- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

Strong Revenue and Earnings Growth Might Change the Case for Investing in WEBTOON Entertainment (WBTN)

Reviewed by Sasha Jovanovic

- WEBTOON Entertainment recently reported strong annual revenue growth of 7.5%, alongside significant gains in earnings per share, and rising demand projections.

- An interesting insight is that this positive momentum contrasts with broader industry challenges, positioning WEBTOON as a standout performer in digital storytelling and content platforms.

- We'll take a look at how WEBTOON's revenue and earnings expansion adds support to its evolving investment narrative and growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WEBTOON Entertainment Investment Narrative Recap

To be a shareholder in WEBTOON Entertainment, you must believe in the potential for digital comics to capture a growing, global audience despite intensifying competition and shifting consumer habits. The recent revenue and earnings surge strengthens the bull case, but the biggest short term catalyst, expanding user growth through IP partnerships, faces the ongoing risk of contracting monthly active users, which, for now, is not materially offset by the latest results.

Among recent announcements, the multi-year platform collaboration with Disney is especially relevant. This deal brings a wave of fresh, beloved IP, Marvel, Star Wars, and more, onto the platform, aimed at driving new user signups and deeper engagement, which ties directly to the pressing need to reverse the observed MAU declines and reinforce the revenue growth story.

By contrast, it’s important for investors to keep in mind the risk that even marquee partners can’t fully offset persistent declines in core market user growth...

Read the full narrative on WEBTOON Entertainment (it's free!)

WEBTOON Entertainment's narrative projects $2.0 billion revenue and $30.0 million earnings by 2028. This requires 13.8% yearly revenue growth and a $130.1 million earnings increase from -$100.1 million.

Uncover how WEBTOON Entertainment's forecasts yield a $19.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

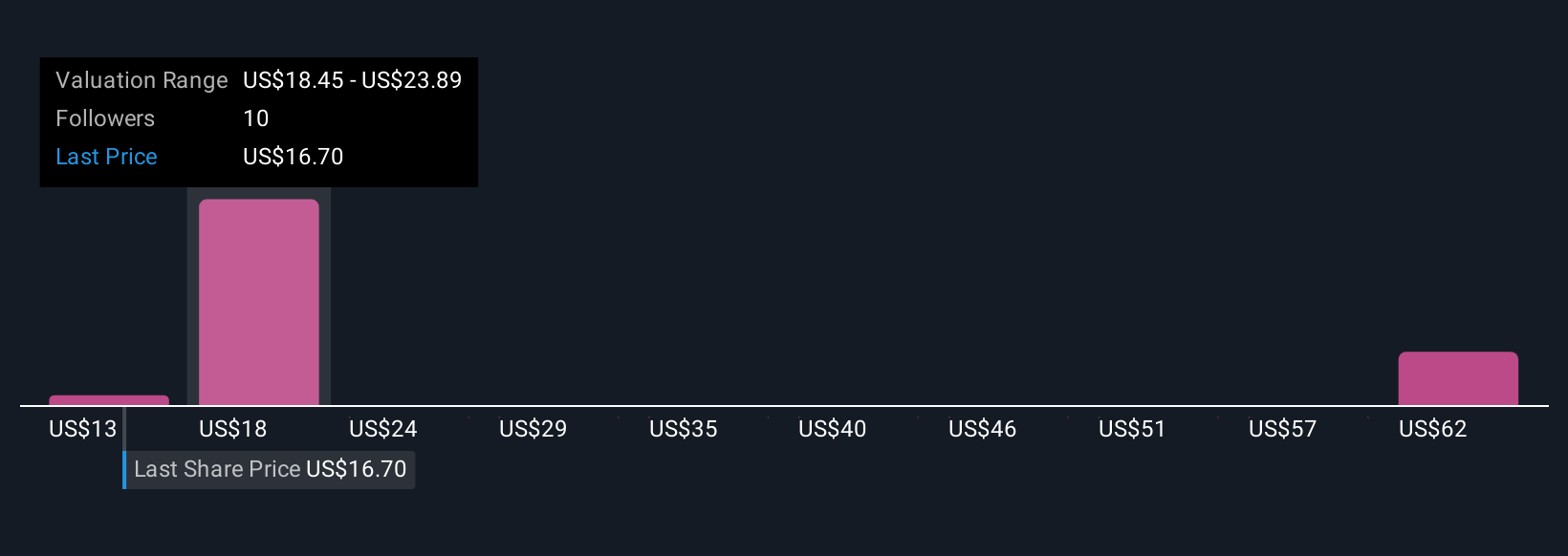

Simply Wall St Community members provided three fair value estimates, ranging from US$13 to US$67.20 per share. With user growth contraction risk still top of mind, your view on WEBTOON's future rests on which side of that spectrum you find most persuasive.

Explore 3 other fair value estimates on WEBTOON Entertainment - why the stock might be worth over 3x more than the current price!

Build Your Own WEBTOON Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEBTOON Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WEBTOON Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEBTOON Entertainment's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives