- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:VMEO

Vimeo (VMEO): Taking a Fresh Look at Valuation After Recent 86% Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Vimeo.

Vimeo’s recent 86% surge stands out against a backdrop of cautious moves earlier in the year, with the stock now trading at $7.77. Short-term share price momentum has picked up, and the one-year total shareholder return sits just above break-even. This suggests sentiment could be turning in the company’s favor.

If you’re on the lookout for the next wave of standout performers, consider broadening your search and uncovering opportunities with fast growing stocks with high insider ownership.

With shares on a tear and recent fundamentals trending upward, the big question now is whether Vimeo is truly undervalued or if recent gains reflect all the optimism about its future. Is there still room for upside, or has the market already priced in the company’s next chapter?

Most Popular Narrative: 7% Overvalued

Vimeo’s last close at $7.77 stands slightly above the most widely followed fair value estimate of $7.23. This implies the share price is running ahead of the narrative’s underlying forecasts. The valuation narrative pivots on new technology adoption and the prospect of improved profit margins, providing a glimpse into what could justify recent optimism.

Ongoing advancements and rollout of AI-powered video features, such as Agentic AI, AI translations, and enhanced natural language search, are driving higher-value enterprise deals and increasing customer adoption of premium features. This is likely to lift ARPU and support top-line revenue growth.

Want to unlock the numbers fueling that premium? The core of this narrative hinges on an aggressive profit margin boost, a bet on tech transformation, and ambitious enterprise expansion. Curious what bold projections underpin that higher valuation? Dive in to uncover the exact drivers and see why the narrative’s forecast is so bullish.

Result: Fair Value of $7.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued self-serve subscriber declines and competitive pricing pressures remain key risks that could limit Vimeo’s margin gains and growth momentum.

Find out about the key risks to this Vimeo narrative.

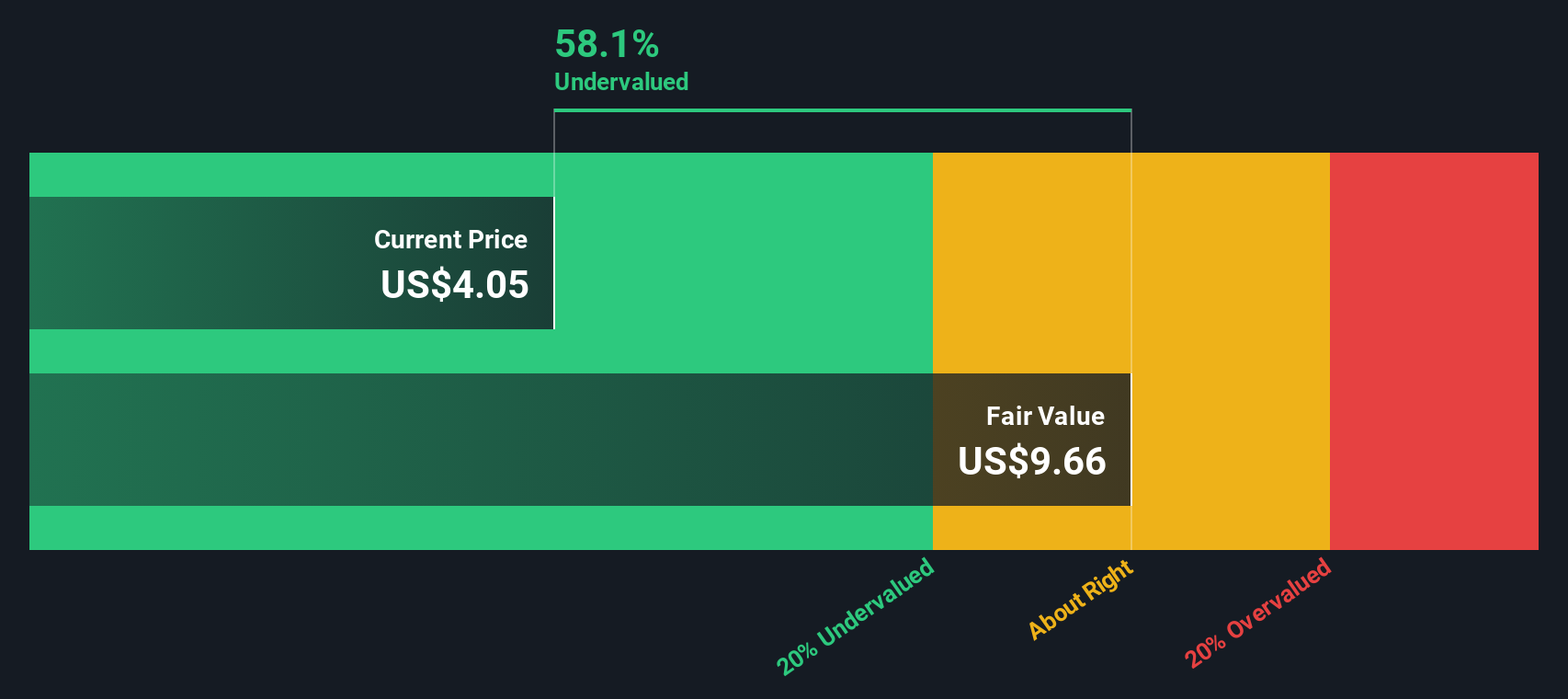

Another View: Our DCF Model Says Undervalued

While the consensus narrative and analyst targets suggest Vimeo may be overvalued at current prices, the Simply Wall St DCF model comes to a different conclusion. DCF analysis points to a fair value of $10.49 per share, well above the current market price. This suggests there may be untapped upside for patient investors. Is the market overlooking long-term cash flow potential, or does it see risks that models miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vimeo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vimeo Narrative

If you see the story playing out differently or want to dig into the details yourself, you can easily craft your own narrative in just minutes: Do it your way.

A great starting point for your Vimeo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

The smart move is to broaden your search now. There are market opportunities waiting if you know where to look. Don’t let great investments pass you by while others get ahead. Use these shortcuts to start your hunt today:

- Pinpoint high-potential companies making waves in artificial intelligence by tapping into these 24 AI penny stocks and see who’s accelerating innovation across the sector.

- Uncover resilient businesses offering consistently strong dividend yields with these 19 dividend stocks with yields > 3% if you want to build a stable income stream as markets shift.

- Get ahead of undervalued gems hiding in plain sight by checking out these 896 undervalued stocks based on cash flows and seize better value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VMEO

Vimeo

Provides video software solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives