- United States

- /

- Entertainment

- /

- NasdaqCM:VS

Shareholders Will Probably Hold Off On Increasing Versus Systems Inc.'s (NASDAQ:VS) CEO Compensation For The Time Being

Key Insights

- Versus Systems will host its Annual General Meeting on 30th of May

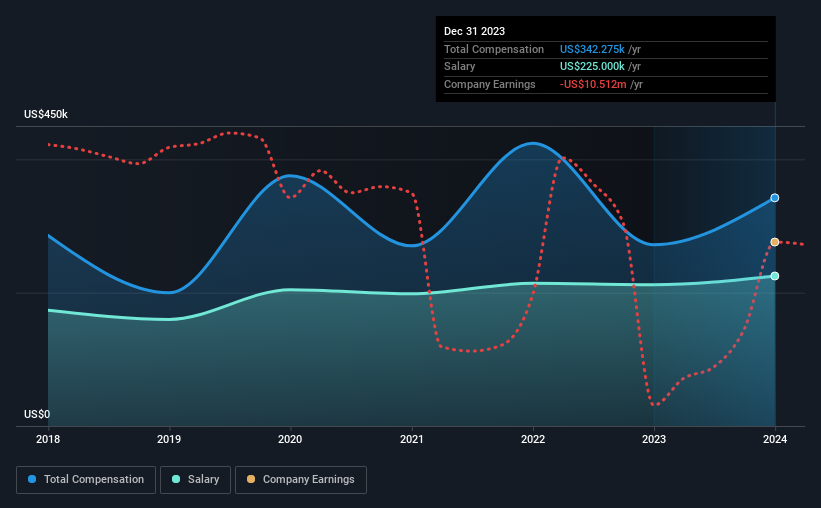

- CEO Matthew Pierce's total compensation includes salary of US$225.0k

- The overall pay is comparable to the industry average

- Versus Systems' three-year loss to shareholders was 100% while its EPS grew by 81% over the past three years

In the past three years, the share price of Versus Systems Inc. (NASDAQ:VS) has struggled to grow and now shareholders are sitting on a loss. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 30th of May. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Versus Systems

Comparing Versus Systems Inc.'s CEO Compensation With The Industry

At the time of writing, our data shows that Versus Systems Inc. has a market capitalization of US$3.6m, and reported total annual CEO compensation of US$342k for the year to December 2023. We note that's an increase of 26% above last year. Notably, the salary which is US$225.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the American Entertainment industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$321k. This suggests that Versus Systems remunerates its CEO largely in line with the industry average.

On an industry level, around 20% of total compensation represents salary and 80% is other remuneration. Versus Systems is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Versus Systems Inc.'s Growth

Over the past three years, Versus Systems Inc. has seen its earnings per share (EPS) grow by 81% per year. In the last year, its revenue is down 85%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Versus Systems Inc. Been A Good Investment?

With a total shareholder return of -100% over three years, Versus Systems Inc. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 5 warning signs for Versus Systems that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VS

Versus Systems

Provides a business-to-business software platform to drive user engagement through gamification and rewards.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

30 Baggers Silver Miner with Gold/VTM Optionality

13x Aussie Polymetal Silver/Zinc/Lead Project

Valuation Analysis of Palantir Technologies: Growth Assumptions and Market Expectations

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks