- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

Is WEBTOON Entertainment Set for Growth After 53% Annual Surge in Share Price?

Reviewed by Bailey Pemberton

If you have been watching WEBTOON Entertainment’s stock lately, you might be torn between excitement and curiosity. With shares closing at $18.05, this company has been catching the eye of investors looking for digital growth stories. The last week alone saw an 8.1% jump, bouncing back from a rougher patch that had the stock down 14.0% over the past month. Still, the bigger picture looks bright. The year-to-date climb is a solid 32.8%, and over the past year, WEBTOON Entertainment is up an eye-popping 53.7%. Moves like these often spark debates: is WEBTOON’s rally just getting started, or has the market already factored in the company’s future potential?

Some of this renewed momentum comes on the heels of broader optimism in digital media and storytelling platforms. Investors have started to see WEBTOON as more than just a niche player, possibly reevaluating the risk and growth profile of the business. But valuation is where things get more interesting. On our six-point valuation check, WEBTOON scores a 3, meaning it is undervalued in exactly half of the key measures we use. That is notable, suggesting there might be overlooked value here. Up next, we will walk through each valuation approach in detail, and, by the end, share a perspective that goes beyond just the numbers for a fuller picture of what WEBTOON’s stock could really be worth.

Approach 1: WEBTOON Entertainment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects WEBTOON Entertainment’s future cash flows and then discounts those figures back to their value today. This approach is often favored for high-growth digital businesses because it specifically looks beyond current profits, focusing on what a company can generate in the years to come.

Currently, WEBTOON Entertainment’s Free Cash Flow (FCF) sits at negative $35.1 million, highlighting the heavy investment phase it is in. However, projections suggest the company will turn a corner quickly and move to $76 million in FCF by 2027. While analyst coverage thins beyond the 5-year mark, Simply Wall St extrapolates robust growth ahead. The model sees FCF rising to nearly $678 million by 2035 as WEBTOON expands its digital reach and monetization opportunities.

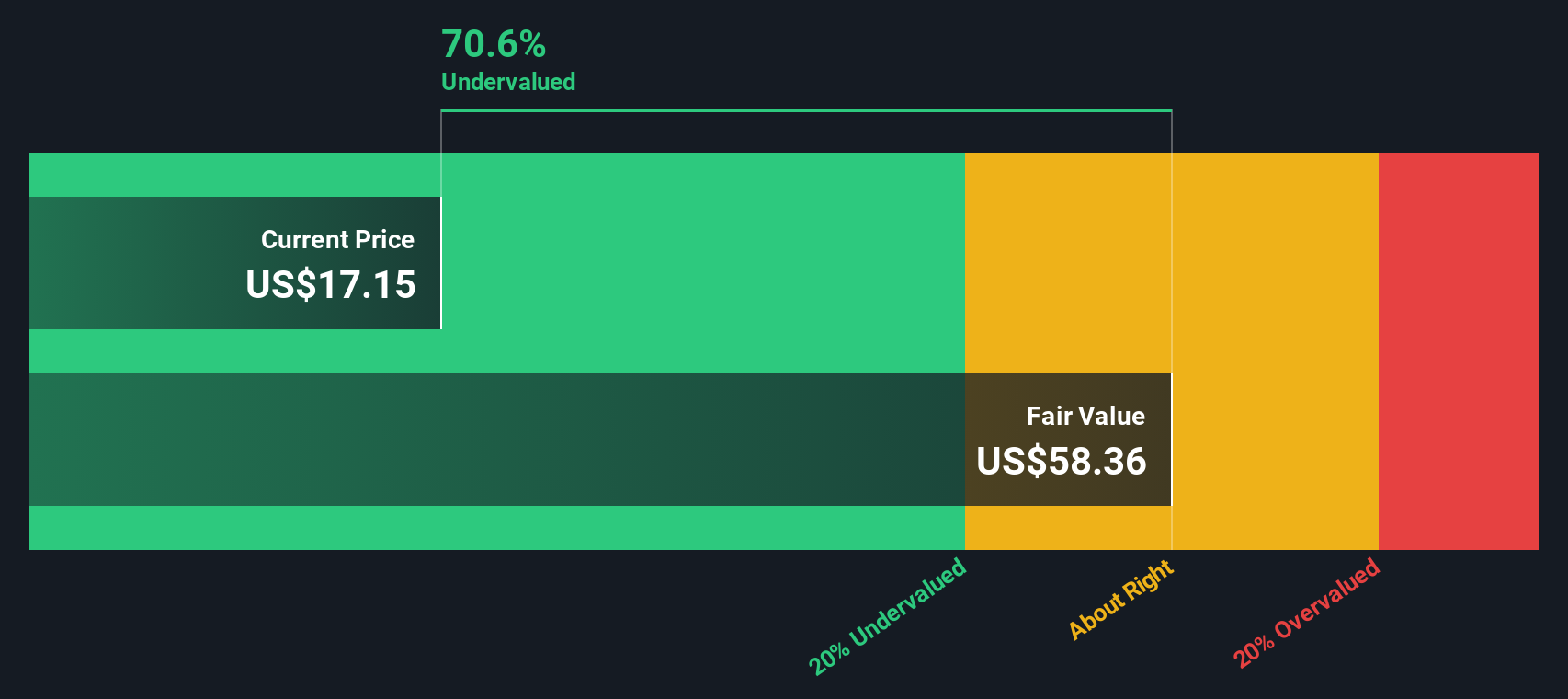

When all these projected cash flows are discounted back to present value, the DCF model puts the fair value of WEBTOON shares at $67.31 each. Compared to the recent share price of $18.05, this implies the stock is trading at a steep 73.2% discount. In plain terms, the model suggests the market may be seriously underestimating the long-term cash-generating ability of WEBTOON Entertainment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests WEBTOON Entertainment is undervalued by 73.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: WEBTOON Entertainment Price vs Sales

The Price-to-Sales (P/S) ratio is a popular way to value digital and growth-oriented companies, especially those that are not yet consistently profitable. For businesses like WEBTOON Entertainment, which are still investing heavily for future growth, sales offer a clearer lens than profits, as earnings can be temporarily skewed by upfront costs or strategic investments.

Growth expectations and business risk also come into play with any valuation multiple. Typically, higher growth rates can justify a higher P/S ratio, as investors expect future revenues to accelerate and eventually convert to sustained profits. Conversely, higher risk or stiff competition would warrant a lower multiple, as future performance is less certain.

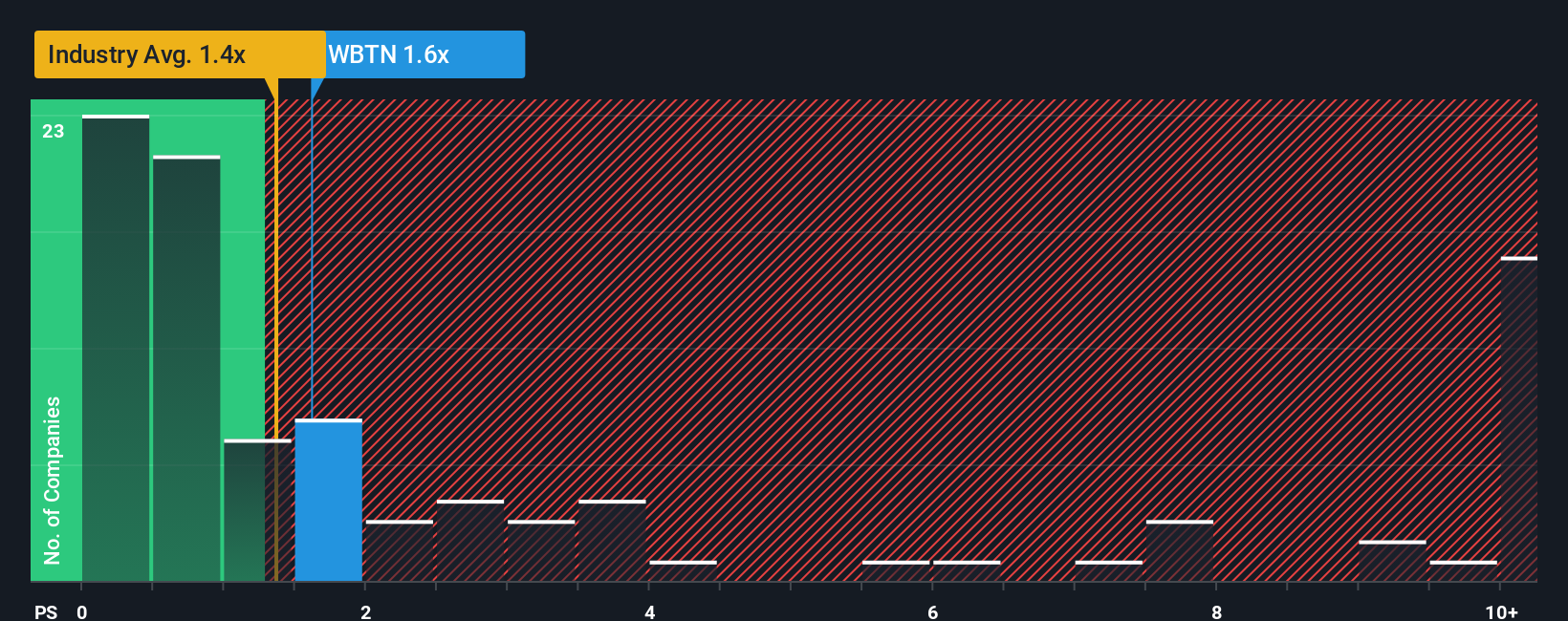

WEBTOON’s current P/S ratio stands at 1.71x. This is just above the Interactive Media and Services industry average of 1.39x, but significantly below the peer group average of 7.89x. Simply Wall St’s proprietary “Fair Ratio” for WEBTOON, which is tailored to the company’s specific growth prospects, margins, risks, and market segment, comes in at 1.46x. Unlike a simple comparison with industry or peers, the Fair Ratio combines multiple factors to estimate what would be reasonable for a company with WEBTOON’s characteristics.

The upshot, then, is that with a P/S ratio of 1.71x compared to its Fair Ratio of 1.46x, WEBTOON Entertainment appears to be valued somewhat above fair value, though not excessively so.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your WEBTOON Entertainment Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you connect your view of a company's story, including its business drivers, growth opportunities, or risks, with specific financial estimates for revenue, earnings, margins, and ultimately, what you believe is a fair value. Narratives take you beyond spreadsheets by letting you capture why you believe WEBTOON Entertainment will succeed or face challenges, then see how those beliefs translate into numbers and investment decisions.

On Simply Wall St's platform, Narratives are instantly accessible within the Community page and used by millions to cut through the noise, compare perspectives, and go well beyond standard ratios. A key benefit is that Narratives update automatically whenever new information, news, or earnings are released, so your analysis stays relevant. Plus, by comparing your Fair Value from your Narrative to the current price, you have a clear signal for timing your investment decisions.

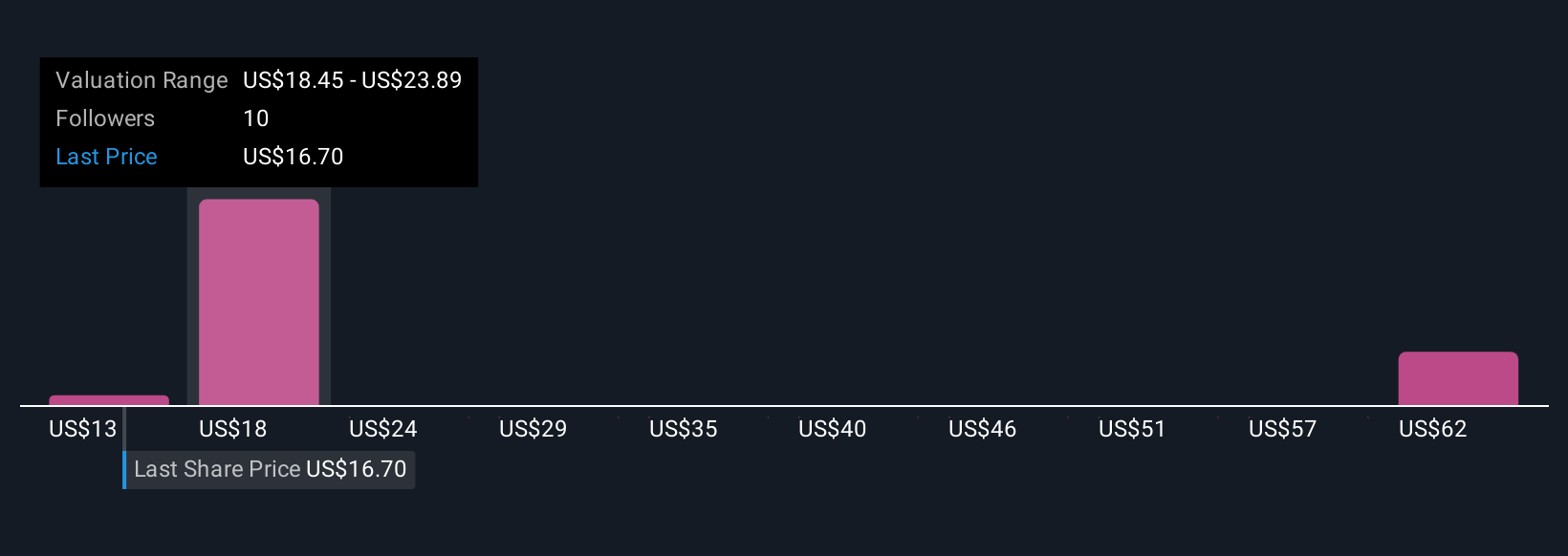

For example, with WEBTOON Entertainment, some investors may build a Narrative expecting $2.0 billion in revenue and $30 million in earnings by 2028 (supporting the average price target of $15.33), while others hold a much more bullish or bearish view, aiming as high as $23.00 or as low as $11.00 per share. How the story plays out, and what you believe, is now part of your investment process.

Do you think there's more to the story for WEBTOON Entertainment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives