- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Take-Two Interactive (TTWO): Assessing Valuation After Strong Earnings Growth and Upgraded Outlook

Reviewed by Simply Wall St

Take-Two Interactive Software (TTWO) reported second-quarter results with substantial revenue growth and sharply reduced net losses compared to last year. The company also raised its full-year outlook, signaling increased confidence in its performance.

See our latest analysis for Take-Two Interactive Software.

Following the upbeat earnings and higher guidance, Take-Two’s stock has retraced sharply in the past week, with a 7-day share price return of -9.51 percent. However, it remains up an impressive 26.7 percent year-to-date. The one-year total shareholder return stands at 30.4 percent, reflecting stronger long-term optimism about the company’s prospects even as short-term momentum has cooled in the wake of recent results and guidance changes.

If Take-Two’s ride caught your attention, it might be a good moment to explore other leading tech and gaming names. See the full list here: See the full list for free.

With Take-Two’s solid financial turnaround and upgraded guidance, the big question is whether the recent pullback presents an attractive entry, or if the market already reflects future growth in today’s share price.

Most Popular Narrative: 15.5% Undervalued

Take-Two Interactive Software’s most widely followed narrative puts fair value at $274, materially above the last close of $232. This suggests that the market may not be fully accounting for the company’s growth catalysts yet. This sets up a pivotal moment: does the current price offer a bargain, or is the market still calibrating for what comes next?

Take-Two's mobile portfolio is experiencing outsized growth through direct-to-consumer initiatives, enhanced personalization, new event-driven features, and benefits from broader access provided by high-speed internet and mobile penetration. These factors may lift both net revenue and margins as distribution costs decline.

Want to know what’s fueling this upbeat fair value? The secret sauce includes accelerating top-line momentum, recurring in-game spending, and a profit transformation that could outpace industry giants. Intrigued by which financial assumptions drive such confidence, especially in a sector known for volatility? Unlock the full narrative to see what underpins these bold valuation calls.

Result: Fair Value of $274 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavy reliance on blockbuster franchise launches and intensified industry competition could quickly challenge even the most optimistic valuation narrative.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Sizing Up the Price Tag

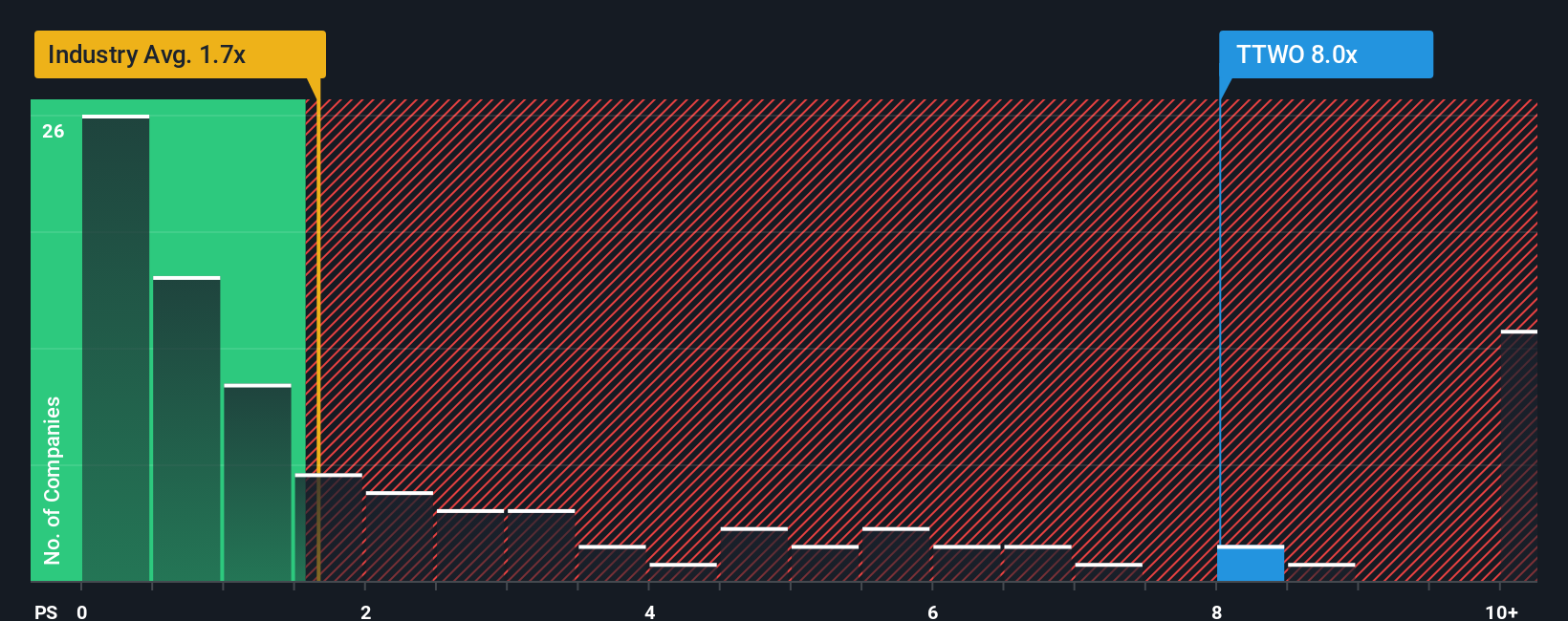

While some see Take-Two as undervalued, a look at its market price-to-sales ratio paints a more expensive picture. At 6.9 times sales, Take-Two trades far above the US Entertainment industry average of 2 times, its peer average of 6.4, and even the fair ratio of 4.9. This gap means investors are placing a premium on future growth. However, it raises the question of whether this signals greater opportunity or more risk as the market adjusts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you’d rather test your own assumptions or see different angles in the numbers, the tools are there to build your own perspective in just minutes, and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

Don't stop your search here. The next big opportunity could be just around the corner if you know where to look. Maximize your chances by picking from these handpicked ideas and stay ahead of the market:

- Capture high yields and grow your passive income by checking out these 16 dividend stocks with yields > 3% offering standout returns over 3 percent.

- Uncover early-stage innovators disrupting markets by jumping into these 3590 penny stocks with strong financials with strong financials and big growth potential.

- Capitalize on the surge in artificial intelligence by getting ahead with these 24 AI penny stocks leading the charge in groundbreaking tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion