total shareholder return of 12.12 percent and year to date share price return of 5.52 percent look modest, with recent 30 day share price weakness suggesting investors are reassessing both growth prospects and legal risk.

If this kind of platform story has your attention, it could be worth scanning other high growth tech names and exploring high growth tech and AI stocks as potential next ideas.

With the share price sliding over the past month despite double digit revenue growth and a near 50 percent intrinsic value discount, is WEBTOON a misunderstood platform on sale, or is the market already discounting future upside?

Most Popular Narrative Narrative: 9.3% Undervalued

With WEBTOON Entertainment last closing at $14.34 against a narrative fair value of $15.81, the story hinges on how aggressively partnerships can reshape earnings power.

The company's increasing ability to adapt proven content IP across media (including originals produced in partnership with major franchises) leverages the rising value of IP and transmedia, driving high-margin ancillary revenues and supporting long-term earnings power.

Curious how a still unprofitable platform earns a premium style future multiple? The narrative leans on powerful top line compounding and a margin inflection that radically reshapes earnings. Want to see the specific growth curve and profitability step change baked into that fair value?

Result: Fair Value of $15.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing core user growth and uncertainty around the economics of the Disney and Warner Bros partnerships could quickly undermine that undervaluation thesis.

Find out about the key risks to this WEBTOON Entertainment narrative.

Another View: Market Ratios Push Back

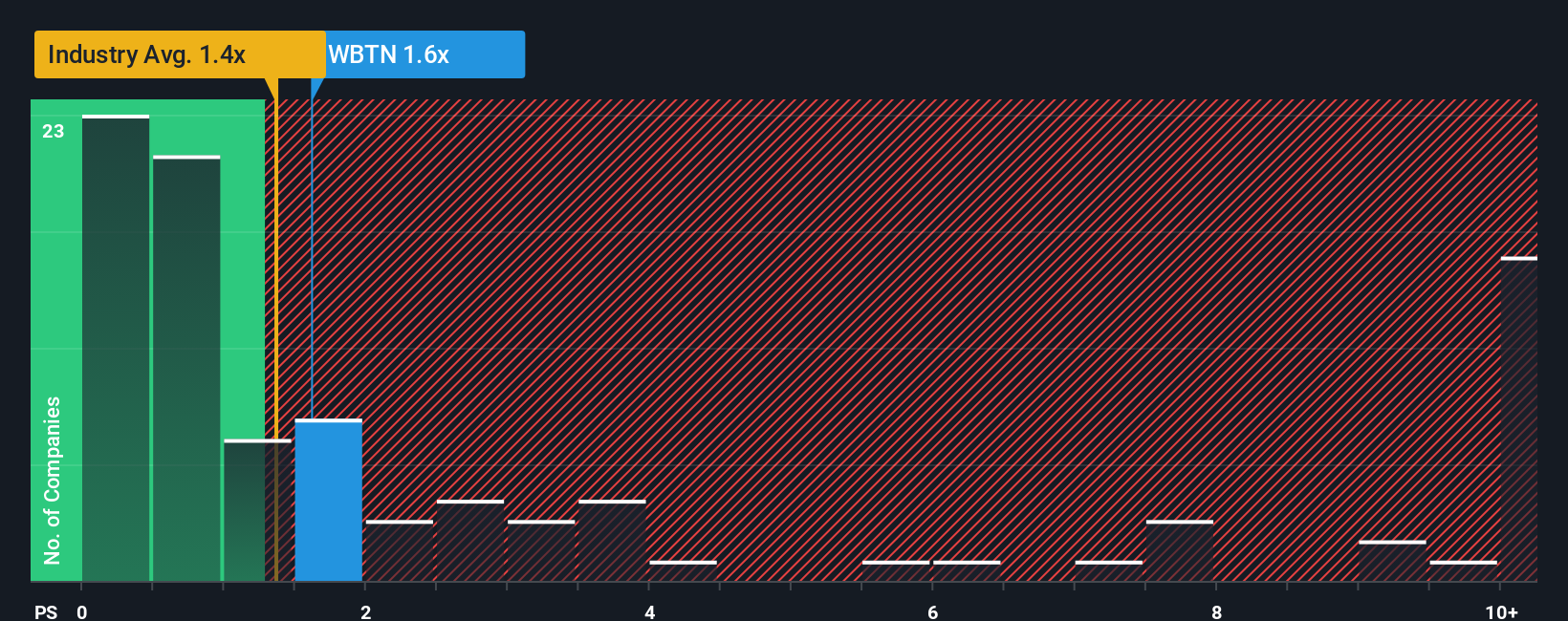

While narrative fair value paints WEBTOON as 9.3 percent undervalued, its 1.3 times price to sales ratio looks rich versus the industry at 1 times and a fair ratio of 1.2 times. That premium narrows the margin of safety, so the question is whether the upside is really as generous as it seems.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEBTOON Entertainment Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom thesis in minutes: Do it your way.

A great starting point for your WEBTOON Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single platform when you can quickly scan fresh opportunities that match your style and stay ahead of the next big move.

- Capture momentum in smaller names by targeting these 3571 penny stocks with strong financials that already pair low prices with solid financial underpinnings.

- Position for the next wave of innovation by locking onto these 26 AI penny stocks shaping everything from automation to intelligent infrastructure.

- Lock in potential mispricings by focusing on these 908 undervalued stocks based on cash flows that markets may be overlooking despite strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026