- United States

- /

- Entertainment

- /

- NasdaqGS:WBD

Warner Bros. Discovery (NasdaqGS:WBD) Reports Lower Q1 Revenue But Reduces Net Loss

Reviewed by Simply Wall St

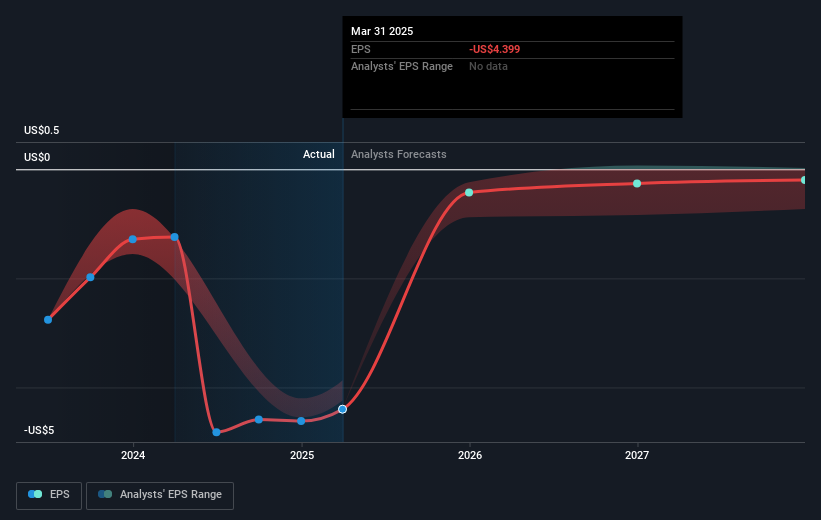

Warner Bros. Discovery (NasdaqGS:WBD) recently reported a decline in revenue for Q1 2025, along with an improved net loss. Despite the drop in revenue to USD 8,979 million from USD 9,958 million a year ago, the company's share price saw a 6% increase over the past month. This movement may have been supported by the broader market rally, as significant developments such as the U.S.-U.K. trade deal spurred a sense of optimism across global markets. Additionally, the announcement of Dr. John C. Malone's transition to Chair Emeritus might have also provided strategic reassurance to investors.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments at Warner Bros. Discovery, including revenue decline and leadership transition, could influence the company's strategic focus on international expansion and integration of sports and news. Over the past year, the company's shares have seen a total return of 9.74%, suggesting resilience amid challenges. However, when compared to the US entertainment industry, which returned a substantial 53.2% over the same period, the company's performance might appear subdued.

The recent price increase of 6% could indicate investor confidence in the company's efforts to boost subscriber engagement and direct-to-consumer revenue through initiatives like streaming expansion. Despite these positive moves, the share price is still traded at a 36.1% discount to the analyst consensus price target of US$13.19, indicating room for potential upward movement if the company achieves its forecasted revenue and earnings goals. The expected international expansion and corporate restructuring may gradually improve revenue and stabilize earnings, but challenges such as ad sales decline and ARPU pressures remain risks that could impact these forecasts. As such, investors might want to closely monitor these strategic efforts to gauge their success in enhancing shareholder value.

Evaluate Warner Bros. Discovery's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Warner Bros. Discovery, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Warner Bros. Discovery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBD

Warner Bros. Discovery

Operates as a media and entertainment company worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives