- United States

- /

- Entertainment

- /

- NasdaqGM:MYPS

Undervalued Opportunities: PLAYSTUDIOS And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

The United States market has remained flat over the past week, but it has seen a 13% increase over the past year, with earnings projected to grow by 14% annually. In such a climate, identifying promising stocks involves seeking out companies with strong financials and growth potential. Penny stocks, though an outdated term, still refer to smaller or emerging companies that can offer significant value; this article highlights several penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.80 | $184.35M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.04 | $171.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.51 | $55.27M | ✅ 1 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.98 | $372.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.03 | $96.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.91 | $23.78M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.82 | $6.07M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.53 | $70.6M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.9098 | $32.33M | ✅ 4 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.12 | $34.44M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 725 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

PLAYSTUDIOS (NasdaqGM:MYPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PLAYSTUDIOS, Inc. develops and publishes free-to-play casual games for mobile and social platforms both in the United States and internationally, with a market cap of $169.96 million.

Operations: The company generates its revenue primarily from its Playgames segment, which accounted for $274.09 million.

Market Cap: $169.96M

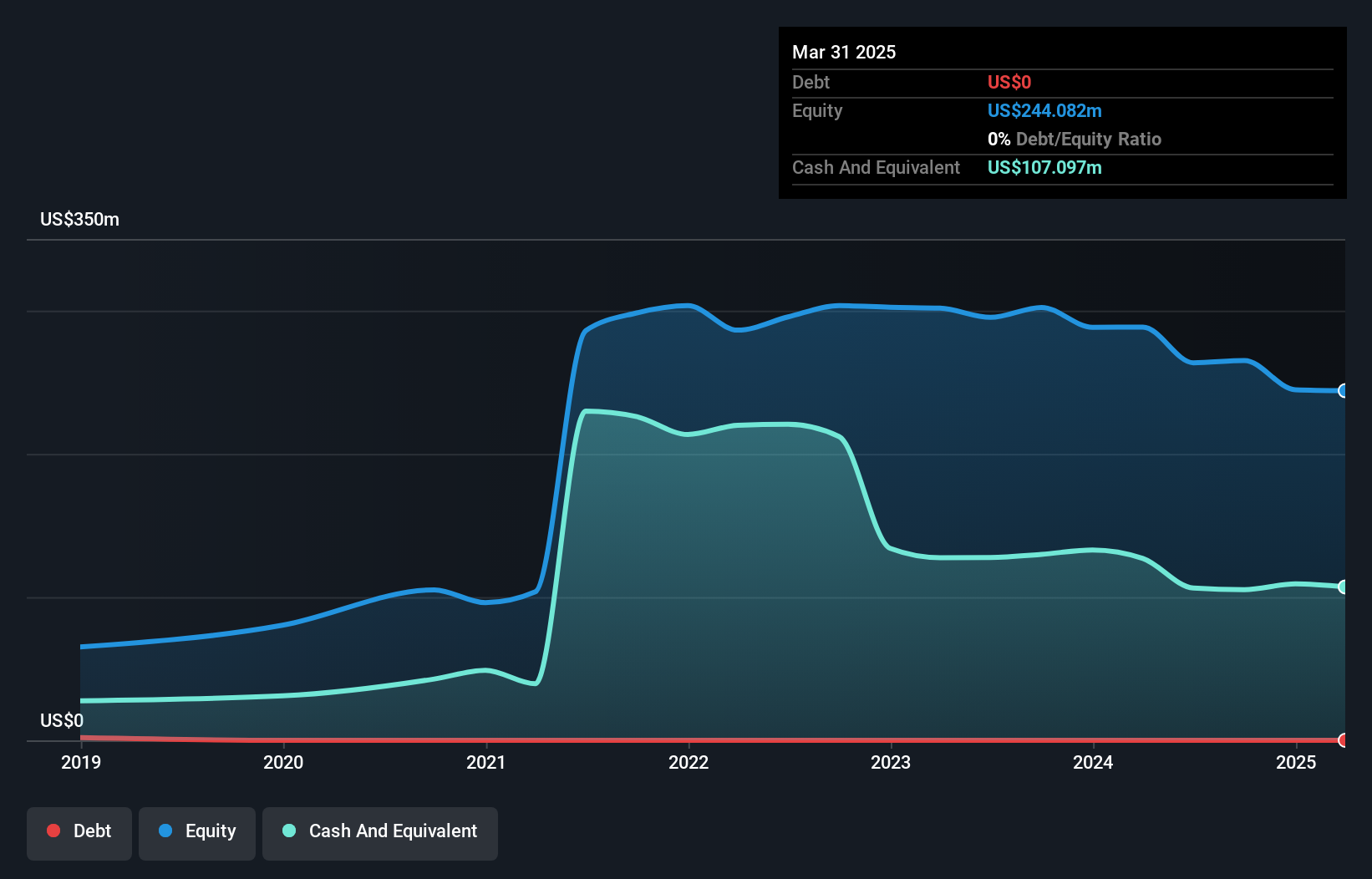

PLAYSTUDIOS, Inc., with a market cap of US$169.96 million, has seen its revenue from the Playgames segment reach US$274.09 million. Despite being unprofitable, it maintains a strong cash runway for over three years due to positive free cash flow and no debt burden. The company's recent share buyback program has reduced outstanding shares by 6.34%, potentially enhancing shareholder value. However, earnings have declined year-over-year with a net loss of US$2.88 million in Q1 2025 compared to the previous year, while maintaining revenue guidance between US$250 million and US$270 million for 2025 amidst challenges in profitability growth.

- Get an in-depth perspective on PLAYSTUDIOS' performance by reading our balance sheet health report here.

- Learn about PLAYSTUDIOS' future growth trajectory here.

Vimeo (NasdaqGS:VMEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vimeo, Inc., along with its subsidiaries, offers video software solutions both in the United States and internationally, with a market cap of approximately $723.23 million.

Operations: The company generates revenue of $415.13 million from its Internet Software & Services segment.

Market Cap: $723.23M

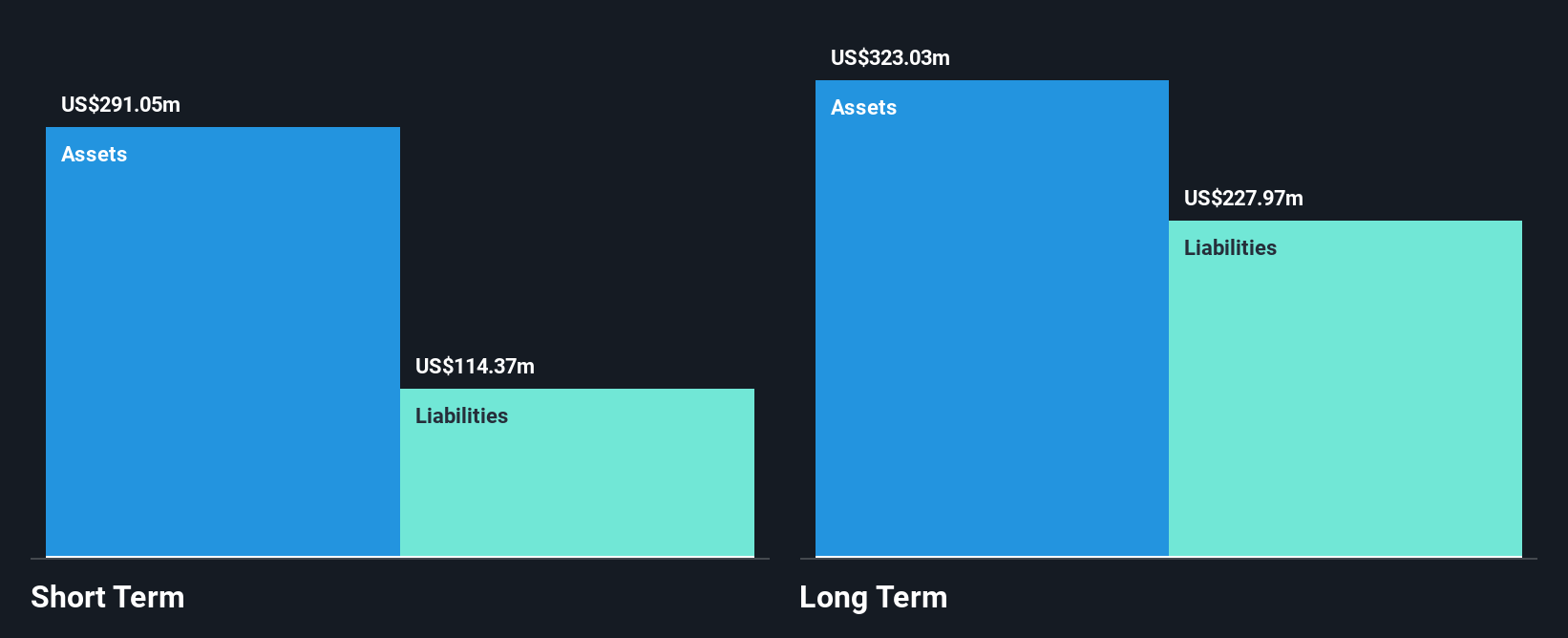

Vimeo, Inc., with a market cap of US$723.23 million, reported Q1 2025 sales of US$103.03 million and a net loss of US$3.92 million, reflecting a decline from last year's profit. Despite this setback, the company is debt-free and its short-term assets significantly exceed both short and long-term liabilities, indicating financial stability. The recent launch of Vimeo Streaming offers creators enhanced monetization tools and advanced analytics to scale globally—potentially unlocking new revenue streams amid challenges in earnings growth. However, management's brief tenure suggests an evolving leadership team navigating these strategic shifts.

- Click here and access our complete financial health analysis report to understand the dynamics of Vimeo.

- Gain insights into Vimeo's future direction by reviewing our growth report.

TETRA Technologies (NYSE:TTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc., along with its subsidiaries, is an energy services and solutions company with a market cap of $372.60 million.

Operations: The company's revenue is derived from two main segments: Water & Flowback Services, which generated $278.24 million, and Completion Fluids & Products, contributing $327.04 million.

Market Cap: $372.6M

TETRA Technologies, Inc., with a market cap of US$372.60 million, has shown significant earnings growth, reporting Q1 2025 revenue of US$157.14 million and net income of US$4.05 million. The company is actively expanding its Evergreen Unit to enhance bromine and lithium production, supported by encouraging test well results indicating rich mineral volumes. However, TETRA's interest payments are not well covered by EBIT, reflecting some financial strain despite reduced debt levels over the past five years. The recent filing for a $400 million shelf registration suggests potential capital raising efforts to support ongoing projects and strategic initiatives in mineral extraction and water management solutions.

- Unlock comprehensive insights into our analysis of TETRA Technologies stock in this financial health report.

- Understand TETRA Technologies' earnings outlook by examining our growth report.

Next Steps

- Unlock more gems! Our US Penny Stocks screener has unearthed 722 more companies for you to explore.Click here to unveil our expertly curated list of 725 US Penny Stocks.

- Ready To Venture Into Other Investment Styles? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MYPS

PLAYSTUDIOS

Develops and publishes free-to-play casual games for mobile and social platforms in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives