- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

With the Zynga (NasdaqGS:ZNGA) Acquisition, Take-Two Interactive (NASDAQ:TTWO) is Looking for a Turnaround

After the first week of 2022, the keyword appears to be synergy. New multi-billion M&A deals are popping around, meeting the mixed reactions from investors.

The latest in line is Take-Two Interactive Software, Inc. (NASDAQ: TTWO), which lost 13% in a single session after it announced an acquisition of Zynga.

Check out our latest analysis for Take-Two Interactive Software

Latest Developments

It is no secret that the global video game market has an optimistic future, growing at 10.5% annually. Still, launch delays made the Take-Two shareholders impatient, as the stock drifted downwards for most of the year.

Now the company is looking for a turnaround, and by acquiring Zynga, they will take a serious step into mobile gaming. Yet, the deal is not without its critics. Since these companies produce games with somewhat different target audiences, naturally, the users are afraid about negative impacts on product quality that could leave both sides dissatisfied.

So far, the deal is worth around US$11b, as Zynga shareholders will receive US$3.50 in cash and US$6.36 in stock. The deal is expected to close by June 30, 2022.

Reminiscences of the Late Bull Market Operator

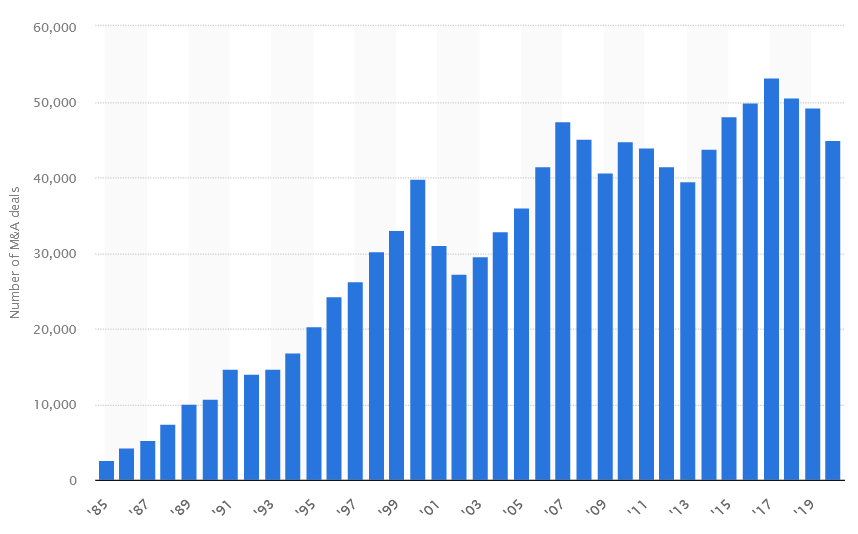

Elevated M&A activity is a characteristic of the late stages of the bull market. Although the following chart has no data for 2021, the volume of deals in 2021 breached US$5tn for the first time, accounting for 62,193 deals. An increase of 24%, although we have to account that 2020 was an outlier in many ways.

Previous record years include 2000 and 2007, at the peak of those bull runs. Despite the looming interest rate hikes that could increase the borrowing costs, investment bankers expect the trend to continue.

What's the opportunity in Take-Two Interactive Software?

According to our price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justified.

The stock's ratio of 27.73x is currently trading slightly below its industry peers' ratio of 29.83x, which means if you buy Take-Two Interactive Software today, you'd be paying a reasonable price for it. And if you believe Take-Two Interactive Software should be trading in this range, then there isn't much room for the share price to grow beyond the levels of other industry peers over the long term.

In addition to this, it seems like Take-Two Interactive Software's share price is relatively stable, which could mean there may be fewer chances to buy low in the future now that it's trading around the price multiples of other industry peers. This is because the stock is less volatile than the broader market, given its low beta.

What kind of growth will Take-Two Interactive Software generate?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

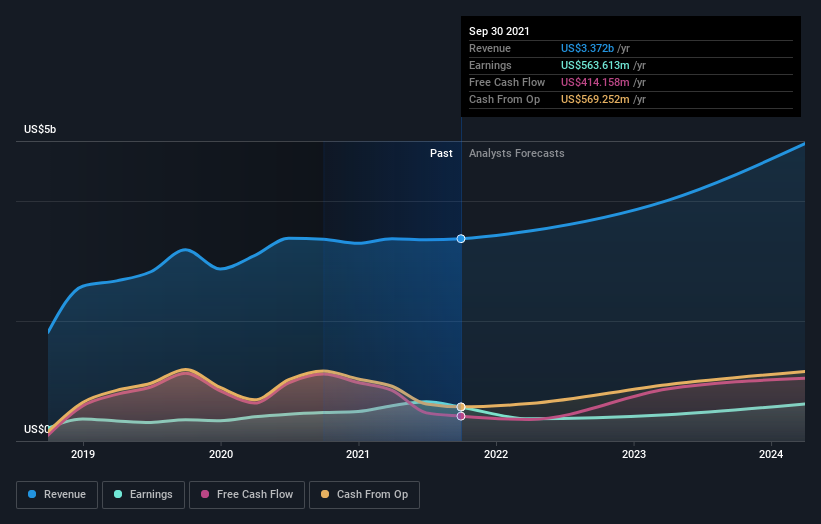

Take-Two Interactive Software's earnings growth is expected to be in the teens in the upcoming years, indicating a solid future ahead. This should lead to robust cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? While the shares are trading around average industry multiples, there might be other important factors that we haven't considered today, such as the company's financial strength. Have these factors changed since the last time you looked at TTWO? Should the price fluctuate below the industry PE ratio, will you have enough conviction to buy?

Are you a potential investor? If you've been keeping an eye on TTWO, you might rethink your investment thesis after the latest news. However, the optimistic forecast is encouraging for TTWO, which means it's worth diving deeper into other factors such as the strength of its balance sheet to take advantage of the next price drop.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. While conducting our analysis, we found that Take-Two Interactive Software has 2 warning signs, and it would be unwise to ignore these.

If you are no longer interested in Take-Two Interactive Software, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion