- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two's (NASDAQ:TTWO) Returns On Capital Make Us Question Its Short-Term Potential

- The company delivered a surprising earnings miss

- Zynga acquisition is yet to provide value

- Institutions are taking a contrarian stance

Although most agree that the equity correction started only at the beginning of this year, for Take-Two Interactive Software, Inc. (NASDAQ: TTWO), it started as early as Q1 2021.

Gaming stocks can be highly cyclical, depending on internal factors like the product pipeline or external ones like the console lifecycle. With missing earnings, more decline could be on the way for the stock that has already lost over 40% from its peak.

View our latest analysis for Take-Two Interactive Software

Take-Two Quarterly Earnings Results

- GAAP EPS: -US$0.76 (miss by US$1.61)

- Revenue: US$1.1b (miss by $10m)

- Results include Zynga for 39 days of the quarter (integration completed on May 23)

Other highlights and guidelines for FY ending March 2023

- GAAP net revenue: in the range of US$5.73b to US$5.83b vs. US$6.4b consensus

- GAAP net loss: US$398-438m

- Capex: US$135m

The higher cost of living seemed to reflect on consumers cutting their entertainment expenses, as Y/Y consumer video game spending retraced by 13%. Furthermore, hardware sales dipped by 1%, accessories by 11%, and content expenditure fell by 13%.

While institutional opinions are mixed, overall sentiment is positive. Analysts are waiting for the post-acquisition (Zynga) dust to settle, to see how the company handles this new environment. This is an interesting stance since the return on the capital seems relatively low - below the current inflation point.

- Jeffries: Buy Rating and US$200 price target

- Morgan Stanley: Overweight Rating and US$190 price target

- Baird: US$140 price target

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE measures a company's yearly pre-tax profit (its return) relative to the capital employed in the business. The formula for this calculation on Take-Two Interactive Software is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

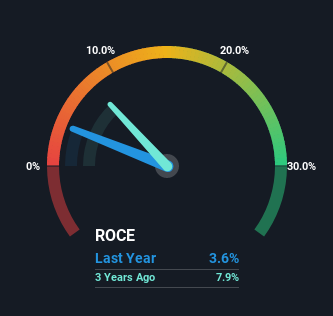

0.036 = US$519m ÷ (US$18b - US$3.3b) (Based on the trailing twelve months to June 2022).

So, Take-Two Interactive Software has a ROCE of 3.6%. In absolute terms, that's a low return, and it also under-performs the Entertainment industry average of 5.1%.

In the above chart, we have measured Take-Two Interactive Software's prior ROCE against its prior performance, but the future is arguably more important. You can check out the forecasts from the analysts covering Take-Two Interactive Software here for free if you'd like.

How Are Returns Trending?

On the surface, the trend of ROCE at Take-Two Interactive Software doesn't inspire confidence. Over the last five years, returns on capital have decreased to 3.6% from 12% five years ago. However, given capital employed and revenue have both increased, it appears that the business is currently pursuing growth as the consequence of short-term returns. If these investments prove successful, this can bode very well for long-term stock performance.

On a side note, Take-Two Interactive Software has done well to pay down its current liabilities to 19% of total assets. That could partly explain why the ROCE has dropped. Moreover, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

Beware Of Empire Builders

M&A activity is typical for late bull markets, during which the valuations often fly through the roof in a race to grow. While the Zynga acquisition made sense from the business point of view, paying US$12.7b for it is where the opinions divide. Even a questionable acquisition can prove good when done at the right price, but overpaying for anything is likely the easiest way to destroy value. On top of that, dilution will only create an additional drag on the earnings.

As Patrick Gaughan once wrote, "Beware of empire builders CEOs who were unrestrained by insufficiently diligent boards of directors."

For those who want to dig deeper into the numbers, read about 4 warning signs facing Take-Two Interactive Software that you might find interesting.

While Take-Two Interactive Software isn't earning the highest return, check out this free list of companies earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential and overvalued.

Similar Companies

Market Insights

Community Narratives